Market Trends

Key Emerging Trends in the Proteinuria Treatment Market

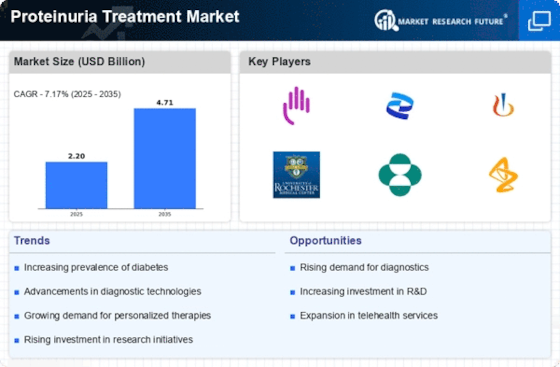

Strategic shifts with regard to corporate interests, as well as both national and international trade, continue shaping trends in the pharmaceutical industry, especially those relating to renal health and nephrology. A logical approach towards entering into this market involves developing innovative drug therapies aimed at treating proteinuria only by some selected groups of people. The recognition of the importance of addressing proteinuria, which is usually a symptom underlying kidney disorders, has forced companies to invest heavily in research and development activities aimed at introducing new therapeutic medicines as well as interventions. Strategic collaborations and partnerships play a pivotal role in shaping market share within the Proteinuria Treatment Market. This is because companies have formed alliances with nephrologists, healthcare institutions, and research organizations due to the multidisciplinary nature of nephrology, together with complicated issues related to kidney diseases. Pricing is also a critical strategy when accessing market segments such as the Proteinuria Treatment Market. Therefore, they walk on a rope between providing the best quality treatments for all patients who have proteinuria but should be able to reach too many people. In order to address economic constraints faced by individuals seeking proteinuria services, some companies may adopt tiered pricing structures, patient assistance programs, or reimbursement support. The success of a marketing strategy determines how well the company will be recognized in the market, and thus, it is fundamental to gaining market share within this segment. Companies invest in strong marketing campaigns that are aimed at enlightening nephrologists about their product offerings for proteinuria, healthcare providers, and patient communities. Establishing a sound brand presence through targeted educational programs, disease awareness initiatives, and active participation in medical conferences ensures credibility. Customization and patient-centricity have become key strategies within the Proteinuria Treatment Market. Offering personalized and disease-specific treatment options for proteinuria is one-way companies realize the heterogeneity of kidney diseases and respond to treatment among patients. This may include custom-made treatment plans, biomarker-based interventions, or therapies targeting specific etiologies, thereby resulting in a more customized approach regarding nephrologists' peculiarities while working with proteinuric patients. By doing so, these companies end up delivering individualized services that are beneficial, hence enhancing the overall experience of patients undergoing treatment for proteinuria.

Leave a Comment