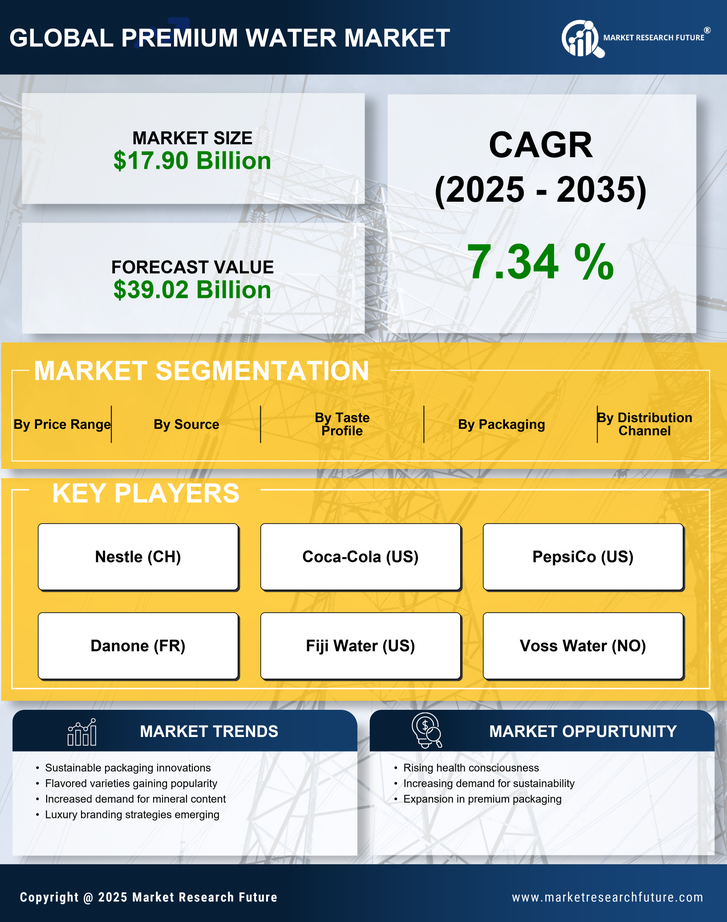

North America : Market Leader in Premium Water Market

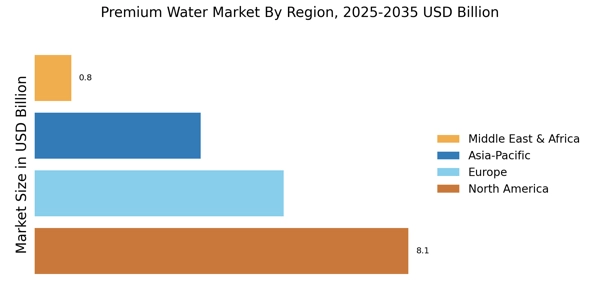

North America is the largest market for premium water, accounting for approximately 45% of the global market share. The region's growth is driven by increasing health consciousness, rising disposable incomes, and a shift towards premium products. Regulatory support for bottled water quality and safety standards further catalyzes market expansion. The U.S. is the primary contributor, followed by Canada, which is experiencing a growing demand for premium bottled water products.

The competitive landscape in North America is robust, featuring key players such as Nestle, Coca-Cola, and PepsiCo. These companies leverage strong distribution networks and marketing strategies to capture consumer interest. The presence of diverse brands, including Fiji Water and Voss, enhances market competition. As consumers increasingly seek premium and sustainable options, the market is expected to continue its upward trajectory, driven by innovation and brand loyalty.

Europe : Emerging Trends in Premium Water Market

Europe is witnessing significant growth in the premium water market, holding approximately 30% of the global share. The demand is fueled by rising health awareness, environmental concerns, and a preference for high-quality products. Countries like Germany and France are leading this trend, supported by stringent regulations on water quality and sustainability practices. The European Union's focus on reducing plastic waste is also influencing consumer choices towards premium bottled water.

Leading countries in Europe include France, known for brands like Evian and San Pellegrino, and Italy, home to Acqua Panna. The competitive landscape is characterized by a mix of established brands and emerging players focusing on organic and mineral-rich waters. The market is also seeing innovations in packaging and sustainability, aligning with consumer preferences for eco-friendly products. This dynamic environment positions Europe as a key player in the premium water sector.

Asia-Pacific : Rapid Growth in Premium Water Market

Asia-Pacific is emerging as a significant player in the premium water market, accounting for about 20% of the global share. The region's growth is propelled by increasing urbanization, rising disposable incomes, and a growing health-conscious population. Countries like China and Japan are at the forefront, with a rising demand for premium bottled water driven by lifestyle changes and a focus on quality. Regulatory frameworks are evolving to ensure product safety and quality, further boosting market confidence.

China is the largest market in the region, with a burgeoning middle class seeking premium products. Japan follows closely, with a strong preference for mineral and functional waters. The competitive landscape features both international brands and local players, with companies like Voss and Fiji Water gaining traction. As consumers become more discerning, the market is expected to expand, driven by innovation and premium offerings that cater to diverse tastes.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the premium water market, holding approximately 5% of the global share. The growth is driven by increasing urbanization, a rising affluent population, and a growing awareness of health and wellness. Countries like the UAE and South Africa are leading this trend, with regulatory frameworks improving to ensure product quality and safety. The demand for premium bottled water is also influenced by the region's climate, which necessitates hydration solutions.

In the UAE, the market is characterized by a mix of international brands and local players, with a focus on luxury and premium offerings. South Africa is witnessing a rise in demand for bottled water, driven by health trends and lifestyle changes. The competitive landscape is evolving, with companies exploring innovative packaging and marketing strategies to attract consumers. As the market matures, opportunities for growth and investment are expected to increase.