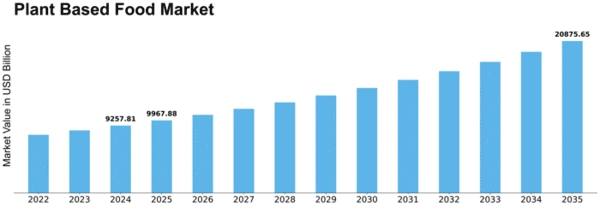

Plant Based Food Size

Plant Based Food Market Growth Projections and Opportunities

A number of factors, including changing consumer preferences, growing health consciousness, and environmental measures, are driving up demand for food produced in factories. One of the primary drivers is the growing understanding of the health benefits of plant-based food. There is a discernible shift in favor of plant-based dairy products as people learn more about the relationship between making good choices and overall wellbeing. The demand for healthful and nourishing solutions is driving this trend. Another significant element affecting the plant-based food industry is environmental sustainability. Due to increased knowledge of climate change and the detrimental environmental impacts of conventional livestock husbandry, consumers are searching for more sustainable solutions. People who are concerned about the environment will find plant-based food to be an enticing alternative because it frequently requires less land, water, and energy to produce. They also typically have a reduced carbon footprint. The industry for plant-based food is growing as sustainability emerges as a critical issue in forming attitudes. The market for plant-based food is expanding in tandem with the emergence of flexitarianism. A flexitarian diet is a flexible approach to plant-based eating, in which individuals occasionally consume beast products and include additional plant-based alternatives into their lifestyle. This change in healthy behaviors allows consumers to cut back on their intake of meat without completely eliminating it. It also reflects a larger movement towards moderation and balance. The industry for plant-based food responds to this changing customer trend by providing a range of mouthwatering and easily available plant-based foods something flexitarians find appealing. A key market aspect is the rise in investment and innovation in the food industry, in addition to shifting customer tastes. Both established food businesses and start-ups are investing in research and development to create cutting-edge plant-based food that closely resemble the flavor, texture, and nutritional makeup of conventional beast-ground meals. The industry is expanding due to the increased variety and quality of plant-based products, which draw in both insectivores and those interested in exploring healthier and sustainable alternatives. The market for plant-based food sourced from factories is also being impacted by government initiatives and rules. In certain areas, initiatives to support diets centered around factory farms are being enforced as part of larger health and environmental agendas. This includes actions like to identifying circumstances, public consciousness campaigns, and subsidies for plant-based husbandry. Government assistance may create an environment that is favourable for the plant-based food industry to flourish in, enticing more customers to convert to plant-based products. The accessibility and cost-effectiveness of plant-based goods are important factors propelling the expansion of the industry. The cost of plant-based demand is expected to decrease as product ramps up and technology progresses, making them more competitive with conventional plant-based food. The market reach is further expanded by increased availability through mainstream stores and widespread availability in caffs and foodservice locations, making plant-based products a viable and accessible option for a wider customer base.

Leave a Comment