Market Trends

Key Emerging Trends in the Refrigeration Insulation Materials Market

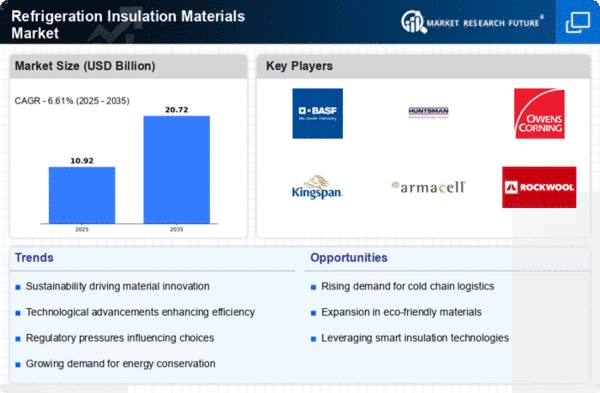

The Refrigeration Insulation Materials Market has witnessed significant trends and transformations indicating how dynamic it is over time. One notable trend is increased emphasis on energy efficiency and sustainability in refrigeration systems worldwide so as to minimize environmental impacts arising from operations carried out. Consequently, the demand for insulation materials has also risen in line with these environmental concerns because such materials should offer thermal protection and also save energy hence emit less greenhouse gases.

Similarly, innovative and advanced insulation materials have been observed as one of the key trends shaping this market. Materials that have higher thermal performance, durability and fire resistance are always being researched and developed by manufacturers. The introduction of new technologies like aerogels and advanced foams also enables greater insulation efficiency without compromising other critical properties.

Moreover, global trend towards refrigeration electrification is another attribute. With a view to moving away from traditional refrigerants which have high Global Warming Potential (GWP), countries and industries need insulating materials that can be able to adapt with the dynamism in refrigeration technologies today. This has led to development of materials compatible low-GWP and natural refrigerants as part of global efforts towards climate change mitigation.

Cold chain logistics is another driver of market trends coupled with growth in food & beverage sector. There has been increased desire for high performance insulation materials due to growing requirement for temperature controlled storage and transportation. This phenomenon is specifically observable in rapidly urbanizing and industrializing areas where cold chain infrastructure is expanding to meet the needs of increasing population size as well as changing preferences by consumers.

Cost is also influencing refrigerator insulation material selection. Thermal efficiency is better in high-performance materials, but performance and cost are always trade-offs. Thus, manufacturers are creating the greatest insulating solutions that balance performance, affordability, and sustainability.

Leave a Comment