Market Analysis

In-depth Analysis of Precision Fermentation Ingredients Market Industry Landscape

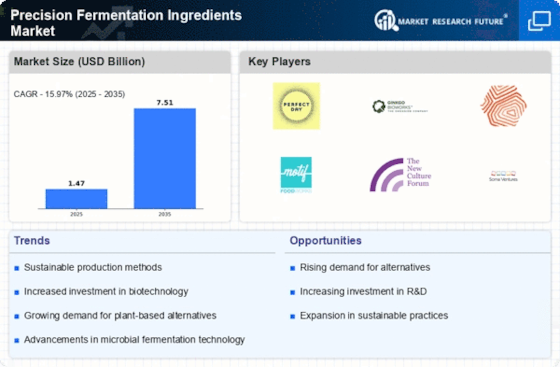

The fermentation ingredients market is experiencing a notable surge in demand, fueled by the rising popularity of bio-based alcohols produced through fermentation processes. This trend is reshaping the landscape of the market as bio-based alcohols gain prominence for their eco-friendly and sustainable attributes. The market is projected to reach a valuation of USD 78.38 billion by 2023, exhibiting a Compound Annual Growth Rate (CAGR) of 5.08%. One of the key factors driving this growth is the increased preference for bio-based alcohols over petroleum-based chemicals, driven by their comparatively lower costs and environmental benefits.

Bio-based alcohols, derived from fermentation processes, have emerged as a sustainable alternative to traditional petroleum-based chemicals. This shift is largely propelled by the growing emphasis on environmental conservation and the pursuit of green technologies. Bio refiners, recognizing the economic and ecological advantages of fermentation, are investing in and encouraging the production of fermentation ingredients. The inherent sustainability of bio-based alcohols aligns with global initiatives to reduce dependence on fossil fuels and mitigate the environmental impact of chemical production.

One of the primary drivers for the increased demand for bio-based alcohols is their lower production costs compared to their petroleum-based counterparts. This cost advantage has become a significant catalyst, incentivizing bio refiners to ramp up the production of fermentation ingredients. As a result, the fermentation ingredients market is witnessing a surge in activities aimed at enhancing production capacities and exploring novel fermentation processes. This economic rationale positions bio-based alcohols as not only environmentally friendly but also economically viable, contributing to the overall growth and sustainability of the fermentation ingredients market.

The steady increase in disposable income and the evolving lifestyles of consumers are pivotal factors influencing the dynamics of the fermentation ingredients market. As disposable incomes rise, there is a parallel increase in consumer spending, particularly on lifestyle products, including alcoholic beverages. This surge in demand for alcoholic beverages directly impacts alcohol production, a key segment of the fermentation ingredients market. The changing preferences and lifestyle choices of consumers, coupled with a desire for high-quality products, are propelling the sales of alcoholic beverages, subsequently supporting the growth of the fermentation ingredients market.

The alcohol production sector plays a central role in the fermentation ingredients market, with bio-based alcohols being a key focus area. The fermentation process serves as a foundational method for the production of various alcohols, including ethanol and butanol, through the metabolic activities of microorganisms. The versatility of fermentation in producing a wide range of alcohols positions it as a crucial technology in the context of sustainable and bio-based solutions. The market's responsiveness to consumer trends and lifestyle changes underscores the dynamic nature of the fermentation ingredients landscape.

The bio-based alcohols produced through fermentation offer distinct advantages in terms of sustainability, renewability, and reduced carbon footprint. These factors contribute to their attractiveness not only to bio refiners but also to industries seeking greener alternatives. The alignment of bio-based alcohols with environmentally conscious practices positions them as a preferred choice for sectors looking to reduce their ecological impact. This emphasis on sustainability resonates with contemporary values and global efforts to transition towards more responsible and environmentally friendly production methods.

The positive trajectory of the fermentation ingredients market is closely linked to the intersection of economic feasibility, consumer behavior, and environmental stewardship. As the demand for bio-based alcohols continues to rise, the market is expected to witness further innovation and investments in fermentation technologies. The inherent flexibility of fermentation processes allows for the production of a diverse range of alcohols, catering to the evolving needs of various industries.

In conclusion, the fermentation ingredients market is experiencing a significant upswing driven by the heightened demand for bio-based alcohols produced through fermentation. This demand is underpinned by the economic advantages, lower production costs, and environmental benefits associated with bio-based alcohols compared to their petroleum-based counterparts. Bio refiners are strategically investing in fermentation ingredients production, leveraging the sustainability aspect of bio-based alcohols. Moreover, the changing lifestyles and increased disposable incomes of consumers are influencing the growth of the market, particularly in the alcohol production sector. As the global focus on sustainability intensifies, the fermentation ingredients market is poised to play a pivotal role in providing eco-friendly solutions to meet the demands of diverse industries.

Leave a Comment