Global Property Tax Service Market Overview

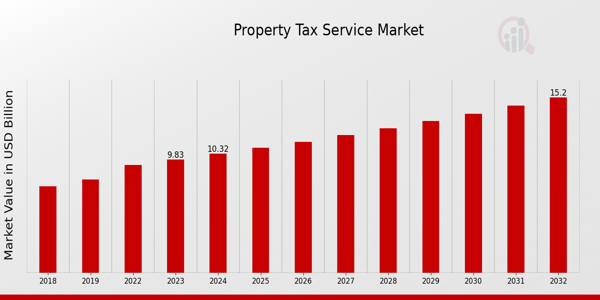

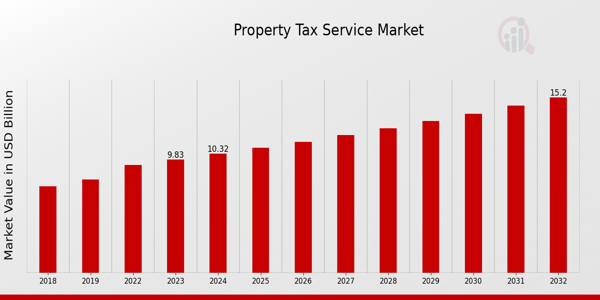

Property Tax Service Market Size was estimated at 9.37 (USD Billion) in 2022. The Property Tax Service Market Industry is expected to grow from 9.83 (USD Billion) in 2023 to 15.2 (USD Billion) by 2032. The Property Tax Service Market CAGR (growth rate) is expected to be around 4.96% during the forecast period (2024 - 2032).

Key Property Tax Service Market Trends Highlighted

The Property Tax Service Market is experiencing a host of transformational trends that are driving growth and innovation within this sector. The increasing levels of urbanization and accompanying population expansions call for increased property resource tax assessment and management. To improve their revenue collection, states and municipalities are also looking for efficient tax collection systems, creating an additional need for value assessment services. Furthermore, such technologies, including automated valuation models and geographic information systems, are enabling accurate property evaluation, thus increasing the importance of these services in both aspects of the economy. This market is dynamic and there are plenty of prospects.

The development of smart cities allows for property tax service firms to provide sophisticated tax management systems. In addition, since the trend for property owners is to minimize their tax burdens, companies providing tax code consulting services may also experience a rapid expansion. New opportunities for these models are emerging from the growing demands of tax assessment fairness and transparency on customer engagement and service. Recent tendencies indicate a move to digitalization of most activities in the property tax sector. Today, most property tax service providers prefer to use cloud-based systems which offer tax assessors and property owners enhanced convenience and effectiveness.

Companies are now placing a lot more emphasis on data and analytics as they are able to derive important information from their property databases to enhance their decision-making capabilities. There is also a growing concern about social justice in property taxation which has opened up the debate of amending the existing tax systems so that they are better suited to the needs of multicultural society. There is a shift towards such a trend of modernization and justice which is changing the manner in which the property tax services are provided and viewed in the market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Property Tax Service Market Drivers

Increasing Urbanization and Property Development

The Property Tax Service Market Industry is primarily driven by increasing urbanization and rapid property development across the globe. As populations continue to migrate to urban areas in search of better employment opportunities, housing demand surges. This influx of people requires significant investments in housing infrastructure, commercial spaces, and public services. Local governments are tasked with assessing property values to ensure that appropriate taxes are levied to fund these essential services. Consequently, the demand for property tax services increases, as municipalities look to implement fair and efficient tax assessment processes. The steady rise in urban population not only necessitates the assessment of existing properties but also the evaluation of new real estate developments, driving growth in the property tax service market. Furthermore, emerging economies experiencing a boom in real estate and construction sectors will continue to bolster the need for specialized property tax services to aid in strategic decision-making and fiscal planning. With the overall market expected to see significant growth, stakeholders remain optimistic about the sustained demand for property tax services over the coming years.

Regulatory Compliance and Transparency

Regulatory compliance and transparency are becoming increasingly important in the Property Tax Service Market Industry. Governments and regulatory bodies are implementing stricter tax laws and guidelines, compelling property owners and businesses to maintain accurate records and ensure compliance with local tax obligations. This trend has created a demand for property tax services that can guide individuals and businesses through the complexities of tax regulations, thereby ensuring compliance. The rise of digital platforms and technological solutions also contributes to improved transparency, allowing property owners to easily access their tax assessments and related information. Consequently, the need for property tax experts who can navigate these regulations while providing transparent and efficient solutions has become a vital driver of growth in this market.

Technological Advancements in Tax Assessment

The integration of advanced technology in property tax assessment processes is significantly influencing the growth of the Property Tax Service Market Industry. The adoption of innovative tools, such as geographic information systems (GIS), big data analytics, and artificial intelligence, allows tax assessors to efficiently analyze vast amounts of property data and accurately determine property values. These technological advancements enable more precise assessments and improve the overall efficiency of tax collection systems. As municipalities increasingly seek to modernize their operations and improve revenue collection, the demand for technology-based property tax services continues to rise, propelling market growth forward.

Property Tax Service Market Segment Insights

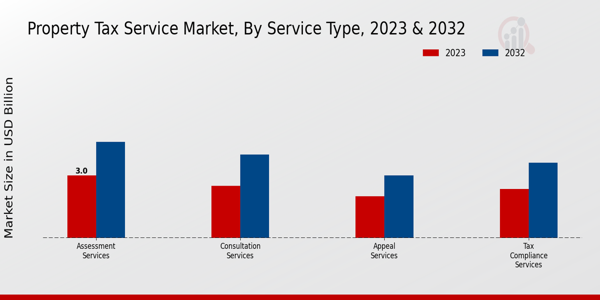

Property Tax Service Market Service Type Insights

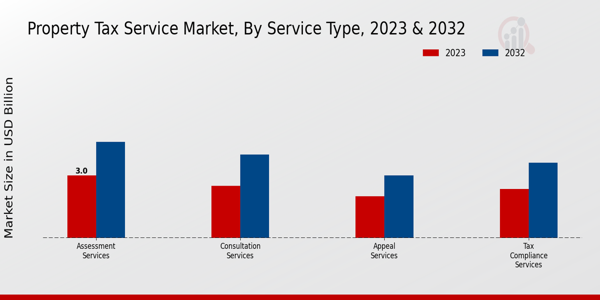

The Property Tax Service Market revenue is significantly influenced by its Service Type segment, which comprises various crucial offerings such as Assessment Services, Consultation Services, Appeal Services, and Tax Compliance Services. In 2023, the Assessment Services account for a substantial share, valued at 3.0 USD Billion, and are projected to rise to 4.6 USD Billion by 2032, indicating its dominance and importance in property taxation. This service plays a vital role in determining property values, which directly affects taxation decisions and the financial liabilities of property owners. Consultation Services follow closely with a market valuation of 2.5 USD Billion in 2023 and anticipated growth to 4.0 USD Billion by 2032. These services are essential for property owners seeking expert advice on navigating the complexities of tax regulations and optimizing their tax obligations, which contributes to their growing significance. The Appeal Services segment, valued at 2.0 USD Billion in 2023 and projected to reach 3.0 USD Billion in 2032, addresses disputes that arise over property assessments, providing critical support to property owners who may feel unfairly taxed. This segment is vital because it supports fairness in tax levies and encourages compliance with property taxes. Lastly, the Tax Compliance Services, currently valued at 2.33 USD Billion in 2023 and expected to grow to 3.6 USD Billion by 2032, help property owners ensure they meet all necessary tax obligations, thereby fostering better compliance and reducing the risk of penalties. Each of these services contributes to the overall infrastructure of the property tax ecosystem, helping property owners understand their obligations, appeal assessments when necessary, and comply effectively with regulations. The growing importance of these services is driven by increased scrutiny of property taxes and the need for transparency in assessments, highlighting notable trends in the market. As such, the market growth is supported by the rising complexities in property taxation and an increasing demand for expert guidance across all service types in the Property Tax Service industry, making it a critical area of focus for stakeholders involved.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Property Tax Service Market Client Type Insights

The Property Tax Service Market is projected to reach a valuation of 9.83 USD billion in 2023, showcasing a steady growth trend across various client types. Residential property owners constitute a significant portion of the market, driven by the need for accurate tax assessments and efficient management of property tax liabilities. Commercial property owners also play a pivotal role, seeking expert services to navigate complex tax regulations and optimize their financial strategies. Government entities leverage property tax services for data analysis and efficient tax collection, ensuring compliance and maximizing revenue streams. Real estate developers are increasingly reliant on property tax services to assess potential developments and plan financial obligations effectively. The trends indicate a consistent demand across these client types, fueled by the need for enhanced compliance and strategic property management, which is likely to drive extensive growth in the Property Tax Service Market industry.

Property Tax Service Market Service Delivery Model Insights

The Property Tax Service Market, valued at 9.83 USD Billion in 2023, shows a diverse array of Service Delivery Models. These models, particularly In-House Services, Outsourced Services, and Hybrid Services, play a crucial role in shaping the market landscape. In-House Services allow organizations to maintain control and utilize internal resources for property tax management, which is essential for maintaining compliance and accuracy. Outsourced Services are becoming more popular as they provide organizations with the opportunity to streamline operations and reduce costs by leveraging external expertise. Conversely, Hybrid Services offer a balanced approach, combining the strengths of both in-house and outsourced methods, allowing organizations flexibility and access to diverse resources. This increasing preference for varied service delivery methods is a significant driver influencing the Property Tax Service Market statistics and aiding in its growth. The segmentation reveals an underlying trend towards customization in service delivery, with organizations striving for efficiency and specialization tailored to their unique tax requirements. Such developments highlight the evolving nature of the market, creating substantial opportunities for growth while addressing emerging challenges in property tax compliance and management.

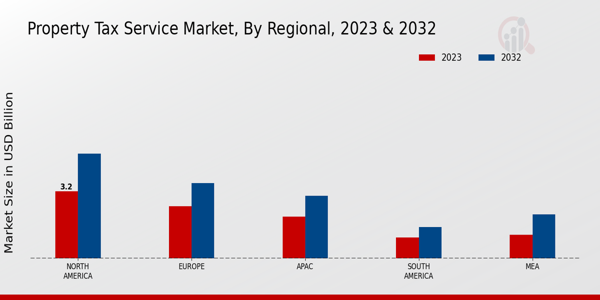

Property Tax Service Market Regional Insights

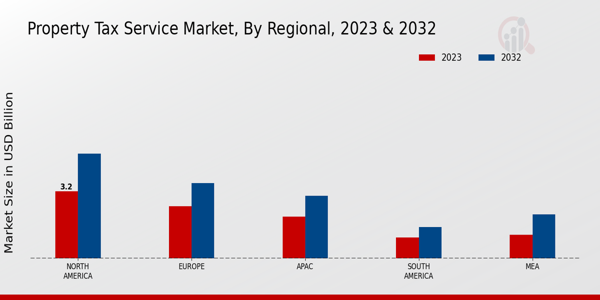

The Property Tax Service Market exhibits a diverse regional segmentation that showcases varying valuations across different areas. In 2023, North America leads the market with a valuation of 3.2 USD Billion, expected to grow to 5.0 USD Billion by 2032, indicating its majority holding and robust demand for property tax services. Europe ranks as the second largest region, valued at 2.5 USD Billion in 2023 and projected to reach 3.6 USD Billion by 2032, reflecting its significant market presence driven by increasing property values and regulatory requirements. The APAC region, valued at 2.0 USD Billion in 2023 and anticipated to grow to 3.0 USD Billion by 2032, holds potential for growth, supported by rapid urbanization and economic expansion. Meanwhile, South America and the MEA regions have smaller market sizes, valued at 1.0 USD Billion and 1.13 USD Billion respectively in 2023, but are expected to grow to 1.5 USD Billion and 2.1 USD Billion by 2032, highlighting emerging opportunities for property tax services in these developing markets. Through these valuations, the Property Tax Service Market segmentation illustrates not only current market dynamics but also the growth trajectory across various regions.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Property Tax Service Market Key Players and Competitive Insights

The Property Tax Service Market is an evolving sector characterized by a diverse range of offerings aimed at assisting property owners and management in navigating the complexities of property taxation. The competitive landscape is marked by a variety of service providers who leverage technology to provide efficient solutions for property valuation, tax assessment, and dispute resolution. The market features both established players and emerging firms, creating a dynamic environment where innovation is essential for maintaining competitiveness. Key trends influencing the market include increasing regulatory compliance requirements, technological advancements that enhance service delivery, and rising demand for specialized property tax consulting services. As globalization continues to impact local economies, the strategies deployed by companies in this market are crucial for sustaining growth and providing value to their clients. Costar Group stands out in the Property Tax Service Market due to its comprehensive suite of high-quality data and analytics services. The company's robust database and research capabilities enable it to deliver precise property information, facilitating better decision-making for its clients. Costar Group's strength lies in its ability to utilize advanced technology to streamline tax assessments and enhance property valuation accuracy, which is critical in a market that is increasingly reliant on data-driven insights. Furthermore, its expansive network and established reputation within the real estate sector allow Costar Group to maintain a significant presence, providing clients with reliable tax services and compliance solutions over a wide geographical area. This competitive edge is enhanced by its commitment to ongoing innovation and responsiveness to the evolving needs of property owners and management.

Zillow Group also plays a crucial role in the Property Tax Service Market, focusing on leveraging its vast real estate data platform to offer unique insights into property tax services. The company is known for its user-friendly interfaces and accessible tools that provide property owners with important tax-related information, such as estimated property values and potential tax liabilities. Zillow Group's strength comes from its comprehensive listing of properties and the ease with which users can navigate the platform. By combining property listings with tax data functionality, Zillow Group delivers significant value to consumers looking to make informed decisions regarding their property investments. Additionally, its strong brand presence and commitment to enhancing user experience ensure that it remains a key player in the competitive landscape, continuously adapting to market demands and technological advancements.

Key Companies in the Property Tax Service Market Include

- Costar Group

- Zillow Group

- PricewaterhouseCoopers

- ProQuest

- KPMG

- PwC

- Deloitte

- Moody's Analytics

- MSCI

- CoreLogic

- EY

- Harley Reed

- RealPage

- CMA

Property Tax Service Industry Developments

Recent developments in the Property Tax Service Market have highlighted an increasing focus on technology integration and the growth of innovative solutions offered by leading companies. The Costar Group and Zillow Group are both enhancing their property analytics capabilities, capitalizing on data-driven insights to support property valuation and tax assessment processes. PricewaterhouseCoopers (PwC) and Deloitte are focusing on providing advisory services that navigate the complexities of property taxation, promoting transparency for municipalities and property owners alike. Several players in this space, including KPMG and Moody's Analytics, have aimed to refine their analytical tools to optimize property tax administration. Currently, there are notable mergers and acquisitions impacting the market. CoreLogic recently announced its acquisition of a technology firm that specializes in property data solutions, reinforcing its position in the market. In a similar vein, ProQuest has expanded its service capabilities through strategic partnerships. As these entities strengthen their offerings, the competition intensifies, fostering innovation and improved service delivery across the sector, ultimately benefiting stakeholders involved in property taxation by enhancing efficiency and accuracy in managing property tax obligations.

Property Tax Service Market Segmentation Insights

-

Property Tax Service Market Service Type Outlook

- Assessment Services

- Consultation Services

- Appeal Services

- Tax Compliance Services

-

Property Tax Service Market Client Type Outlook

- Residential Property Owners

- Commercial Property Owners

- Government Entities

- Real Estate Developers

-

Property Tax Service Market Service Delivery Model Outlook

- In-House Services

- Outsourced Services

- Hybrid Services

-

Property Tax Service Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

| Report Attribute/Metric |

Details |

| Market Size 2022 |

9.37 (USD Billion) |

| Market Size 2023 |

9.83 (USD Billion) |

| Market Size 2032 |

15.2 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

4.96% (2024 - 2032) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2023 |

| Market Forecast Period |

2024 - 2032 |

| Historical Data |

2019 - 2023 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Costar Group, Zillow Group, PricewaterhouseCoopers, ProQuest, KPMG, PwC, Deloitte, Moody's Analytics, MSCI, CoreLogic, EY, Harley Reed, RealPage, CMA |

| Segments Covered |

Service Type, Client Type, Service Delivery Model, Regional |

| Key Market Opportunities |

Digital transformation in tax assessments, Growing demand for compliance solutions, Expansion of real estate investment, Integration of artificial intelligence tools, Increasing focus on accurate valuations |

| Key Market Dynamics |

Technology adoption in tax assessment, Regulatory compliance and changes, Growing property investment trends, Demand for transparency and accuracy, Increasing emphasis on data analytics |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ) :

The Property Tax Service Market is expected to be valued at 15.2 USD Billion by 2032.

The expected CAGR for the Property Tax Service Market from 2024 to 2032 is 4.96%.

North America is projected to have the largest market share, valued at 5.0 USD Billion by 2032.

Assessment Services is expected to be valued at 4.6 USD Billion in 2032 within the Property Tax Service Market.

Key players in the market include Costar Group, Zillow Group, PwC, and Deloitte among others.

The Tax Compliance Services segment is projected to reach a value of 3.6 USD Billion by 2032.

The Property Tax Service Market is estimated to be valued at 9.83 USD Billion in 2023.

The Appeal Services segment is expected to grow from 2.0 USD Billion in 2023 to 3.0 USD Billion in 2032.

Europe's market size is forecasted to reach 3.6 USD Billion by 2032 in the Property Tax Service Market.

Emerging trends include increasing demand for consultation services and advancements in tax compliance solutions.