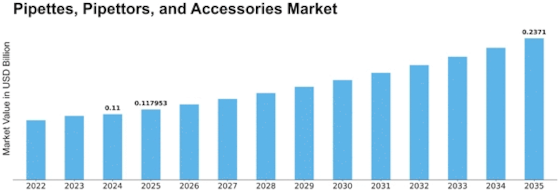

Pipettes Pipettors And Accessories Size

Pipettes, Pipettors, and Accessories Market Growth Projections and Opportunities

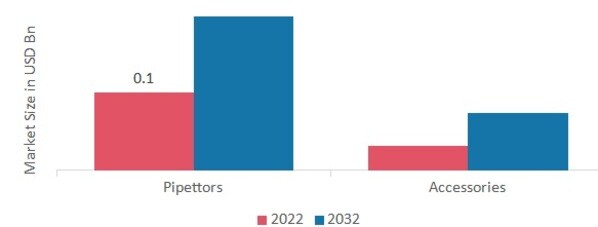

The ever-growing demand notably pushes the Pipettes, Pipettors, and Accessories market for laboratory studies and diagnostics. This critical equipment are fundamental for unique liquid handling in diverse clinical packages, including molecular biology, biochemistry, and scientific diagnostics. As research activities and diagnostic procedures continue to amplify, the demand for pipettes and related accessories studies a regular upward trajectory. The market dynamics are closely motivated by the stringent requirements for accuracy and precision in liquid managing strategies. Pipettes and pipettors must deliver dependable and steady consequences to ensure the reproducibility of experiments and diagnostic tests. The market responds to the non-stop demand for gadgets that meet excessive overall performance standards. The versatility of pipetting applications throughout various clinical disciplines impacts the market. Pipettes and pipettors find application in diverse duties, including pattern education, DNA sequencing, drug discovery, and scientific testing. The huge spectrum of applications contributes to the wide adoption of that equipment, riding the market increase. The enlargement of medical and diagnostic laboratories globally contributes drastically to the Pipettes, Pipettors, and Accessories market. The increasing number of diagnostic assessments and clinical studies activities necessitates specific liquid coping with gear. As healthcare infrastructure grows, the demand for pipettes and related accessories follows health. The pharmaceutical and biotechnology industries are principal customers of pipettes and pipettors. These tools play a pivotal role in drug discovery, bioprocessing, and quality manipulation methods. The market is motivated by using the needs of those industries for advanced pipetting answers that cater to specific necessities in drug improvement and production. Stricter regulatory compliance and adherence to satisfactory standards are essential factors shaping the Pipettes, Pipettors, and Accessories market. Manufacturers ought to meet regulatory necessities to ensure the safety and reliability of their merchandise. The market is attentive to improvements that align with exceptional standards and address regulatory concerns. The market is witnessing a growing demand for disposable pipette suggestions. These unmarried-use add-ons reduce the risk of infection and enhance workflow efficiency in laboratories. As awareness of hygiene and contamination control increases, the demand for disposable pipette tips grows, influencing market developments. Innovations in pipette add-ons, which include pipette stands, racks, and calibration equipment, make contributions to the general market dynamics. These add-ons decorate the capability and preservation of pipettes, offering customers comprehensive solutions. The market responds to improvements that enhance the general pipetting experience for laboratory experts.

Leave a Comment