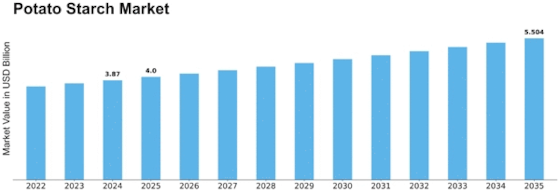

Potato Starch Size

Potato Starch Market Growth Projections and Opportunities

Potato Starch Market expansion has been driven by variables that meet consumer and industrial needs. The market is driven by gluten-free and clean label diet awareness and acceptance. People with celiac illness or gluten intolerance prefer potato starch since it's gluten-free. Potato starch is also in demand as a flexible and recognized starch source due to the clean label trend, which stresses natural and minimally processed products.

Food and beverage companies' search for beneficial additives has impacted the potato starch market. It is widely used by food makers to increase product quality and consumer satisfaction by improving texture and mouthfeel.

Convenience food expansion has also driven potato starch consumption. Manufacturers want starches that improve processed food texture, stability, and quality as customers choose ready-to-eat meals. With its neutral flavor and versatility, potato starch is a standard in fast and convenience food items, growing the industry.

Potato starch's sustainability is also growing in popularity. With rising environmental awareness, consumers and producers want ingredients with less impact. As a widely farmed and renewable resource, potatoes make potato starch a sustainable alternative. Sustainability fits the industrial trend toward environmental and social responsibility.

Pharmaceuticals and industry also affect potato starch sales. Since it is inert and hypoallergenic, potato starch is used as an excipient in medicinal tablets and capsules. As a versatile ingredient, potato starch is used in many industrial processes beyond the food and beverage sector.

Global commerce and geopolitics affect the potato starch market since potato farming and production are transnational. Agricultural regulations, trade agreements, and geopolitics can affect worldwide potato starch availability and cost. Because of geopolitical events that may disrupt the potato supply chain, the sector is volatile.

Technology improves starch extraction and processing efficiency and quality, driving market development. Innovative extraction technologies increase potato starch output and quality to suit industry demand. These advances reduce production costs, making potato starch more competitive.

Economic variables like price stability and affordability affect potato starch sales. Food producers and other businesses choose potato starch because it is cheaper than other starches. Potato starch is widely used and growing due to its economic and functional properties.

Leave a Comment