Power Transmission Belting Market Overview

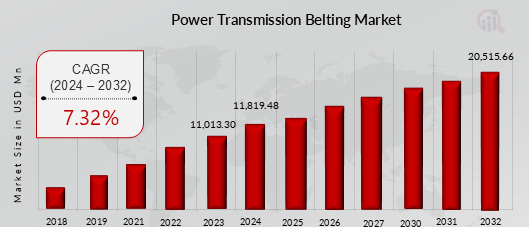

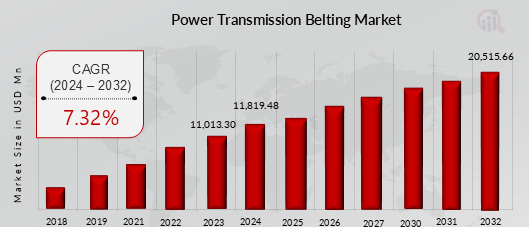

Power Transmission Belting Market Size was valued at USD 11,013.30 Million in 2023. The Global Power Transmission Belting industry is projected to grow from USD 11,819.48 Million in 2024 to USD 20,515.66 Million by 2032, exhibiting a compound annual growth rate (CAGR) of 7.32% during the forecast period (2024 - 2032).

Growing demand for energy-efficient solutions and opportunities due to rapid urbanization and increasing industrialization in emerging economies is driving the Power Transmission Belting Market.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

-

Power Transmission Belting Market Trends

Increasing Demand for Precision Engineering, and opportunities due to adoption of additive manufacturing and hybrid techniques augmenting Power Transmission Belting Market.

The increasing focus on sustainability and energy efficiency across industries is a significant driver for the Power Transmission Belting Market. With global energy consumption on the rise, there is a growing need to adopt technologies and solutions that minimize energy loss and enhance operational efficiency. Power transmission belting, particularly synchronous belts, plays a crucial role in reducing energy consumption due to their higher efficiency compared to traditional systems. These belts reduce slippage, ensure smoother operations, and require less maintenance, making them ideal for industries striving to reduce energy costs and carbon footprints.

Consequently, industries such as manufacturing, automotive, and material handling are increasingly adopting power transmission belting solutions to achieve energy efficiency goals, driving the market's growth. Furthermore, government regulations and initiatives aimed at promoting energy-efficient practices have accelerated the adoption of advanced belting systems. Policies like energy audits and efficiency certifications in key markets such as the United States, Europe, and Asia-Pacific have pushed industries to invest in newer, more efficient technologies. In the automotive sector, the emphasis on fuel efficiency and emissions reduction has led to the increased use of belts in engine systems, enhancing overall vehicle performance.

This growing regulatory pressure to meet stringent environmental standards is a significant factor influencing market dynamics, fostering innovation in belt designs and materials.

The rapid urbanization and industrialization observed in emerging economies represent a substantial opportunity for the Power Transmission Belting Market. Countries like China, India, Brazil, and Southeast Asian nations are experiencing a surge in infrastructure development, manufacturing expansion, and economic growth. This transformation is driving demand for power transmission belts across various industries, including automotive, construction, mining, and energy. As these economies continue to evolve, the need for efficient and reliable power transmission solutions is growing, creating significant opportunities for market expansion. Urbanization is leading to the development of smart cities and modern industrial hubs that require advanced machinery and equipment.

Power transmission belting plays a crucial role in these developments by enhancing the efficiency and performance of machinery used in transportation systems, manufacturing units, and construction sites. For example, the booming automotive industry in India and China, driven by rising consumer demand and supportive government policies, is leading to increased production volumes and the need for advanced belting systems in assembly lines and engine systems. Similarly, the growth of the mining sector in Brazil and Indonesia is boosting the demand for durable and high-strength belts capable of withstanding harsh operational conditions.

Power Transmission Belting Market Segment Insights

Global Power Transmission Belting Belt Type Insights

Based on Belt Type, the global Power Transmission Belting are segmented into Indexable Inserts, and Solid Round Tools. The V-belts dominated the global market in 2023, while the flat belts are projected to be the fastest–growing segment during the forecast period. V-belts are one of the most popular types of belts used in power transmission due to their high efficiency and reliable performance. They come in various profiles, such as classical, narrow, and cogged, and are widely used in automotive, industrial, and agricultural machinery.

V-belts are designed to fit into V-shaped grooves on pulleys, which helps prevent slippage and ensures efficient power transmission. The market for V-belts is witnessing steady growth driven by the increasing demand for durable and energy-efficient power transmission solutions. Innovations such as the development of high-performance V-belts with enhanced tensile strength and heat resistance are further enhancing their application scope, especially in heavy-duty operations.

Figure 1: Power Transmission Belting Market, by Belt Type, 2023 & 2032 (USD Million)

Global Power Transmission Belting Material Type Insights

Based on Material Type, the global Power Transmission Belting are segmented into Rubber Belts, Polyurethane Belts, Neoprene Belts, Leather Belts, Fabric Belts, Composite Belts, and Others. The Rubber Belts segment dominated the global market in 2023, while the Polyurethane Belts is projected to be the fastest–growing segment during the forecast period. Rubber belts are widely used due to their durability, flexibility, and cost-effectiveness. They are suitable for a range of applications, including industrial machinery and automotive components. Rubber belts can withstand harsh operating conditions and provide reliable performance.

Their ability to absorb shock and vibration makes them ideal for heavy-duty applications. Rubber belts are also resistant to abrasion and wear, ensuring a long service life. They are commonly used in conveyor systems, power transmission, and various industrial processes. The versatility of rubber belts makes them a preferred choice for many industries.

Global Power Transmission Belting Application Insights

Based on Application, the global Power Transmission Belting are segmented into Elevators, Packaging, Food & Beverages, Materials handling & Logistics, Textile, Machine Tools, Corrugated & Cardboard, Fitness, Hygiene, Ceramics & Marble, and Others. The Food & Beverages segment dominated the global market in 2023 and projected to be the fastest–growing segment during the forecast period. Power transmission belts used in the food and beverage industry must meet strict hygiene and safety standards. These belts are designed to be easy to clean and resistant to chemicals and contaminants.

Food-grade belts are made from materials that are safe for direct contact with food products. They offer good resistance to abrasion and wear, ensuring long service life. The flexibility and strength of food-grade belts allow for smooth operation in various processing and packaging applications. Their ability to maintain performance under harsh conditions makes them essential for the food and beverage industry.

Global Power Transmission Belting Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. The North America Power Transmission Belting market accounted for the largest market share in 2023 and expected to exhibit a significant CAGR growth during the study period. The dominance of North America is driven by the region’s strong industrial base, expanding automotive sector, and advancements in agriculture and energy industries. Power transmission belts, including V-belts, timing belts, and flat belts, are essential components in machinery, offering efficient and reliable power transfer.

Rubber and polyurethane are the predominant materials used, with polyurethane belts gaining traction due to their durability and resistance to chemicals and abrasion. The United States leads the market, supported by robust manufacturing and agricultural activities, followed by Canada and Mexico. Key drivers include increasing adoption of automation across industries, which demands high-performance and energy-efficient transmission systems, and the rising focus on maintenance and operational efficiency in industrial equipment. Aftermarket sales are a significant contributor to market revenue as companies emphasize replacing worn-out belts to minimize downtime.

Figure 2: Power Transmission Belting Market, by region, 2023 & 2032 (USD Million)

Moreover, Europe is the second-largest region in the Power Transmission Belting Market. The Europe Power Transmission Belting Market is witnessing steady growth driven by advancements in industrial automation, increasing manufacturing activities, and the region's strong automotive sector. Power transmission belts, including V-belts, timing belts, and flat belts, are extensively used across industries such as automotive, industrial machinery, agriculture, and energy. The market is segmented by material into rubber, polyurethane, and neoprene, with polyurethane belts gaining popularity due to their lightweight and resistance to chemicals and wear.

Germany, France, Italy, and the UK dominate the market, supported by their robust industrial and automotive sectors. The growing trend toward energy-efficient and durable belt solutions is encouraging manufacturers to invest in advanced materials and innovative designs.

Additionally, the Asia Pacific Power Transmission Belting Market has grown significantly in recent years, driven by the region's robust industrialization, expanding automotive production, and the increasing adoption of automation in manufacturing and agriculture. Countries such as China, India, Japan, and South Korea are key contributors, benefiting from large-scale industrial activities and rising investments in advanced machinery. Power transmission belts, including V-belts, timing belts, and flat belts, are extensively used in applications ranging from automotive engines to industrial conveyor systems and agricultural machinery.

Polyurethane and rubber belts dominate the market, with polyurethane belts gaining traction due to their durability and resistance to wear and chemicals. The region's growing emphasis on energy efficiency and reduced maintenance costs is driving the adoption of advanced belt solutions, such as synchronous belts that enhance operational precision.

Further, the major countries studied in the market report are the U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, Japan, UAE, South Africa, Saudi Arabia, Argentina, and Brazil.

Global Power Transmission Belting Key Market Players & Competitive Insight

The power transmission belting market is a vital segment within the industrial machinery and components industry, encompassing a variety of products such as V-belts, timing belts, ribbed belts, and flat belts. These belts are essential for power transmission in numerous applications across industries like automotive, agriculture, manufacturing, mining, and energy. The market is dominated by several key players, including Megadyne, Gates Corporation, Mitsuboshi Belting Ltd, Sanlux Co., Ltd, Optibelt, and ContiTech. These companies have established strong global presences and are known for their high-quality, durable products. They continuously invest in research and development to innovate and maintain their competitive edge.

Technological advancements and innovation are crucial in this market, with companies developing belts that offer higher efficiency, greater durability, and improved performance. Innovations in materials science, such as the use of aramid and polyester fibers, have led to the creation of belts with superior strength and flexibility. The demand for power transmission belts is driven by their diverse applications across various industries. In the automotive sector, these belts are used in engines and transmissions, while in the industrial sector, they are essential for machinery in manufacturing, mining, and energy production.

The agricultural sector also relies on these belts for equipment like tractors and harvesters.

Leading companies employ various strategic initiatives to strengthen their market positions, such as expanding product portfolios, entering new geographic markets, forming strategic partnerships, and investing in advanced manufacturing technologies. Despite facing challenges like intense competition, fluctuating raw material prices, and stringent environmental regulations, these companies find opportunities for innovation and growth. By developing eco-friendly products, optimizing supply chains, and leveraging digital technologies for predictive maintenance, they can maintain their competitive edge. The focus on sustainability and efficiency will continue to shape the future of the power transmission belting market, driving the industry’s growth.

Key Companies in the Power Transmission Belting Market include.

- Fulong Metal Industrial Co., Ltd.

- Ningbo Jiebao Group Co., Ltd.,

- Zhejiang Fengmao Technology Co., Ltd.

- Onlive Transmission Technology Co., Ltd.

- Ningbo Beidi Synchronous Belt Co., Ltd.

- Foshan Pengwang Industrial Belt Co., Ltd.

Global Power Transmission Belting Industry Developments

- In November 2024, BMG announced that it has launched its newly specialised Gates belting, which is produced from advanced materials, constructed to improve durability & performance of farming machinery and extended its portfolio of belting. According to the company, these flexible belts safeguard minimum downtime, enabling farmers to achieve extreme productivity, even in the maximum difficult environments.

- In November 2019, Continental announced that it has launched a wide range of OEM quality multi V-belts on the agricultural spare parts market.

- In October 2022, JKF Americas Inc. announced that it has launched its Top Drive line of power transmission products to the Central, North, and South American markets, which include various types of belts such as harvester belts, raw-edge cogged belts, poly-V belts, classical V belts, synchronous belts, wrapped belts, banded belts, and specialty belts.

Power Transmission Belting Market Segmentation:

Power Transmission Belting Market by Belt Type Outlook (USD Million, 2019-2032)

-

V-Belts

- Fractional Horsepower (FHP) V-Belts

Power Transmission Belting Market by Material Type Outlook (USD Million, 2019-2032)

Power Transmission Belting Market by Application Outlook (USD Million, 2019-2032)

- Materials handling & Logistics

Global Power Transmission Belting Regional Outlook

-

Middle East and Africa

- Rest of Middle East and Africa

-

South America

- Rest of South America

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 11,013.30 Million |

| Market Size 2024 |

USD 11,819.48 Million |

| Market Size 2032 |

USD 20,515.66 Million |

| Compound Annual Growth Rate (CAGR) |

7.32% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Million) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Belt Type, Material Type, Application and Region |

| Geographies Covered |

North America, Europe, Asia-Pacific, Middle East & Africa, and South America. |

| Countries Covered |

The U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, China, Japan, India, UAE, South Africa, Saudi Arabia, Argentina, and Brazil. |

| Key Companies Profiled |

Megadyne, Gates Corporation, Mitsuboshi Belting Ltd., Sanlux Co., Ltd., Optibelt, ContiTech, Habasit, SIT Group, Yongli Belting Group, Fulong Metal Industrial Co., Ltd., Ningbo Jiebao Group Co., Ltd.,, Zhejiang Fengmao Technology Co., Ltd., Onlive Transmission Technology Co., Ltd., Ningbo Beidi Synchronous Belt Co., Ltd., Foshan Pengwang Industrial Belt Co., Ltd. |

| Key Market Opportunities |

· Opportunities Due to rapid urbanization and increasing industrialization in emerging economies |

| Key Market Dynamics |

· Growing demand for energy-efficient solutions is Driving the Demand for Power Transmission Belting |

Frequently Asked Questions (FAQ):

The Power Transmission Belting Market size is expected to be valued at USD 20,515.66 Million in 2032.

The global market is projected to grow at a CAGR of 7.32% during the forecast period, 2024-2032.

North America held the largest share of the global market.

The key players in the market are Megadyne, Gates Corporation, Mitsuboshi Belting Ltd., Sanlux Co., Ltd., Optibelt, ContiTech, Habasit, SIT Group, Yongli Belting Group, Fulong Metal Industrial Co., Ltd., Ningbo Jiebao Group Co., Ltd.,, Zhejiang Fengmao Technology Co., Ltd., Onlive Transmission Technology Co., Ltd., Ningbo Beidi Synchronous Belt Co., Ltd., and Foshan Pengwang Industrial Belt Co., Ltd.

The rubber belt category dominated the market in 2023.

V-belt segment had the largest revenue share of the global market.