Market Share

Introduction: Navigating the Competitive Landscape of Production Information Management

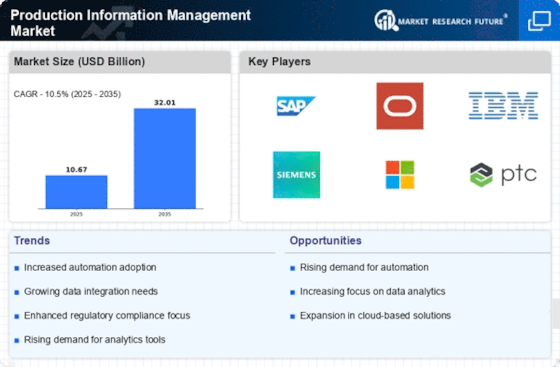

The competition in the field of Production Information Management is growing fiercer by the day. The major players, such as the equipment manufacturers, IT companies, system integrators, and new AI companies, are all vying for the leadership, and they are doing it with cutting-edge technology such as the use of artificial intelligence for data analysis, automation, and the integration of IoT. These are not only improving operational efficiency but are also responding to the regulatory changes and the trend towards greater efficiency. Green IT and data-driven decision-making are becoming more and more important for companies. In this regard, the opportunities for growth are emerging in the regions, especially in Asia-Pacific and North America, where strategic deployments are expected to alter the landscape in 2024–25. The C-level executives need to keep a close eye on these developments, as the future of market share in this important field is determined by the interplay between technology and the expectations of the end-users.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions that integrate various aspects of production information management, providing end-to-end capabilities.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| SAP (US) | Robust enterprise resource planning | Enterprise software solutions | Global |

| Oracle | Strong database and cloud services | Cloud applications and database management | Global |

| IBM (US) | Advanced analytics and AI integration | Data management and analytics | Global |

| Informatica (US) | Data integration and quality expertise | Data integration solutions | Global |

Specialized Technology Vendors

These vendors focus on niche solutions tailored for specific aspects of production information management, enhancing functionality and user experience.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Akeneo (France) | Strong product information management | Product information management (PIM) | Europe, North America |

| Inriver (Sweden) | User-friendly PIM solutions | Product information management | Europe, North America |

| Riversand (US) | Master data management expertise | Master data management (MDM) | Global |

| Stibo Systems (US) | Strong MDM and PIM capabilities | Master data management | Global |

| Contentserv (Switzerland) | Comprehensive PIM and DAM solutions | Product information management and digital asset management | Europe, North America |

Infrastructure & Equipment Providers

These vendors provide the necessary infrastructure and tools to support production information management processes.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Winshuttle (US) | Excel-based data management solutions | Data management and automation | North America, Europe |

| Mobius (India) | Cost-effective data management solutions | Data management and integration | Asia, North America |

| Perfium (Denmark) | Focus on data quality and governance | Data quality solutions | Europe |

| Profishee (U.S.) | Tailored solutions for specific industries | Data management solutions | North America |

| Censhare (USA) | Integrated content and product management | Content and product information management | Global |

| Vinculum (US) | Omnichannel retail solutions | Retail and supply chain management | Asia, North America |

| Truecommerce (US) | Comprehensive supply chain solutions | Supply chain management | North America |

| Vimedici (Germany) | Healthcare-focused data management | Data management for healthcare | Europe |

Emerging Players & Regional Champions

- DataStream Solutions, USA: specializes in real-time data collection and analysis in production environments. It has just teamed up with a major automobile manufacturer to improve the efficiency of its production line. It is challenging the established suppliers by offering a more flexible and customizable solution.

- Production Tech Innovations (Germany): specializes in Internet of Things production management tools, has recently implemented a smart factory solution for a large electronics manufacturer, complementing traditional vendors by integrating advanced analytics and machine learning.

- IT-solutions company AgilOps (India): This cloud-based, business-management service for small and medium-sized enterprises (SMEs) has recently won several textile industry contracts, enabling it to position itself as a cost-effective alternative to the established players.

- In the field of production automation, Smart Factory Solution from Canada is a pioneer in artificial intelligence, delivering the first production planning and optimization solution based on machine learning and deep learning. It has been collaborating with a food company to optimize production.

Regional Trends: In 2023, there will be a considerable increase in the use of cloud-based solutions and IoT, especially in North America and Europe. Besides, a great number of companies will be looking for flexible and scalable production information management systems that can be integrated into their existing IT systems. There is a growing need for sustainable and efficient solutions based on data analysis and machine learning.

Collaborations & M&A Movements

- With the aim of increasing the transparency of data and the efficiency of production processes, the two companies have entered into a partnership in which they will integrate their respective solutions, and thus further increase their competitive position in the Industry 4.0 landscape.

- Rockwell Automation acquired Plex Systems in mid-2023 to expand its cloud-based manufacturing solutions, significantly increasing its market share in the Production Information Management sector and enhancing its capabilities in smart manufacturing.

- Honeywell and Microsoft are collaborating on developing advanced analytical tools for manufacturing operations, with the goal of improving productivity and reducing downtime.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Biometric Self-Boarding | SITA, Gemalto | IT systems provider SITA has introduced biometric self-boarding at over 100 airports worldwide, improving the flow of passengers and reducing boarding time. Gemalto’s technology is highly accurate and can be easily integrated into existing systems. This is demonstrated by its use in major international airports. |

| AI-Powered Ops Mgmt | IBM, Siemens | The artificial intelligence of the IBM Watson system is used for the prediction of breakdowns and the automation of operations in various transport sectors. In some of the test cases, this has resulted in a reduction of downtime by 20 per cent. In industry, Siemens uses its artificial intelligence to analyse data in real time and to improve the decision-making process in production. |

| Border Control | Thales, NEC | Thales has developed an effective system of border control based on facial recognition and biometric data which has been successfully put into operation in several European countries. NEC’s solutions are known for their speed and accuracy. In one case in Japan, NEC has been able to reduce the time taken for border control by a third. |

| Sustainability | Honeywell, Schneider Electric | Honeywell’s efforts in this area have been directed to the development of energy-saving solutions, and the result has been a reduction in the energy consumption of several airports by up to 15 per cent. The EcoStruxure platform from Schneider Electric has been shown to reduce carbon emissions in real-life case studies. |

| Passenger Experience | Amadeus, Travelport | Amadeus Personalised Travel Experiences have been proven to increase passenger satisfaction by 25 per cent. Travelport’s ground-breaking technology has shortened the booking process and increased the engagement of its users by 40 per cent. |

Conclusion: Navigating the Competitive Landscape Ahead

Production information management will be characterized by a high degree of competition and a high degree of fragmentation in 2023. Both the old and the new players will be fighting for a share of the market. Regional developments show a tendency towards more local solutions, where the suppliers adapt to the local market and the local regulatory environment. The old players use their reputation and their resources to further develop their products, while the new companies use the latest technology and the newest ideas to differentiate themselves. The ability to provide flexible and scalable solutions will be a key factor for leadership. The suppliers will have to put this ability on the top of their investment list to be able to meet current demands and also to anticipate the future expectations of consumers and technological development.

Leave a Comment