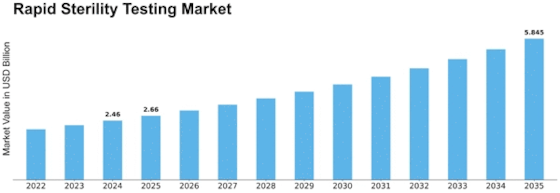

Rapid Sterility Testing Size

Rapid Sterility Testing Market Growth Projections and Opportunities

The RAPID STERILITY TESTING MARKET is closely tied to the expansion of the pharmaceutical and biotechnology industries. As these industries experience growth, the demand for rapid sterility testing solutions increases, driven by the need for efficient quality control measures in drug manufacturing. Regulatory standards and requirements set by health authorities significantly shape the RAPID STERILITY TESTING MARKET. Compliance with stringent regulations is essential for market players to gain approval for their testing solutions, and innovations that meet regulatory expectations drive market competitiveness. The technology advancements are the one which helps in reshaping the rapid sterility testing market. The constant innovations of testing methodologies and the advanced rapid as well automated systems with fast delivery better sterility values to enlarge market demand for controlling factors. The changing roles of biopharmaceutical manufacturing drive the market. Most of the biopharmaceuticals call for unique sterility testing methods, and with changing landscape of biomanufacturing rapid sterility testing solution are being formulated to meet their needs in turn influencing market growth. It is the quality assurance policy in healthcare including that required by pharmaceutical manufacturing, which provides one of most important foundations for rapid sterility testing market. In order to guarantee the safety and effectiveness of pharmaceutical products, rapid and reliable sterility testing is critical; this has boosted demand for novel test methods. The incorporation of risk mitigation strategies in manufacturing process is largely a driving factor for the market. In this way, rapid sterility testing is the fundamental element in view of rapidly discovering and handling prospective contamination dangers mending with business attempts to improve irrefutable nature esteem concerning reducing these generation ceases. It reacts to the growing demand for manufacturing processes that are time saving made by pharmaceutical and biotechnology industries. Speedy methods of sterility testing enable seamless workflows and reduced turnaround time, release products faster; this is an important factor influencing adoption by the market. The topmost companies envision to create advanced technologies and innovative solutions that help them stay ahead of the competition. The market behavior is due to the ongoing improvement of accuracy, efficiency and convenience both as a result correspondingly. Cost-efficiency is a significant factor in the adoption of rapid sterility testing methods. Companies in the RAPID STERILITY TESTING MARKET aim to offer solutions that balance high performance with cost-effectiveness, addressing the economic considerations of pharmaceutical manufacturers and healthcare facilities.

Leave a Comment