Market Analysis

In-depth Analysis of Primary Osteoarthritis Market Industry Landscape

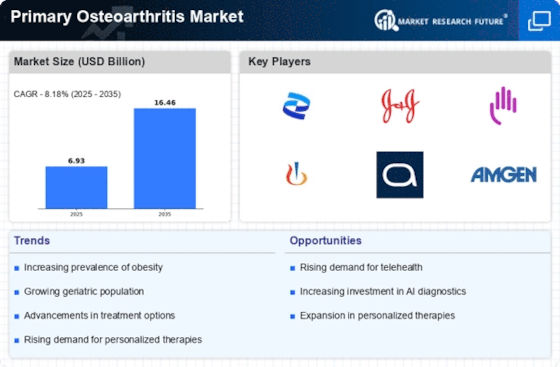

The market dynamics of Primary Osteoarthritis is characterized by complex factors that shape the treatment landscape of osteoarthritis. One of the major catalysts behind Primary Osteoarthritis is global aging population. As people age, there are increased cases of osteoarthritis which require more efficient treatments. Growing awareness about arthritis coupled with an expanding elderly population contributes to this market’s continuous growth; it becomes an integral part of musculoskeletal health care system.

Medical research advances and technological innovations play key roles in shaping dynamics within primary osteoarthritis field. Pharmaceutical companies are involved in developing innovative drugs and therapies that reduce symptoms and slow down progression of arthritis disease. This makes the market dynamic because new types of medications like painkillers, NSAIDS, DMOADS (disease-modifying osteoarthritic drugs) find their way into this business area. Regenerative therapy research works alongside personalized interventions for those affected by arthritis are still on-going efforts to differentiate approaches among patients suffering from this condition.

The dynamics of the Primary Osteoarthritis market can be shaped by regulatory factors. Stringent rules exist for the endorsement and commercialization of osteoarthritis drugs and therapies. Pharmaceutical companies’ compliance with regulatory norms is crucial for launching new treatments in the market while ensuring their safety and efficiency. The changing regulation hence affects the development timelines as well as market entry strategies, which in turn influence competitive environment within the osteoarthritis arena.

The competitive landscape that exists among the pharmaceutical industries is a significant part of primary OA’s market dynamics. In this case, companies compete to produce, formulate, and sell more effective, safer, evidence-based products. Partnerships, mergers and acquisitions are frequently used by drug firms to cement their place in the market and expand their product range . Moreover, various treatment options and disease-modifying approaches lead to fierce competition across osteoarthritis industry.

Furthermore, global demographic trends such as population aging and lifestyle changes also impact on Primary Osteoarthritis Market. Aging population is largely responsible for increased prevalence of osteoarthritis indicating need for efficient treatments which can be afforded by many people. Lifestyle aspects like lack of exercise and obesity also contribute to more cases of arthritis thus defining how much it costs to get certain services or goods from superiors. Understanding these demographic shifts will be essential for actors in the Primary Osteoarthritis market who want to create strategies that align with an evolving healthcare landscape.

Leave a Comment