Top Industry Leaders in the Rack Mount Servers Market

Competitive Landscape of Rack Mount Servers Market

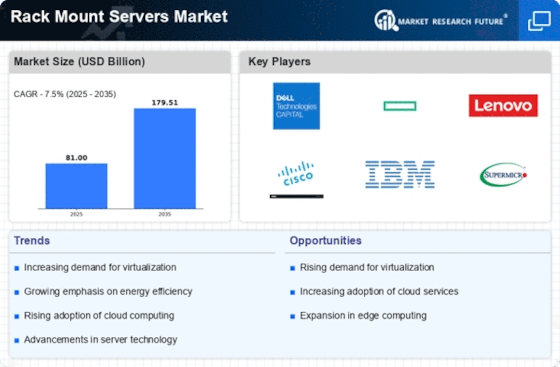

The global rack mount servers market is driven by the surging demand for data center applications, cloud computing, and enterprise IT infrastructure advancements. This dynamic landscape fosters intense competition among established players and new entrants, all vying for a larger market share.

Key Players:

- DELL

- HPE

- Inspur

- Lenovo

- IBM

- Huawei

- Cisco

- Fujitsu

Factors for Market Share Analysis:

-

Product Portfolio: Offering a diverse range of servers for different form factors, performance levels, and price points caters to a wider customer base. Dell and HPE excel in this aspect, while Inspur and Lenovo are focusing on niche segments like edge computing and HPC.

-

Technological Innovation: Continuous investment in R&D to develop energy-efficient, high-performance servers with cutting-edge technologies like AI and machine learning (ML) is crucial. Huawei's focus on ARM-based servers and Quanta's liquid cooling technology are examples of innovative approaches.

-

Geographic Footprint: Strong presence in key regions like North America, Europe, and Asia-Pacific is essential due to market variations and local preferences. Dell and HPE have a global network, while Huawei dominates the Chinese market and Inspur targets emerging Asian economies.

-

Pricing Strategy: Balancing cost-effectiveness with performance is critical. Tier-2 players like Supermicro and local vendors often compete on price, while Tier-1 players offer premium features at higher costs.

-

Customer Service and Support: Providing excellent after-sales support and maintenance builds brand loyalty and customer retention. Dell's ProSupport and HPE's Pointnext services are prime examples.

Current Company Investment Trends:

-

Cloud-Optimized Servers: Rack mount server vendors are tailoring their offerings for cloud workloads with features like virtualization, scalability, and containerization. HPE's Cloudline servers and Dell's EMC PowerEdge MX series cater specifically to this segment.

-

Green Technology Initiatives: Sustainability is a growing concern, leading to investments in energy-efficient server designs and eco-friendly manufacturing practices. Lenovo's ThinkSystem servers and Dell's PowerEdge R950 server are examples of energy-efficient models.

-

Software Defined Infrastructure (SDI) Integration: Integrating management software with rack mount servers enables easier deployment, automation, and orchestration. HPE's OneView and Dell's OpenManage Enterprise are examples of such software solutions.

-

Security and Compliance: Data security and compliance are paramount in today's digital world. Vendors are incorporating advanced security features like encryption and intrusion detection into their servers. Dell's PowerEdge Secure Server Technology and HPE's Silicon Root of Trust are examples of these efforts.

Latest Industry News:

- October 24, 2023: Dell Technologies launches its PowerEdge R760xa server, specifically designed for cloud-native workloads and optimized for AMD EPYC Genoa processors.

- November 15, 2023: HPE unveils its ProLiant Gen11 servers, featuring improved performance, security, and manageability capabilities.

- December 05, 2023: Lenovo introduces its ThinkSystem SR670 server, powered by Intel Sapphire Rapids processors and offering enhanced performance for various workloads.