Market Share

Plant-Based Beverages Market Share Analysis

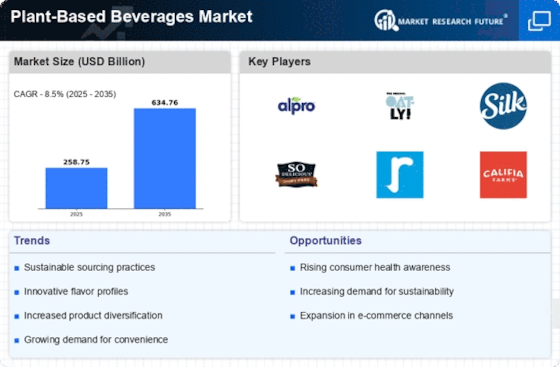

People worldwide demand healthier, more ecologically friendly food, thus plant-based drinks are rising fast. Companies are utilizing various market share positioning methods to enter this burgeoning company and fulfill plant-based demand. The growth rate indicates that buyers are increasingly selecting plant-based drinks. Since more people care about health and the environment, plant-based drinks will grow.

People are learning about plant-based diets, animal welfare, and how conventional livestock rearing harms the environment. People will seek healthier, more environmentally friendly drinks, growing the plant-based beverage business. This is a major issue for investors and companies. Plant-based beverages are constantly evolving. To stand apart, companies sell coconut, soy, almond, and soy milk. This strategy works for many with varying tastes, health challenges, and time constraints. Companies may gain market share by offering several options.

When prices are low, a business gets a bigger share of the market. Companies are looking for cheaper ways to ship, make, and get products so they can keep up with the growing demand for drinks made from plants. If you can lower the prices of plant-based dairy goods, you might be able to get customers who care about prices and get an edge over your competitors.

People who make drinks from plants need to work together to get ahead in the market. When they try to reach people, they look at what they like about their health, food, and way of life. People who can't handle lactose may feel better after eating foods that are high in protein. People of all kinds are more likely to buy from and use a business that can sell to a wide range of people. Through collaboration, companies working on big projects are helping to make the market for drinks made from plants. Retail stores, restaurants, and other businesses that sell food and drinks work with businesses that sell other goods and services to get more customers. By drawing attention to plant-based items that are on shelves and tables, these deals make it easier to find goods that are made from plants. You could get more people to drink drinks made from plants by working with restaurants, bars, and other food businesses.

Companies that make drinks from plants are becoming more and more aware of how important e-commerce and online advertising and marketing are. Businesses use social media to show how their products are good for people and the world. When you use internet marketing, you can reach people who care about the environment, have a lot of power, and eat plant-based foods. Plant-based drinks can grow and get a bigger part of the market because they can be bought through an online store.

Leave a Comment