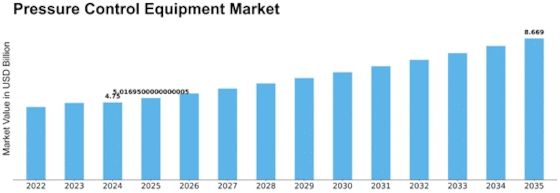

Pressure Control Equipment Size

Pressure Control Equipment Market Growth Projections and Opportunities

Pressure Control Equipment Market dynamics are shaped by market forces. The rising demand for pressure control devices in various industries is significant. Growing industries including oil and gas, manufacturing, and energy require reliable pressure control solutions. Improved operational efficiency, worker safety, and strict regulatory compliance drive this demand.

Technological advances shape the pressure control equipment industry. Innovative and advanced pressure control technologies have driven market expansion. R&D is being used to produce cutting-edge solutions that suit current industry needs and predict future issues. Integration of automation, smart sensors, and data analytics improves pressure control equipment performance and dependability.

Global economic and geopolitical changes affect market dynamics. For instance, oil price fluctuations affect the oil and gas industry, a key pressure control equipment buyer. Economic downturns may lower industry capital spending, affecting equipment demand. Geopolitical events can affect the worldwide supply chain, producing pressure control equipment market uncertainty.

Environmental restrictions are influencing the market more. Industries are adopting cleaner, more sustainable technologies as governments and regulators tighten environmental rules. Companies seeking to comply with these rules and exhibit corporate social responsibility are increasingly interested in pressure control equipment that decreases emissions and environmental effect.

Market competition shapes the pressure control equipment sector. More competitors force organizations to differentiate through product innovation, quality, and cost-effectiveness. Consumers gain from this competitive landscape because it drives producers to enhance their products and offer greater value.

End-user industries are crucial to market understanding. Pressure control equipment needs vary by industry, including oil & gas, manufacturing, healthcare, and aerospace. The market must adapt to these businesses' needs, such as designing equipment for intense oil and gas exploration or satisfying pharmaceutical hygiene standards.

The pressure control equipment market depends on regulatory compliance. The industry must meet regulatory safety and quality criteria. Noncompliance can lead to legal action, fines, and brand damage for companies. So manufacturers must invest in making sure their products meet or exceed these standards.

Leave a Comment