Market Analysis

In-depth Analysis of Remote Automotive Exhaust Sensing Market Industry Landscape

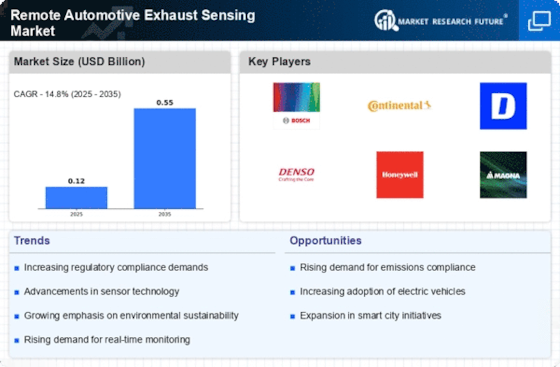

The remote automotive exhaust sensing market is characterized by dynamic and multifaceted market dynamics that significantly influence its growth and evolution. One key driver is the increasing global concern for environmental sustainability. Governments worldwide are implementing stringent emission regulations to combat air pollution, pushing automotive manufacturers to adopt advanced sensing technologies for exhaust monitoring. This regulatory landscape creates a demand for remote automotive exhaust sensing solutions, fostering market growth.

Technological advancements play a pivotal role in shaping the market dynamics. As sensor technologies continue to evolve, remote automotive exhaust sensing systems become more sophisticated and efficient. Miniaturization, increased sensitivity, and improved integration capabilities contribute to the development of compact and reliable sensing solutions. This technological progress not only enhances the accuracy of exhaust measurements but also opens up new opportunities for innovation and differentiation within the market.

The market dynamics are also influenced by the growing prevalence of electric and hybrid vehicles. While these alternative fuel vehicles contribute to reduced emissions, they present unique challenges for exhaust sensing. Market players must adapt their sensing solutions to cater to the distinctive characteristics of electric and hybrid vehicle emissions, ensuring their relevance in this changing automotive landscape. The coexistence of traditional internal combustion engine vehicles and alternative fuel vehicles further adds complexity to the market dynamics.

The globalization of the automotive industry is another significant factor shaping the dynamics of the remote automotive exhaust sensing market. As automotive manufacturers expand their operations globally, the need for standardized sensing solutions becomes paramount. Remote sensing technologies must be adaptable to different regional regulations, fuel compositions, and vehicle types. This globalization trend fosters collaborations and partnerships among market players to create versatile sensing systems that can address the diverse needs of the global automotive market.

Market dynamics are also influenced by the integration of artificial intelligence (AI) and data analytics in remote automotive exhaust sensing systems. The vast amounts of data generated by these sensing solutions can be leveraged for real-time monitoring, predictive maintenance, and performance optimization. The integration of AI enhances the overall functionality of exhaust sensing systems, providing actionable insights and contributing to the efficiency of the automotive ecosystem. This infusion of smart technologies not only aligns with the industry's quest for sustainability but also drives market growth through increased demand for advanced, data-driven sensing solutions.

Furthermore, market dynamics are shaped by the emphasis on cost-effective solutions. As the automotive industry faces economic challenges, manufacturers seek exhaust sensing solutions that offer a balance between affordability and performance. Companies that can optimize manufacturing processes, achieve economies of scale, and provide cost-effective sensing solutions gain a competitive advantage in the market. Cost efficiency becomes a crucial factor in driving adoption, especially among price-sensitive segments of the automotive industry.

Market dynamics also reflect the industry's response to changing consumer preferences and expectations. The demand for user-friendly, reliable, and easily integrable remote automotive exhaust sensing systems is on the rise. Manufacturers that prioritize customer-centric design and functionality enhance their market positioning, driving adoption and market growth.

Leave a Comment