Market Analysis

In-depth Analysis of Predictive Analytics Market Industry Landscape

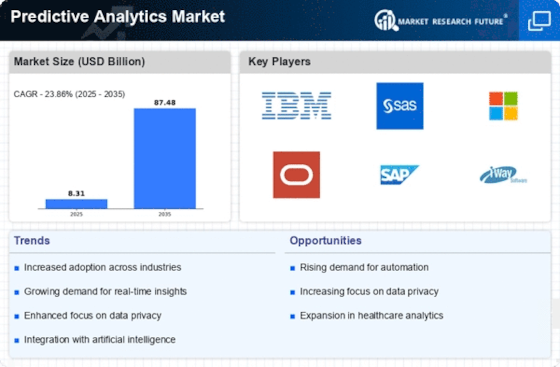

The predictive analytics market has witnessed a remarkable surge in recent years, driven by the increasing reliance on data-driven decision-making across various industries. This dynamic sector is characterized by a multitude of factors that collectively shape its trajectory. One of the key drivers is the escalating demand for actionable insights derived from vast datasets. Businesses are increasingly recognizing the potential of predictive analytics to forecast trends, identify patterns, and optimize operations. This surge in demand is met by a growing supply of sophisticated predictive analytics solutions, fostering a competitive market environment.

Furthermore, technological advancements play a pivotal role in shaping the market dynamics. The evolution of machine learning algorithms and artificial intelligence has empowered predictive analytics tools to deliver more accurate and nuanced predictions. As businesses seek to gain a competitive edge, they are investing in cutting-edge technologies that enhance the predictive capabilities of analytics solutions. This constant innovation creates a dynamic landscape where vendors strive to outpace each other in terms of algorithmic sophistication and predictive accuracy.

The predictive analytics market is also heavily influenced by the increasing volume and variety of data generated by businesses. The advent of big data has significantly expanded the scope and potential of predictive analytics. Organizations are leveraging not only structured data but also unstructured data from diverse sources, such as social media, sensors, and text documents. This influx of data poses both opportunities and challenges for market players, prompting them to develop solutions that can efficiently handle and analyze diverse datasets.

Moreover, the widespread adoption of cloud computing has transformed the delivery models of predictive analytics solutions. Cloud-based predictive analytics platforms offer scalability, flexibility, and accessibility, allowing businesses to harness the power of predictive insights without the need for extensive infrastructure investments. This shift towards cloud-based solutions has reshaped the competitive landscape, with both established players and emerging startups vying for market share by offering cloud-compatible and user-friendly predictive analytics tools.

The regulatory environment is another significant factor influencing the market dynamics of predictive analytics. As data privacy and security concerns gain prominence, businesses are under increasing pressure to ensure compliance with regulations such as GDPR and CCPA. This has prompted predictive analytics vendors to incorporate robust data protection features into their solutions, creating a market where regulatory compliance is a key differentiator.

The democratization of predictive analytics is yet another aspect shaping the market. As the demand for predictive insights transcends traditional data science teams, vendors are developing user-friendly interfaces and tools that enable non-technical users to leverage the power of predictive analytics. This democratization trend is expanding the user base and driving the adoption of predictive analytics across various business functions, from marketing and sales to finance and human resources.

In conclusion, the market dynamics of predictive analytics reflect a dynamic interplay of factors, including the demand for actionable insights, technological advancements, data proliferation, cloud adoption, regulatory considerations, and the democratization of analytics. This vibrant landscape presents both challenges and opportunities for market players, driving continuous innovation and competition as businesses strive to harness the full potential of predictive analytics in an increasingly data-driven world.

Leave a Comment