Market Analysis

In-depth Analysis of Portable Diagnostic Devices Market Industry Landscape

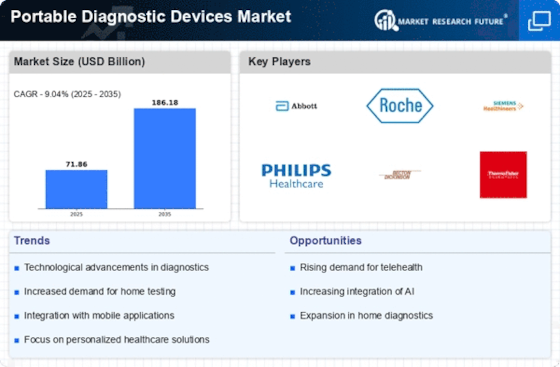

Health and fitness awareness increase portable diagnostic equipment sales. People want convenient solutions to monitor their vital signs to better manage their health. As indicated, the mindset shift has raised portable diagnostic equipment demand. Market functioning depends on technology improvement. Wireless connectivity, decreasing diagnostic equipment, and cutting-edge sensors enable tiny, high-tech diagnostic devices. Some of these technological breakthroughs improve device performance and availability. Number of point-of-care diagnostics has expanded dramatically. Portable diagnostic technology eliminates lab time and gives immediate results. Critical conditions that need frequent monitoring and crises without typical labs require this. The market is affected by increasing individuals with chronic conditions including heart, lung, and diabetes. Chronic disease management requires portable diagnostics. These tools enable health tracking and informed management. Online patient monitoring and telemedicine are revolutionizing medicine. Portable diagnostic devices let doctors track and treat long-term patients. These technologies let physicians remotely watch patients in real time. Remote healthcare is growing due to global catastrophes like the COVID-19 pandemic. Regulations and government activities impact markets. Digital health technologies, efficient payment systems, and supportive legislation boost portable diagnostic equipment. Market participants must carefully adapt to changing healthcare policy to comply with government requirements. Portable diagnostic equipment communicates personal health data, thus data security is important. Legal and secure solutions are emphasized to solve consumers' privacy concerns and build confidence due to market realities. Market worries exist. Establishing device communication, standardizing standards, and making portable diagnostic instruments accurate and dependable are continuing difficulties. These concerns must be addressed by market players for these devices to thrive and be accepted in healthcare.

Leave a Comment