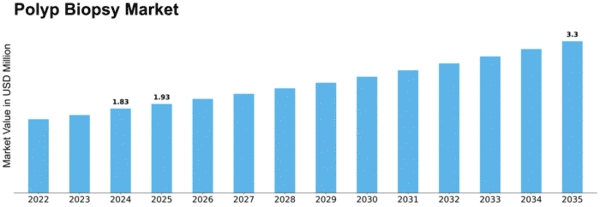

Polyp Biopsy Size

Polyp Biopsy Market Growth Projections and Opportunities

The rise in colon cancers drives the poly biopsy industry. Because colorectal polyps are considered precursors to colorectal cancer, more individuals desire screening tests like polybiomies, which boosts the market. Ever-improving endoscopic instruments affect the poly biopsy industry. Recent imaging and biopsy advances have made poly biopsy therapies more precise and helpful, growing the market. Polyps are typically removed during colorectal cancer screenings. This affects poly biopsy sales. Poly biopsy treatments are in demand as more individuals undergo colon cancer screenings and learn about it. Colon polyps increase with age, a major market component. As the population ages, colorectal polyps increase. Thus, multi biopsy therapies are indicated. New pathology technologies like digital pathology and AI influence polybiomies. These technologies help physicians diagnose and treat colon polyps by improving diagnostic testing. More individuals know about colon cancer dangers and early detection, which affects the poly biopsy market. Information regarding colon polyp hazards encourages screening therapies like polybiopsies. Healthcare legislation and colon cancer screening guidelines effect poly biopsy sales. The necessity for these diagnostic procedures depends on how well patients follow normal screening protocols, which commonly involve polybiopsy. Clinical research and colon cancer biomarkers impact the market. Understanding colon polyp genetic markers allows targeted and effective poly biopsy. Patients' preference for non-invasive testing affects the poly biopsy industry. Endoscopic biopsy technologies are becoming increasingly popular as individuals seek less invasive solutions. Market conditions change. Poly biopsy treatment ease varies on local healthcare systems. When healthcare systems are well-developed and diagnostic technologies improve, poly biopsy utilization increases. Regulations on biopsy procedures impact the poly biopsy industry. Following the guidelines ensures poly biopsy instrument and procedure safety and quality, which impacts market entry and product development. The economy and compensation regulations impact the market. Cost and insurance coverage impact patients' capacity to obtain poly biopsy treatments and their desire for them.

Leave a Comment