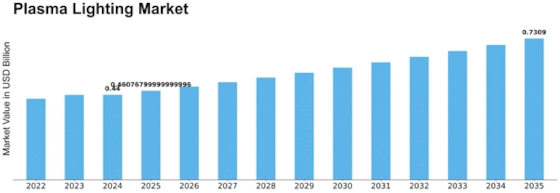

Plasma Lighting Size

Plasma Lighting Market Growth Projections and Opportunities

One of the primary market factors driving the adoption of plasma lighting is the growing emphasis on energy efficiency. As global awareness of environmental sustainability increases, consumers and businesses are actively seeking lighting solutions that consume less energy. Plasma lighting, with its inherent efficiency, aligns with this demand and is thus propelled by the overarching market factor of energy conservation. Technological advancements represent another pivotal factor shaping the plasma lighting market. Continuous innovation in plasma lighting technology has led to improvements in product performance, lifespan, and overall efficiency. Manufacturers, in response to this factor, are investing in research and development to stay ahead in the competitive landscape. The ongoing technological progress contributes to the market's evolution, providing consumers with cutting-edge plasma lighting solutions that cater to their diverse needs. Economic factors, such as the overall economic health of regions and countries, also impact the plasma lighting market. Economic growth can drive increased investments in infrastructure projects, leading to higher demand for lighting solutions in various sectors. Conversely, economic downturns may influence budget constraints, affecting purchasing decisions and slowing down market growth. Manufacturers and stakeholders closely monitor these economic factors to assess market conditions and adapt their strategies accordingly. Market factors related to consumer preferences and trends significantly influence the plasma lighting landscape. The increasing popularity of smart lighting solutions and the integration of plasma lighting with IoT platforms reflect consumer demands for advanced, customizable lighting experiences. Manufacturers respond to these factors by incorporating smart features into their plasma lighting products, contributing to the overall trend of connected and intelligent lighting solutions. Competitive factors within the market also play a crucial role in shaping its dynamics. The presence of established players and emerging competitors creates a competitive landscape that drives innovation and product differentiation. Companies strive to offer unique features, cost-effective solutions, and superior performance to gain a competitive advantage. These competitive factors contribute to the ongoing evolution of plasma lighting technology and market trends.

Leave a Comment