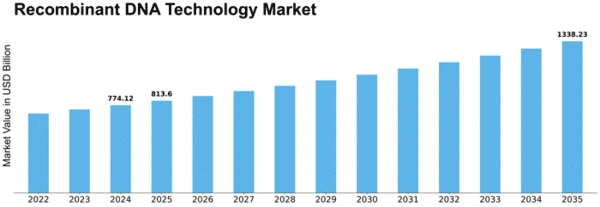

Recombinant Dna Technology Size

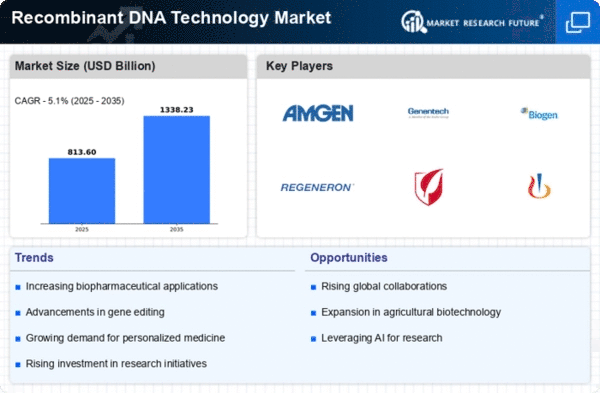

Recombinant DNA Technology Market Growth Projections and Opportunities

Biopharmaceuticals have a big impact on recombinant DNA technology. Being able to change and add to DNA has changed how hormones, vaccines, and medicinal proteins are made, which has helped the business grow. Gene treatment progress has an effect on the business world. Recombinant DNA technologies are used in gene therapy to change and add genetic material in order to treat genetic problems and other illnesses at the molecular level. Recombinant DNA has changed how insulin and other hormones are made. Biopharmaceuticals are made in big quantities by engineered enzymes or bacteria, which is helpful for the endocrinology industry. Make vaccines are what drives the market. With recombinant DNA technology, vaccines for cancer, respiratory diseases, and other health problems are safer and work better. Recombinant DNA technology sales go up because of study in biotechnology. Understanding and changing genes could help natural science, farming, and health move forward. Genomics is made possible by recombinant DNA technology, which lets scientists study genes and their effects on health. Individualized treatment, genetically designed drugs, and tests are all things that are helping precision medicine grow very quickly. More and more market power is being gained over crop engineering. Recombinant DNA technology creates crops with desired traits, such as resistance to pests or high nutritional value. This supports long-term farming and market trends. Funding for biotechnology research and development is very important to the business. Recombinant DNA technology gets better because governments, private donors, and drug companies fund new projects. Biotech, research, and drug companies work together to make recombinant DNA tools better. These partnerships affect market trends by speeding up the creation, study, and release of biopharmaceuticals. The recombinant DNA technology business is growing thanks to automation and new technologies. Automation lowers production costs and improves the speed and scale of bioprocessing, which makes things made from recombinant DNA easier to get. The market is shaped by rules and ethics. Respecting the ethics of genetic engineering and following strict rules makes sure that recombinant DNA technology is used in an ethical and safe way, which affects the technology's market potential. The market has changed because of CRISPR technology. Because CRISPR can change DNA more precisely and quickly, it could change health and how people act.

Leave a Comment