- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

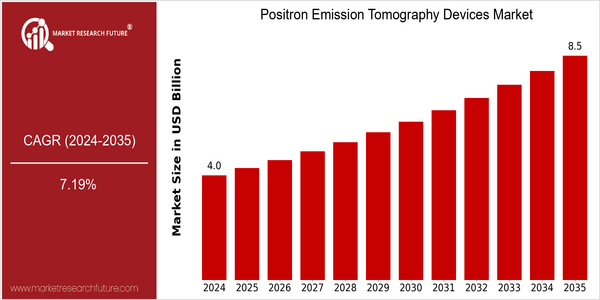

| Year | Value |

|---|---|

| 2024 | USD 3.96 Billion |

| 2035 | USD 8.5 Billion |

| CAGR (2025-2035) | 7.19 % |

Note – Market size depicts the revenue generated over the financial year

PET devices market is expected to reach USD 3.9 billion in 2024, and is expected to reach USD 8.5 billion by 2035. The growth rate of this market is expected to be a strong CAGR of 7.19% from 2025 to 2035. The increasing occurrence of chronic diseases and the increasing demand for advanced diagnostic methods are the main factors driving this growth. Artificial intelligence in PET analysis and the development of hybrid PET devices have also further expanded the scope of application of PET devices in clinical practice. The three major PET device manufacturers in the world, namely Siemens Healthineers, GE Healthcare, and Philips Health, have all made significant investments in R & D. They are also investing in the development of new PET systems. The establishment of strategic alliances and the establishment of new PET systems are the main strategies to enhance their market position and meet the needs of hospitals. These factors will play an important role in shaping the future of PET devices.

Regional Market Size

Regional Deep Dive

The market for PET devices is growing in all regions of the world, driven by technological advances, increasing prevalence of chronic diseases, and the growing demand for early diagnosis. Each region is unique, influenced by the health system, regulatory framework, and economic conditions. North America is the leader in innovation and adoption of new technology, whereas Europe focuses on regulatory compliance and the integration of PET with other modalities. The Asia-Pacific region is experiencing rapid growth, owing to increasing health care expenditures and the growing patient population. The Middle East and Africa are slowly establishing themselves as markets through government initiatives and public–private collaborations. Latin America is also emerging as a potential market, with increasing access to health care and the development of a strong health care system.

Europe

- The European Union has implemented stringent regulations regarding the use of radiopharmaceuticals, which has led to increased collaboration among manufacturers and healthcare providers to ensure compliance and safety.

- Innovations in hybrid imaging technologies, such as PET/MRI systems, are gaining traction in Europe, with companies like Philips and Canon Medical Systems leading the way in developing these advanced diagnostic tools.

Asia Pacific

- Countries like China and India are significantly increasing their healthcare budgets, leading to enhanced investments in advanced imaging technologies, including PET devices, to meet the growing demand for diagnostic services.

- The rise of public-private partnerships in the region is facilitating the establishment of PET imaging centers, making these technologies more accessible to the population and improving early disease detection.

Latin America

- Brazil and Mexico are leading the way in adopting PET technology, with government programs aimed at improving cancer diagnosis and treatment, which is driving demand for PET devices.

- The region is witnessing an increase in local manufacturing of PET devices, supported by initiatives from organizations like the Pan American Health Organization (PAHO) to enhance healthcare access.

North America

- The U.S. Food and Drug Administration (FDA) has recently approved several new radiopharmaceuticals for PET imaging, enhancing diagnostic capabilities and expanding the applications of PET devices in oncology and neurology.

- Key players like Siemens Healthineers and GE Healthcare are investing heavily in R&D to develop advanced PET systems that integrate artificial intelligence for improved imaging accuracy and patient outcomes.

Middle East And Africa

- Governments in the Middle East are launching initiatives to improve healthcare infrastructure, which includes the establishment of advanced imaging centers equipped with PET technology, particularly in countries like the UAE and Saudi Arabia.

- Collaborations between local healthcare providers and international companies are on the rise, aiming to enhance the availability of PET devices and training for healthcare professionals in the region.

Did You Know?

“Did you know that PET scans can detect diseases at the cellular level, often years before symptoms appear, making them a crucial tool in early diagnosis?” — American Cancer Society

Segmental Market Size

The PET-CT device plays a crucial role in the medical imaging market, mainly in oncology, cardiology and neurology applications. This segment is currently experiencing a steady growth, driven by the growing demand for early disease diagnosis and the development of individualized medicine. The accuracy of PET images has improved thanks to the development of radiopharmaceuticals, and the number of chronic diseases is on the rise. Hence, the market for PET-CT devices is expected to grow steadily in the coming years. The PET-CT device market has matured in North America and Europe. These markets are mainly used in oncology, cardiology and neurology. The main access routes are hospitals and specialized medical imaging centers. The growth is accelerated by the development of new radiopharmaceuticals and the integration of artificial intelligence in image analysis. The trend of individualized medicine and the government's efforts to increase access to medical resources are also driving the development of this industry.

Future Outlook

The PET market is expected to grow from $3.96 billion to $8.51 billion from 2024 to 2035, with a CAGR of 7.19 percent. This growth is due to the rising prevalence of chronic diseases, the development of medical imaging technology, the emphasis on early diagnosis and the development of personalized medicine. In the future, the penetration of PET into clinical practices is expected to be greater than that of SPECT, and the use rate of PET will be higher than that of SPECT in advanced medical institutions in 2035, compared with the expected use rate of SPECT in 2024. The key technology of combining artificial intelligence and deep learning in the analysis of medical images will greatly improve the accuracy and efficiency of PET. , and further promote the clinical application. In addition, the government's support for the development of nuclear medicine and its research and development will also stimulate the development of the market. Also, the development of hybrid PET. , combining MRI and CT, will play an important role in the market. The hybrid PET is not only capable of diagnosing, but also of treatment and follow-up, which will make it an indispensable medical device in the future.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 6.5% |

Positron Emission Tomography Devices Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.