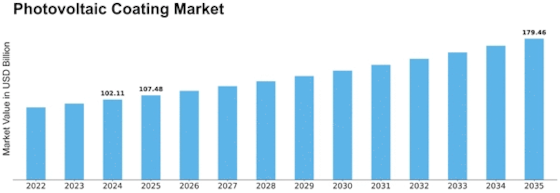

Photovoltaic Coating Size

Photovoltaic Coating Market Growth Projections and Opportunities

The global need for clean and sustainable energy sources is a primary driver of the photovoltaic coating business. Photovoltaic coatings on solar panels convert sunlight into electricity. This is consistent with the rising desire for renewable energy sources to combat global warming and reduce dependency on fossil fuels. Improvements in solar power technology are pushing the development of new PV coatings. Researchers and manufacturers are developing coatings that increase the efficiency and lifetime of solar panels, such as anti-reflective coatings, transparent conductive coatings, and new materials that maximize light absorption and energy conversion. The increasing number of solar energy installations worldwide is driving the Photovoltaic Coating Market. As solar energy becomes more popular, the demand for coatings that improve the performance and durability of solar panels increases. Large-scale solar projects, residential installations, and commercial solar farms are all contributing to the growing demand for effective PV coatings. The market is placing a greater emphasis on increasing solar panel energy efficiency and decreasing the overall cost of solar power generation. PV coatings contribute to these goals by improving light absorption and conversion efficiency, leading in a more cost-effective and sustainable solar energy system. Nanotechnology facilitates Photovoltaic Coatings innovation. Nanomaterials and coatings can provide unique qualities such as higher light absorption, increased electrical conductivity, and resistance to environmental conditions. As nanotechnology advances, new opportunities for producing high-performance coatings in the Photovoltaic Coating Market emerge. Concerns about the environmental effects of current energy sources are driving the development of renewable energy options. Photovoltaic coatings help to ensure the long-term viability of solar energy by increasing the efficiency of solar panels and lowering the environmental impact of energy generation. Despite significant progress, there continue to be obstacles in achieving long-lasting and resilient PV coatings. External elements, such as weather and environmental conditions, can significantly impact the functionality of the coatings over time. As a result, ongoing research and development efforts are focused on finding solutions to these challenges and extending the lifespan of photovoltaic coatings. The competitive landscape in the Photovoltaic Coating Market is fierce, with manufacturers striving to provide coatings that are both cost-effective and high-performing. The pressure to keep prices competitive in the solar industry can impact the profit margins of coating companies, making it essential to balance innovation, efficiency, and affordability to maintain a competitive edge in the market.

Leave a Comment