Refrigerated Truck Size

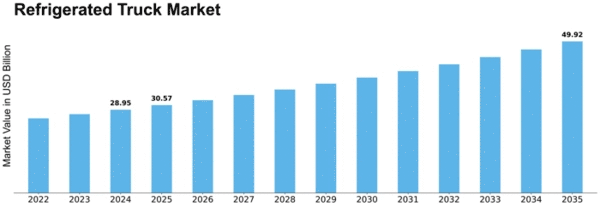

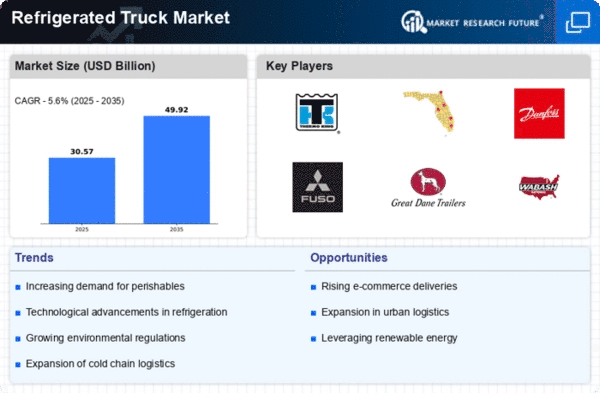

Refrigerated Truck Market Growth Projections and Opportunities

The refrigerated truck market is influenced by various factors that shape its dynamics and growth. One significant factor is the increasing demand for temperature-controlled transportation solutions across industries such as food and beverage, pharmaceuticals, and healthcare. Refrigerated trucks, also known as reefer trucks, play a crucial role in transporting perishable goods, fresh produce, and temperature-sensitive products from production facilities to distribution centers and retail locations. With the rise of global trade, e-commerce, and urbanization, there is a growing need for reliable and efficient refrigerated transportation to ensure the integrity and safety of goods throughout the supply chain. This trend is driven by consumer preferences for fresh and high-quality products, as well as regulatory requirements governing food safety and cold chain management.

Moreover, technological advancements and innovations play a crucial role in shaping market dynamics within the refrigerated truck industry. Manufacturers are investing in research and development to improve the performance, efficiency, and sustainability of refrigerated truck systems. Advanced insulation materials, refrigeration units, and temperature monitoring systems enable the production of refrigerated trucks with precise temperature control, energy efficiency, and real-time monitoring capabilities. Additionally, innovations in vehicle design, aerodynamics, and powertrain technologies contribute to reducing fuel consumption, emissions, and operating costs of refrigerated trucks. These technological advancements drive product innovation, enabling manufacturers to offer a diverse range of refrigerated truck solutions tailored to specific industry requirements and application needs.

Furthermore, regulatory requirements and quality standards influence market factors in the refrigerated truck industry. The transportation of perishable goods is subject to stringent regulations governing food safety, temperature control, and cold chain management to ensure product integrity and consumer protection. Refrigerated trucks must comply with regulatory standards such as FDA (Food and Drug Administration) regulations, HACCP (Hazard Analysis and Critical Control Points) guidelines, and ATP (Agreement on the International Carriage of Perishable Foodstuffs) certification to be suitable for transporting food products. Additionally, manufacturers of refrigerated trucks must adhere to industry standards such as ISO (International Organization for Standardization) certifications and TAPA (Transported Asset Protection Association) guidelines to ensure product quality, safety, and reliability. These regulatory requirements create barriers to entry for new players and reinforce the importance of established manufacturers with a track record of compliance and quality assurance.

Moreover, market factors such as fuel prices, vehicle costs, and economic conditions influence the pricing and availability of refrigerated trucks. Fluctuations in fuel prices impact the operating costs and profitability of refrigerated truck operators, as fuel consumption represents a significant portion of the total operating expenses. Additionally, the cost of refrigerated trucks, including vehicle acquisition, maintenance, and insurance, influences purchasing decisions and fleet investments by transportation companies. Economic conditions such as GDP growth, consumer spending, and industrial activity also influence demand for refrigerated transportation services and, consequently, the refrigerated truck market. During periods of economic expansion, there is typically increased demand for refrigerated goods and temperature-controlled logistics, driving the growth of the refrigerated truck market. One of the major driving forces behind the refrigerated truck market growth is consumer demand. For the past several years there has been a steady growth in per capita consumer spending in major industrial countries. Based on that parameter, there is a significant boost in the food and beverages industry

Furthermore, changing industry trends and customer preferences influence market dynamics within the refrigerated truck industry. Customers are increasingly seeking transportation solutions that offer reliability, efficiency, and sustainability. Refrigerated trucks are favored for their ability to maintain precise temperature control, ensure product freshness, and comply with food safety regulations. Additionally, industry trends such as cold chain logistics, online grocery delivery, and pharmaceutical distribution drive the adoption of refrigerated trucks for transporting perishable goods and temperature-sensitive products. As industries evolve and adapt to changing market dynamics, the demand for refrigerated trucks continues to grow, creating opportunities for manufacturers to innovate and expand their product offerings to meet evolving customer needs.

Leave a Comment