Market Share

Plastic Extrusion Machine Market Share Analysis

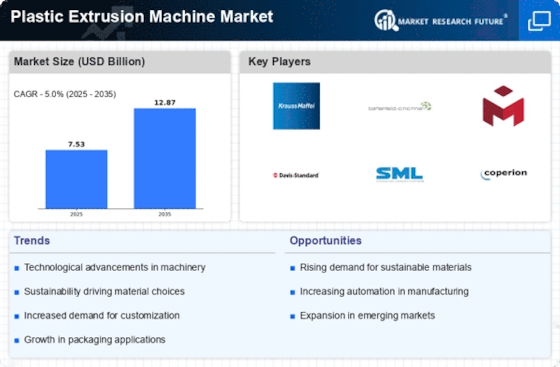

The plastic extrusion machine market has gained considerable investments in the global market via either rapid or medium-paced growth due to their increasing utility across industries. Innovation has led to the growing use of computers and advanced machinery in plastics extrusion processes resulting in higher production rates and product consistency. The industry is witnessing a rise of plastic extruder manufacturers who offer improved options like automation, control system and real time monitoring for enhancing throughput as well as maintaining proper quality of the product. This move in line with the industries target to produce more productivity with controlled waste and higher in terms of quality in the process of making plastic components

Additionally, the rising preferrence of those extrusion solutions which are sustainable and eco-friendly is another key trend. As the environmental concerns intensify, it is expected that the machines which create the plastic extruded products that use recycled materials and low-energy operations will be developed. Companies who are considered leaders are engineers who invest in the research and development of machines used in extrusion so that they promote green living and sustainability efforts and meet the necessary strict environmental rules and regulations.

Beyond the change in trend, another factor has also been marked, that is the market tendency of customization and flexibility in the plastic extruding processes. Due a large variety of extrusion equipment is applicable across industry sector such as packaging, construction, and automotive market, there is a high demand for equipment which can process materials of any size and shape. Adjustable features, speedy-changeover properties, and open built design provides manufacturers with numerable ways to process different specs requirements and market trends as well as improving production efficiency.

On the one hand, the circular economy is gaining traction in the plastics extrusion machines market, because of greater emphasis on energy efficiency and cost effectiveness. Manufacturers innocuous of the high energy use of extrusion process develops machines with shall energies consumption profiles, exploiting the most recent technologies of heating and cooling for better energy utilisation of the extrusion process. The trend not only provides an environmental concern's answer but also makes a profit contribution to manufacturers aiming at mitigating rising energy cost and consequently energy efficient extrusion machines offers what is desirable in the competitive market.

Automation and computerization have, at the present time, offer an irresistible pull on developments of extruder machines market. The integration of sensors, data analytics, and control systems makes possible online tracking the extrusion parameters which give the chance for their real-time adjustment. This degree of automation not only allows the extra high precision and consistency in the extrusion operation but also the predictive maintenance so that no downtime will appear and good efficiency of the equipment will be achieved. Application of fourth generation manufacturing industrial principles towards plastic extrusion indicates that the company is strongly drifting towards the use of digital technologies for productivity and competitiveness.

Leave a Comment