- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

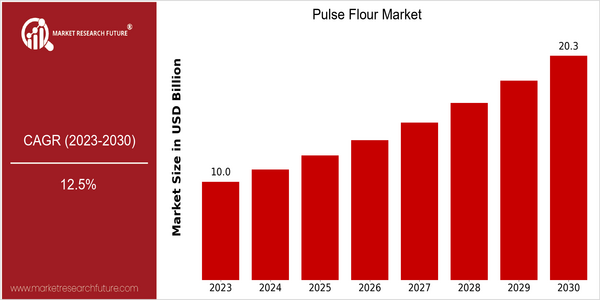

| Year | Value |

|---|---|

| 2023 | USD 10.01 Billion |

| 2030 | USD 20.29 Billion |

| CAGR (2023-2030) | 12.5 % |

Note – Market size depicts the revenue generated over the financial year

The global pulse flour market is currently valued at USD 10.01 billion in 2023 and is projected to reach USD 20.29 billion by 2030, reflecting a robust compound annual growth rate (CAGR) of 12.5% during the forecast period. This significant growth trend underscores the increasing consumer demand for gluten-free and plant-based food products, as pulse flour is recognized for its nutritional benefits, including high protein and fiber content. As health-conscious consumers seek alternatives to traditional wheat flour, the market for pulse flour is expanding rapidly, driven by a shift towards healthier eating habits and sustainable food sources. Technological advancements in food processing and the rising popularity of plant-based diets are key factors propelling this market growth. Innovations in milling techniques and product formulations have enhanced the quality and versatility of pulse flour, making it suitable for a wide range of applications, from baking to snacks. Notable companies such as Ingredion Incorporated and Archer Daniels Midland Company are actively investing in research and development to expand their product offerings and improve processing methods. Strategic initiatives, including partnerships and collaborations with food manufacturers, are also being pursued to capitalize on the growing demand for pulse-based ingredients, further solidifying the market's upward trajectory.

Regional Market Size

Regional Deep Dive

The Pulse Flour Market is experiencing significant growth across various regions, driven by increasing consumer demand for gluten-free and plant-based products. In North America, Europe, Asia-Pacific, the Middle East and Africa (MEA), and Latin America, the market dynamics are influenced by health trends, sustainability concerns, and innovations in food technology. Each region exhibits unique characteristics, such as varying dietary preferences, regulatory frameworks, and economic conditions that shape the pulse flour landscape. Overall, the market is poised for expansion as more consumers recognize the nutritional benefits of pulse-based products.

Europe

- In Europe, the increasing focus on sustainability has prompted brands like Pulsin and Doves Farm to incorporate pulse flour into their offerings, aligning with the EU's Green Deal initiatives aimed at promoting plant-based diets.

- The European Food Safety Authority (EFSA) has been actively involved in assessing the health benefits of pulse consumption, which has led to greater consumer awareness and acceptance of pulse flour in various food applications.

Asia Pacific

- The Asia-Pacific region is witnessing a growing trend towards health-conscious eating, with companies like Tasty Bite and Nature's Path introducing pulse flour products that cater to local tastes and preferences.

- Government initiatives in countries like India, promoting the cultivation of pulses for food security, are expected to boost the availability and affordability of pulse flour in the region.

Latin America

- Latin America is experiencing a revival of ancient grains and pulses, with companies like La Fama and NutriGrain focusing on the nutritional benefits of pulse flour in their product lines.

- Cultural factors, such as the traditional use of beans in Latin American cuisine, are influencing the acceptance and integration of pulse flour into everyday cooking, enhancing its market potential.

North America

- The rise of plant-based diets in North America has led to a surge in demand for pulse flour, with companies like Bob's Red Mill and Banza innovating their product lines to include chickpea and lentil flours.

- Recent regulatory changes, such as the FDA's updated guidelines on labeling gluten-free products, have encouraged manufacturers to explore pulse flour as a gluten-free alternative, enhancing its market appeal.

Middle East And Africa

- In the Middle East and Africa, traditional diets rich in legumes are being complemented by modern pulse flour products, with local brands like Al Dahra and Pure Harvest leading the charge in product innovation.

- The region's increasing urbanization and changing dietary habits are driving demand for convenient, nutritious food options, positioning pulse flour as a key ingredient in ready-to-eat meals.

Did You Know?

“Did you know that pulse flour is not only gluten-free but also rich in protein, fiber, and essential nutrients, making it a popular choice among health-conscious consumers?” — Pulse Canada

Segmental Market Size

The Pulse Flour Market is experiencing significant growth, driven by increasing consumer demand for gluten-free and plant-based alternatives. This segment plays a crucial role in the broader health food market, catering to a diverse range of dietary preferences and restrictions. Key drivers include the rising awareness of health benefits associated with pulse-based products, such as high protein and fiber content, and the growing trend towards sustainable food sources that reduce environmental impact. Regulatory policies promoting healthier eating habits further bolster this demand. Currently, the adoption of pulse flour is in the scaled deployment stage, with companies like Banza and The Pulse Food Company leading the charge in North America. Primary applications include baking, pasta production, and snack foods, where pulse flour is utilized to enhance nutritional profiles. Trends such as the COVID-19 pandemic have accelerated interest in home cooking and healthier eating, while sustainability initiatives push for more eco-friendly ingredients. Technologies like advanced milling processes and innovative product formulations are shaping the evolution of this segment, making pulse flour a versatile and appealing choice for manufacturers and consumers alike.

Future Outlook

The Pulse Flour Market is poised for significant growth from 2023 to 2030, with a projected market value increase from $10.01 billion to $20.29 billion, reflecting a robust compound annual growth rate (CAGR) of 12.5%. This growth trajectory is driven by the rising consumer demand for gluten-free and plant-based products, as well as the increasing awareness of the health benefits associated with pulse-based ingredients. As more consumers adopt healthier lifestyles, the penetration of pulse flour in various food applications, including baked goods, snacks, and protein supplements, is expected to rise substantially, potentially reaching a usage rate of over 20% in mainstream food products by 2030. Key technological advancements in processing and product formulation are likely to enhance the quality and versatility of pulse flour, making it an attractive alternative to traditional flours. Innovations in milling technology and the development of new pulse varieties will further support market expansion. Additionally, supportive policies promoting sustainable agriculture and plant-based diets are expected to bolster the market. As the food industry continues to evolve, the Pulse Flour Market is set to benefit from emerging trends such as clean label products and the growing popularity of functional foods, positioning it as a critical player in the future of food innovation.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 12.5 % (2023-2030) |

Pulse Flours Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.