Refinery Catalyst Size

Refinery Catalyst Market Growth Projections and Opportunities

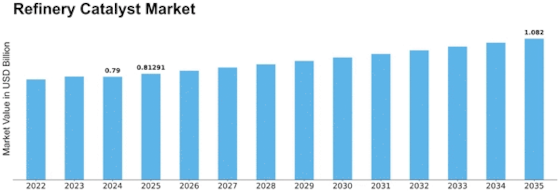

Many variables affect the Refinery Catalyst market's dynamics and growth. Global demand for refined petroleum products drives it. Refinery catalyst market size was USD 0.75 billion in 2022. The refinery catalyst market is expected to increase from USD 0.90 billion in 2023 to USD 2 billion by 2030, a CAGR of 2.90%.

The refinery catalyst market is heavily influenced by regulations and environmental standards. As governments globally tighten emission restrictions and enforce environmentally friendly fuel standards, refineries must invest in catalyst technologies to produce low-sulfur, low-emission fuels. These strict restrictions ensure environmental responsibility and stimulate catalyst formulation research to satisfy industrial standards.

Global economic conditions strongly affect Refinery Catalyst. Economic variations, currency exchange rates, and geopolitical concerns can affect refined product demand, altering refinery investment and operational plans. The economy of major businesses like transportation and manufacturing affects refined product and refinery catalyst demand. Market stakeholders and manufacturers must actively watch these macroeconomic elements to overcome hurdles and make informed business decisions.

Technological breakthroughs drive the Refinery Catalyst market. Improvements to catalyst efficiency, selectivity, and lifetime are under development. Catalyst formulation and manufacturing innovations address feedstock unpredictability and operational constraints, helping refineries improve their processes and boost output yields.

Refinery Catalyst market variations are geographical. Different regional legislation, feedstock availability, and refining facilities affect global market dynamics. Each region has different conditions and tastes, so manufacturers must alter their catalyst products to meet local norms and market trends.

Refinery Catalyst market dynamics are also shaped by industry competition. Research collaborations, strategic partnerships, and product diversification tactics affect competition. To compete in the Refinery Catalyst market, companies build brand awareness, quality, and new catalyst formulations.

Leave a Comment