Probiotics Animal Feed Size

Market Size Snapshot

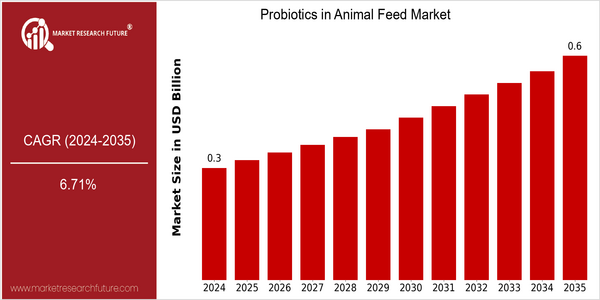

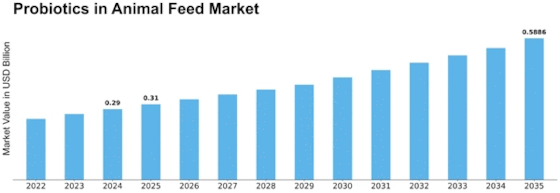

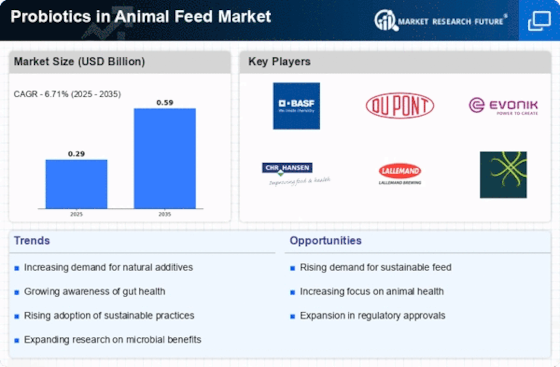

| Year | Value |

|---|---|

| 2024 | USD 0.29 Billion |

| 2035 | USD 0.6 Billion |

| CAGR (2025-2035) | 6.71 % |

Note – Market size depicts the revenue generated over the financial year

The global probiotics in animal feed market is poised for significant growth, with a current market size of USD 0.29 billion in 2024, projected to reach USD 0.6 billion by 2035. This growth trajectory reflects a robust compound annual growth rate (CAGR) of 6.71% from 2025 to 2035. The increasing demand for high-quality animal products, coupled with a growing awareness of the health benefits associated with probiotics, is driving this upward trend. As livestock producers seek to enhance animal health and productivity, the incorporation of probiotics into feed formulations has become a strategic focus.

Several factors are contributing to the expansion of this market, including advancements in probiotic strains and formulations that improve gut health and nutrient absorption in animals. Additionally, the rising trend of sustainable and organic farming practices is further propelling the adoption of probiotics in animal feed. Key players in this sector, such as Chr. Hansen, Eligo Bioscience, and BASF, are actively investing in research and development, forming strategic partnerships, and launching innovative products to capture market share. These initiatives not only enhance product offerings but also align with the growing consumer demand for healthier and more sustainable animal products.

Regional Market Size

Regional Deep Dive

The Probiotics in Animal Feed Market is experiencing significant growth across various regions, driven by increasing awareness of animal health, rising demand for organic and natural feed additives, and stringent regulations on antibiotic use in livestock. Each region exhibits unique characteristics influenced by local agricultural practices, consumer preferences, and regulatory frameworks. The market dynamics are further shaped by innovations in probiotic formulations and delivery systems, which enhance the efficacy of probiotics in promoting animal health and productivity.

Europe

- In Europe, the market is heavily influenced by stringent regulations on animal welfare and antibiotic usage, with the European Commission promoting the use of probiotics as a natural alternative to antibiotics in animal feed.

- Innovations in probiotic formulations, such as encapsulation technologies, are being developed by companies like ProbioFerm, which are expected to improve the stability and delivery of probiotics in feed.

Asia Pacific

- The Asia-Pacific region is experiencing rapid growth in the probiotics market, driven by increasing livestock production and a rising awareness of animal health among farmers, particularly in countries like China and India.

- Government initiatives aimed at promoting sustainable livestock practices, such as the 'National Livestock Mission' in India, are encouraging the adoption of probiotics in animal feed.

Latin America

- Latin America is witnessing a growing interest in probiotics as livestock producers seek to improve feed efficiency and animal health, particularly in countries like Brazil and Argentina, where livestock farming is a significant economic sector.

- The region is also seeing increased investment from multinational companies like DSM and BASF, which are introducing innovative probiotic products tailored to local market needs.

North America

- The North American market is witnessing a surge in demand for probiotics due to the growing trend of sustainable farming practices and the reduction of antibiotic use in livestock, driven by regulations from organizations like the FDA.

- Key players such as Eligo Bioscience and Chr. Hansen are investing in research and development to create advanced probiotic strains tailored for specific animal species, enhancing the overall effectiveness of animal feed.

Middle East And Africa

- In the Middle East and Africa, the market is characterized by a growing demand for high-quality animal products, leading to increased adoption of probiotics in animal feed to enhance livestock health and productivity.

- Local companies, such as Biovet and NutriTech, are focusing on developing region-specific probiotic solutions that cater to the unique climatic and agricultural conditions of the region.

Did You Know?

“Did you know that probiotics can help reduce methane emissions from livestock, contributing to more sustainable farming practices?” — FAO (Food and Agriculture Organization)

Segmental Market Size

The Probiotics in Animal Feed segment plays a crucial role in enhancing livestock health and productivity, and it is currently experiencing significant growth. Key drivers of demand include increasing consumer awareness regarding animal welfare and the rising need for sustainable farming practices. Additionally, regulatory policies promoting the use of natural feed additives over antibiotics are further propelling this segment's expansion.

Currently, the adoption of probiotics in animal feed is in a mature stage, with companies like DSM and Eligo Bioscience leading the way in innovative product development. Notable regions such as North America and Europe are at the forefront of this trend, implementing probiotics in various livestock sectors, including poultry and swine. Primary applications include improving gut health, enhancing nutrient absorption, and boosting overall animal performance. Trends such as the push for organic farming and sustainability initiatives are accelerating growth, while advancements in fermentation technologies and microbial research are shaping the future of this segment.

Future Outlook

The Probiotics in Animal Feed Market is poised for significant growth from 2024 to 2035, with a projected market value increase from $0.29 billion to $0.6 billion, reflecting a robust compound annual growth rate (CAGR) of 6.71%. This growth trajectory is driven by the rising demand for sustainable and health-oriented animal husbandry practices, as livestock producers increasingly recognize the benefits of probiotics in enhancing animal health, improving feed efficiency, and reducing reliance on antibiotics. As awareness of the link between animal nutrition and product quality continues to grow, the penetration of probiotics in animal feed is expected to rise, potentially reaching usage rates of over 30% in key markets by 2035.

Key technological advancements, such as the development of targeted probiotic strains and innovative delivery systems, are expected to further propel market growth. Additionally, supportive regulatory frameworks and increasing consumer demand for organic and antibiotic-free meat products will drive the adoption of probiotics in animal feed. Emerging trends, including the integration of probiotics with other feed additives and the growing interest in precision livestock farming, will also shape the market landscape. As the industry evolves, stakeholders must remain agile to capitalize on these trends and leverage data-driven insights to meet the changing needs of the market.

Leave a Comment