- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

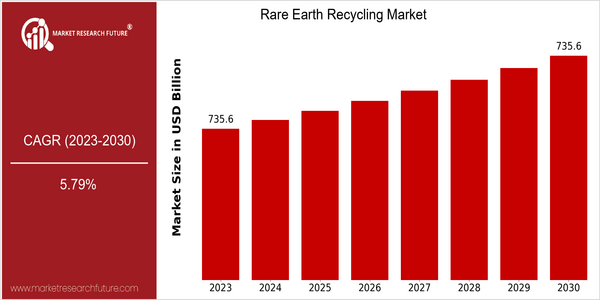

| Year | Value |

|---|---|

| 2023 | USD 735.65 Billion |

| 2030 | USD 735.65 Billion |

| CAGR (2023-2030) | 5.79 % |

Note – Market size depicts the revenue generated over the financial year

The Rare Earth Recycling Market is estimated to be valued at $735.65 billion in 2023, with a projected CAGR of 5.79% for the forecast period of 2023 to 2028. The market size has remained stable, indicating a stable demand for rare earth elements, which are critical for high-tech industries, such as the electronics, renewable energy, and automobile industries. In addition, with the growing emphasis on the circular economy and sustainable practices, companies are looking for ways to reduce their reliance on mining and minimize their environmental impact. Meanwhile, technological advancements in the pyro- and hydrometallurgical methods of rare earth recovery are increasing the efficiency and cost-effectiveness of rare earth recovery from end-of-life products. Lynas, MPM, and Neo Performance Materials are forming strategic alliances to drive their market share. Similarly, technology companies are collaborating with rare earth recovery companies to develop new extraction methods from e-waste, which will ensure a stable supply of rare earths while addressing the concerns of the environment. These strategic initiatives will play a critical role in shaping the future of the rare earth recovery market.

Regional Market Size

Regional Deep Dive

The rare earths recycling market is experiencing significant growth in several regions, mainly driven by the rising demand for rare earths in high-tech applications and the increasing importance of sustainable development. The North American market is characterized by a high focus on innovation and regulatory support, with the goal of reducing the dependence on imported rare earths. The European market is also experiencing a boom, driven by stricter environmental regulations and the implementation of the circular economy. As a major centre of rare earths production, the Asia-Pacific region is also advancing in its rare earths recovery technology and government support for domestic rare earths recovery is increasing. Meanwhile, the Middle East and Africa are gradually emerging as potential markets, as the economic benefits of rare earths recovery are becoming more widely known. Latin America, still developing its rare earths recovery capabilities, is beginning to explore the opportunities presented by the growing world demand for rare earths.

Europe

- The European Union has implemented the Circular Economy Action Plan, which includes specific targets for recycling rare earth elements, driving investment in recycling facilities across member states.

- Organizations such as the European Rare Earths Competency Network (ERECON) are collaborating to enhance the recycling of rare earth materials, emphasizing the importance of local sourcing and sustainability.

Asia Pacific

- China, as the largest producer of rare earth elements, is increasingly focusing on recycling to meet domestic demand and reduce environmental impact, with companies like Lynas Corporation leading the charge.

- Governments in countries like Japan are incentivizing the development of rare earth recycling technologies, particularly in the electronics sector, to enhance resource security.

Latin America

- Brazil is starting to invest in rare earth recycling projects, driven by the need to diversify its economy and reduce reliance on imports.

- Local companies are beginning to collaborate with international firms to develop recycling technologies tailored to the region's unique waste streams.

North America

- The U.S. Department of Energy has launched initiatives to promote rare earth recycling technologies, including funding for research projects aimed at improving the efficiency of recycling processes.

- Companies like Urban Mining Company are pioneering innovative methods to extract rare earth elements from electronic waste, showcasing the potential for urban mining in the region.

Middle East And Africa

- Countries like South Africa are beginning to explore rare earth recycling as part of their broader mining and resource management strategies, recognizing the potential economic benefits.

- The African Union is promoting initiatives to develop a sustainable rare earth recycling industry, aiming to leverage the continent's mineral wealth.

Did You Know?

“Approximately 90% of the rare earth elements used in the world are sourced from just a few countries, primarily China, making recycling a critical component for supply chain security.” — U.S. Geological Survey

Segmental Market Size

Despite the growing demand for rare earth elements (REEs) in high-tech applications, the global rare earth element (REE) market is still in its infancy. The two main drivers of the market are the increasing demand for sustainable products and the tightening of regulations on the disposal of waste. The technological development of the recycling processes increases the yield of valuable materials from the end-of-life products and stimulates the market. The rare earth element market is currently in a growth stage, which is moving from experimental to commercial projects. The most advanced companies are Urban Mining and Lynas. The main applications are the recovery of rare earth elements from magnets in electric vehicles and wind generators and the recovery of rare earth elements from end-of-life consumer products. In the long run, the growth will be driven by government regulations and the demand for sustainable products, and by technological developments such as hydrometallurgical processes and advanced separation methods, which will lead to a more circular economy for rare earth elements.

Future Outlook

The rare earths are used in the manufacture of phosphorus and phosphoric acid, of which the rare earths constitute the chief part. The rare earths are also used in the manufacture of glass, and in the manufacture of the paints used in cars. But in the manufacture of glass, they are used in very small quantities, for they are extremely brittle. As the efforts of the world to adopt a more virtuous system of industry become more and more pronounced, the importance of the rare earths is becoming more and more apparent. By the year 2030, the market for rare earths is expected to reach about 735,650,000 dollars. This reflects the growing importance of the idea of a circular economy and the importance of the recovery of used materials. Technological advances, such as improvements in extraction and separation methods, will increase the efficiency of rare earth recovery. In this way, the cost of rare earths will decrease, and manufacturers will find it more profitable to recover them. Government policies will also promote the recovery of rare earths. As public awareness of the negative impact of mining increases, industry will adopt more sustainable practices. This will result in the increasing use of rare earths from recovery, which could account for up to thirty per cent of total consumption by the year 2030. In this way, the rare earth recovery industry will play a major role in meeting the growing demand for these strategic materials, and in achieving sustainable development.

Rare Earth Recycling Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.