Market Analysis

In-depth Analysis of Plant Growth Regulators Market Industry Landscape

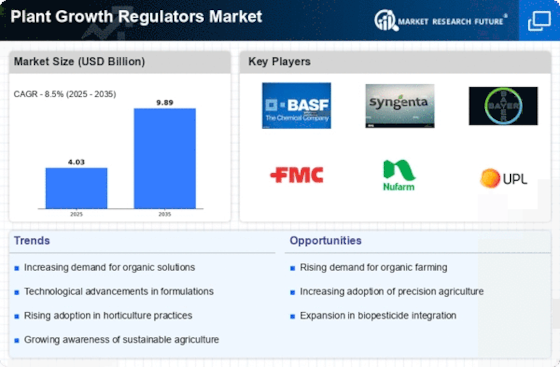

Plant growth regulators (PGRs) market size is shaped by several variables that affect their growth and importance in agriculture. Growing global need for higher agricultural yields and quality drives this industry. Need for greater agricultural efficiency and production drives PGR implementation. The plant growth regulator market is expected to reach USD 6.79 billion by 2030, growing 10.23% from 2022 to 2030. Regulatory variables drive plant growth regulator market dynamics. To maintain safety, environmental sustainability, and quality, governments and regulatory agencies worldwide set limits and restrictions on agricultural inputs, including PGRs. Manufacturers must follow these rules to get PGR product clearance. Regulatory changes like new active component approvals or use guidelines might affect product compositions and market access. Sustainable farming principles make PGRs useful instruments for creating more environmentally friendly and resilient agricultural systems.

The precision agricultural movement affects market dynamics. Precision farming optimizes agricultural decisions with technology, data, and analytics. Precision agriculture uses PGRs to customize crop growth and development to precise conditions. The precision agriculture industry's use of PGRs shows its dedication to creative and effective crop management.

Complex plant hormonal interactions, precise administration procedures, and varying efficiency across crops and settings might hinder market expansion. Different species, developmental phases, and environmental factors affect plant hormones and growth regulators, which work in complex signaling cascades. To maximize PGRs' potential, one must grasp these complexity and do continuing research to improve formulations for varied crops and growing circumstances. To achieve desired results without harming crops, precise application procedures are essential.

The global demand for crop productivity, regulatory considerations, the adoption of sustainable and precision farming practices, and the complexity of plant hormonal interactions all affect the plant growth regulators market size. As the agriculture business evolves, plant growth regulator formulas, application technology, and sustainable farming practices will improve. Researchers, industry stakeholders, and regulatory agencies must work together to solve problems and shape the plant growth regulators market to fulfill modern agriculture's demands.

Leave a Comment