Top Industry Leaders in the Polyphenylene Oxide Market

Polyphenylene Oxide Market

Polyphenylene oxide (PPO), a high-performance engineering plastic, finds its way into diverse applications ranging from automotive parts to medical devices. But within this seemingly promising market lies a battleground for manufacturers grappling for dominance. Understanding the competitive landscape of the PPO market is crucial for anyone wanting to succeed in this dynamic space.

Key Players and Strategies:

-

Global Giants: Leading the charge are Solvay, SABIC, BASF, and Evonik Industries. These players leverage their strong brand recognition, extensive distribution networks, and continuous R&D efforts to maintain their foothold. Solvay, for instance, focuses on specialty PPO grades and customization solutions, while SABIC emphasizes cost-efficiency and global reach. -

Regional Champions: Companies like Asahi Kasei and Toray Industries in Asia Pacific cater to the region's booming demand, often through strategic partnerships and joint ventures. Their strength lies in understanding local market nuances and offering competitive pricing. -

Niche Players: Smaller players like RTP Company and Quadrant EPP specialize in specific PPO applications or niche markets. They stand out with their technical expertise, agility, and customized product offerings.

Factors Shaping Market Share:

-

Technological Innovation: Developing novel PPO blends with enhanced properties like improved flame retardancy or lighter weight attracts new customers and opens up new application possibilities. Companies like SABIC are actively focusing on bio-based PPO alternatives, aligning with sustainability trends. -

Cost Optimization: Efficient production processes and cost-effective raw material sourcing become crucial in price-sensitive markets. Asian manufacturers often have an edge here due to lower labor and production costs. -

Regional Growth: The surging demand from Asia Pacific, particularly China and India, attracts players to invest in regional production facilities and distribution networks. Building strong relationships with local distributors and OEMs also plays a pivotal role. -

Environmental Regulations: Stringent regulations on hazardous materials are pushing manufacturers towards developing greener PPO solutions. Compliance with these regulations can become a competitive advantage.

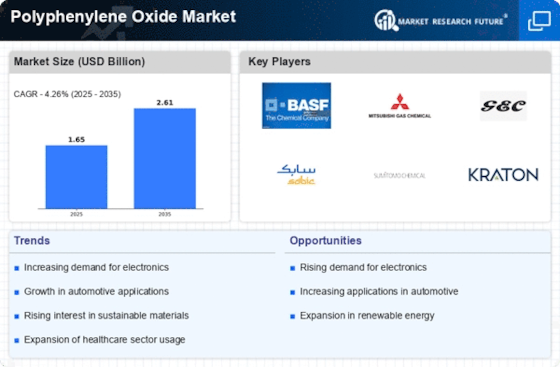

Key Companies in the Polyphenylene Oxide market include

- BASF SE (Germany)

- SABIC (Saudi Arabia)

- RTP Company (US), Celanese Corporation (US)

- Ensinger Inc. (India)

- Mitsubishi Electric Corporation (Japan)

- 3M (US)

- Goodfellow (UK)

- Asahi Kasei Chemicals Corporation (Japan)

- Solvay SA (Belgium), Sumitomo Chemical Co., Ltd (Japan)

- LyondellBasell Industries Holdings BV (Netherlands)

Recent Developments:

June 2022: Mitsubishi Chemical Holdings Corp. launched DYSVAL capsules 40mg for treating Tardive Dyskinesia in Japan.

May 2022: Sumitomo Chemical and Newlight Technologies proposed a joint Development Project to Create Automotive and Textile Materials Using a Carbon-Negative*1 Microbe-Produced Biomaterial Called air carbon.

November 2021: Solvay SA and 9T Labs AG collaborated on developing CF-reinforced polyphenylene sulfide (CF/PPS) composite and other materials for various end-use applications in aerospace, automation, and other industries.