Refined Nickel Size

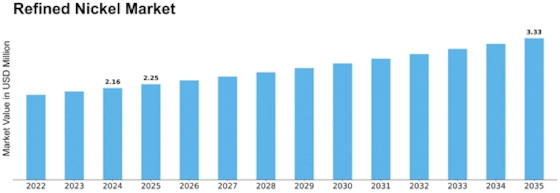

Refined Nickel Market Growth Projections and Opportunities

The refined nickel market is affected by various market factors that are critical for determining its dynamics. One of the main determinants of this market is the global demand for stainless steel. With the growth of industries like construction, automotive and manufacturing, there has also been an increase in requirement for stainless steel thereby altering the demand for refined nickel. The recent analysis report on market showed that global refined nickel market was estimated to be more than 2 billion tons with a CAGR forecasted rate of 4.8% during the period between 2022-2027. Also, supply and demand dynamics have a significant impact on the refined nickel market. It is important to note that one of these major sources is nickel ores from which it is normally extracted from. The supply chain can be altered by geological and geopolitical factors which can also lead to price variations in nickel. Additionally, mining projects and novel extraction measures may affect overall refined nickel availability in the marketplace. Major consuming regions’ economic conditions and industrial activities play a big role too. China and India as emerging economies with high industrialization contribute significantly to refined nickel consumption. In the case where such countries experience economic downturn or shift their industrial production rates, these changes might affect prices in addition to consumption patterns. Exchange rates are another factor affecting trade in refined-nickel especially because it is traded internationally. The risk of investing varies depending on fluctuations experienced by investors against different currencies worldwide For instance, if substitute currency appreciates or depreciates vis-a-vis the US dollar, changes in global production costs; trade positions and final prices of refined-nickel are prone to change. Technological advancements in processing methods can impact the efficiency and cost-effectiveness of refining nickel. New refining technologies and extraction methods can lead to increased production while lowering costs hence making it more affordable for different companies requiring refined nickel. These trends continue to transform the refined nickel market through research and development in materials science and metallurgy. As a result, political stability as well as trade policies applied in key producing countries for this metal like Russia, Canada are crucial factors. Trade Wars, political Unrest or new government policies can disrupt supply chains and make market conditions uncertain. At the same time, trade pacts plus various levels of tariffs also define competition within such businesses.

Leave a Comment