Global Renewables Blade Repair & Maintenance Market Overview

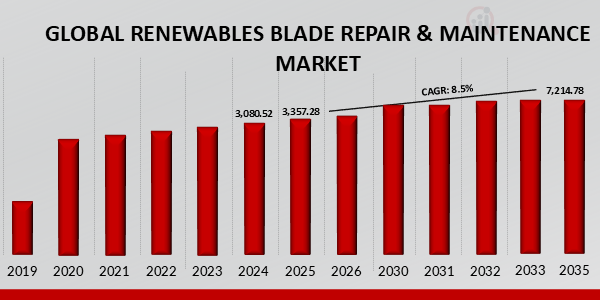

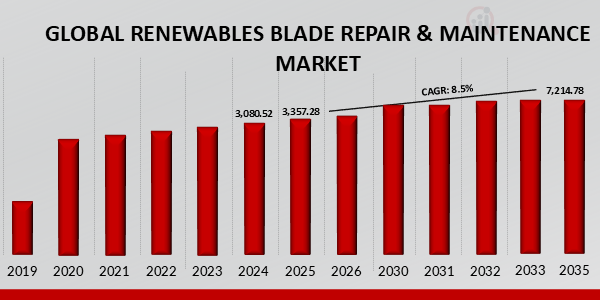

The Renewables Blade Repair & Maintenance Market size was valued at USD 3,080.52 Million in 2024. The Renewables Blade Repair & Maintenance Market industry is projected to grow from USD 3,357.28 Million in 2025 to USD 127.43 Million by 2035, exhibiting a compound annual growth rate (CAGR) of 14.4% during the forecast period (2025-2035).

The growth of wind energy installations and advancements in composite material types are driving the growth of the Renewables Blade Repair & Maintenance Market.

As per the Analyst at MRFR, the growth of wind energy installations is a significant driver for the demand for renewable blade repair and maintenance services. As wind energy expands globally, the need for maintenance of wind turbine blades is also increasing. Turbine blades endure harsh environmental conditions and experience wear over time, and thus require regular inspection, maintenance, and repair to ensure efficient operation and longevity.

Wind energy is rapidly becoming a significant renewable energy source, driven by factors such as rising technological innovation, supportive government policies and environmental awareness. Countries worldwide are investing in wind energy projects to reduce greenhouse gas emissions and reduce the dependency on fossil fuels. The growth in installations will increase the number of wind turbines in operation and, consequently, the demand for maintenance services to keep these assets in optimal condition will rise

Figure 1: Renewables Blade Repair & Maintenance Market Value (2019-2035) Usd Million

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Renewables Blade Repair & Maintenance Market Opportunity

-

Emerging Economies Boosting Renewable Energy Investments

The rapid expansion of wind energy in various emerging economies is creating substantial growth opportunities for the renewables blade repair and maintenance market. As countries strive to meet increasing energy demands, reduce carbon emissions, and achieve energy independence, wind power has emerged as a pivotal component of their renewable energy strategies. This surge in investments in the wind energy sector is leading to rising wind turbines deployment, thereby escalating the need for specialized blade repair and maintenance services.

The economic and environmental benefits offered by renewable energy are encouraging various nations to invest in renewables, and this has led to supportive government policies that incentivize wind energy deployment. Operators in renewables generally face tight budget constraints and thus focus on extending the operational lifespan of the wind turbines. With the high upfront costs associated with wind turbine installation, extending blade life becomes very essential. As a result, the operators prioritize blade repair and maintenance to prevent costly replacements and to maintain consistent energy production.

Renewables Blade Repair & Maintenance Market Segment Insights

Renewables Blade Repair & Maintenance System by Service Type Insights

Based on Service type, this segment includes Inspection, Repair, Preventive Maintenance, Blade Replacement, Consulting & Diagnostics. The Repair segment dominated the global market in 2024, while the Preventive Maintenance segment is projected to be the fastest–growing segment during the forecast period. Repair services primarily focus on addressing damage or wear that occurs over time, ensuring that wind turbine blades remain operational and efficient.

Common repairs include fixing cracks, erosion, lightning strikes, or damage caused by debris. These repairs often involve the use of specialized materials such as composite resins, carbon fiber patches, and other advanced materials to restore the structural integrity of the blade. For complex repairs, especially on larger or offshore turbines, companies employ cutting-edge technologies like robotics, drones, and specialized repair tools to access hard-to-reach areas and carry out repairs safely and efficiently.

Renewables Blade Repair & Maintenance System by Technology Insights

Based on Technology, this segment includes Drone-based Inspection, Rope & Manual Access, Robotics and Automated Solutions, Thermal Imaging & Ultrasound, Others. The Rope & Manual Access segment dominated the global market in 2024, while the others segment is projected to be the fastest–growing segment during the forecast period.

Rope and manual access techniques are traditional methods used for inspecting, repairing, and maintaining wind turbine blades, particularly in hard-to-reach or remote locations. In this approach, skilled technicians use ropes, harnesses, and other safety equipment to climb turbines and access the blades directly. This method is often employed when drones or other automated technologies are not feasible, such as in extreme weather conditions or for specific types of damage that require hands-on work.

While rope access offers flexibility and can be used on turbines of various sizes, it is more time-consuming and poses higher safety risks compared to newer, technology-driven inspection methods. However, it remains a critical option for turbine maintenance, particularly when dealing with complex repairs, detailed visual inspections, or when working on offshore or mountainous wind farms where other access methods are impractical.

Renewables Blade Repair & Maintenance System by Location of Service Insights

Based on Location of Service, this segment includes Onshore Wind Turbines and Offshore Wind Turbines. The Onshore Wind Turbines segment dominated the global market in 2024, while the Offshore Wind Turbines segment is projected to be the fastest–growing segment during the forecast period. Onshore wind turbines are wind energy systems installed on land, typically in open areas such as fields, hills, or plains, where wind resources are abundant and consistent.

These turbines are the most common type of wind power installations and are crucial in driving the growth of renewable energy worldwide. Onshore wind farms benefit from lower installation and maintenance costs compared to offshore turbines, as they do not require specialized vessels or infrastructure for installation or servicing. The blades on onshore turbines can range from small to large, depending on the turbine’s capacity and the wind conditions at the site. While onshore turbines are generally easier to access for maintenance and repair, their performance can be impacted by factors like local wind turbulence, soil erosion, or extreme weather.

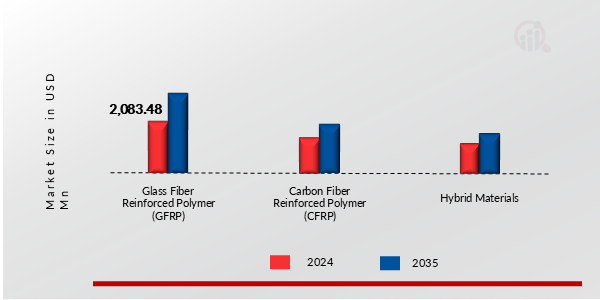

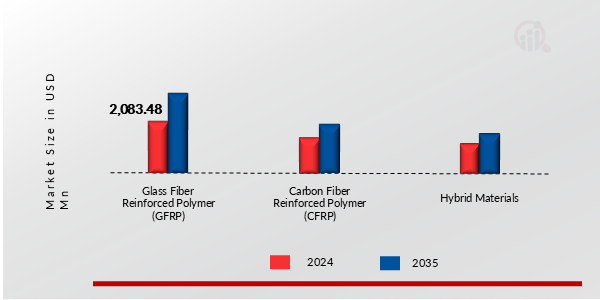

Renewables Blade Repair & Maintenance System by Blades Material Type Insights

Based on Blades Material type, this segment includes Glass Fiber Reinforced Polymer (GFRP), Carbon Fiber Reinforced Polymer (CFRP), Hybrid Materials. The Glass Fiber Reinforced Polymer (GFRP) segment dominated the global market in 2024, while the Hybrid Materials segment is projected to be the fastest–growing segment during the forecast period. Glass Fiber Reinforced Polymer (GFRP) is a widely used composite material in the construction of wind turbine blades due to its excellent combination of strength, flexibility, and cost-effectiveness.

GFRP consists of a polymer matrix reinforced with glass fibers, which provide high tensile strength and impact resistance while keeping the weight of the blades relatively low. It is particularly valued for its ability to withstand fatigue and harsh environmental conditions, making it ideal for turbine blades that endure constant wind pressure, extreme weather, and UV exposure. While GFRP is not as strong or lightweight as Carbon Fiber Reinforced Polymer (CFRP), it is more affordable, making it a popular choice in the manufacturing of standard-size onshore wind turbine blades.

In blade repair, GFRP is often used for patching and reinforcing damaged areas, particularly for smaller or less severe defects.

Figure 2: Renewables Blade Repair & Maintenance Market Share By Blades Material Type 2024 And 2035 (Usd Million)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Renewables Blade Repair & Maintenance System by End-Users Insights

Based on End-Users, this segment includes Wind Farm Owners/Operators, Turbine OEMs, Independent Service Providers (ISPs), and Utility Companies. The Wind Farm Owners/Operators segment dominated the global market in 2024, while the Independent Service Providers (ISPs) segment is projected to be the fastest–growing segment during the forecast period. Wind farm owners and operators are key stakeholders in the wind energy industry, responsible for the installation, management, and maintenance of wind farms.

These entities can include energy companies, private investors, or even government organizations that own the rights to wind farm sites and the turbines installed there. Operators manage the day-to-day operations, ensuring turbines are running efficiently, performing regular maintenance, and overseeing the performance monitoring of turbines. They are tasked with optimizing energy production, minimizing downtime, and ensuring the long-term profitability of the wind farm. This often involves coordinating routine inspections, preventive maintenance, and dealing with any necessary repairs or component replacements, such as blade maintenance.

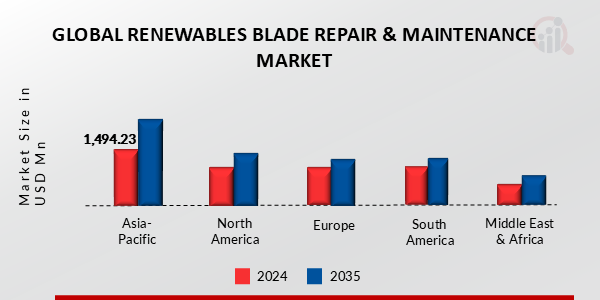

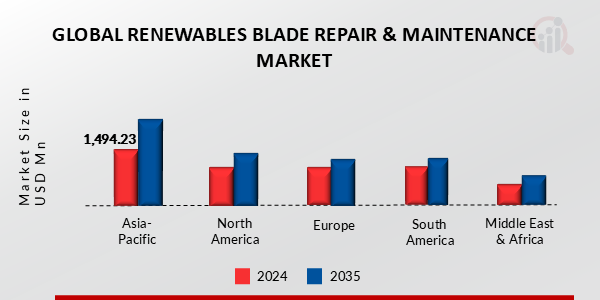

Renewables Blade Repair & Maintenance System Regional Insights

Based on the Region, the global Renewables Blade Repair & Maintenance is segmented into North America, Europe, Asia-Pacific, South America, Middle East & Africa. Major demand factors driving the Asia-Pacific market are the growth of wind energy installations and advancements in composite material types. In the Asia-Pacific region, as wind power becomes a key component of energy strategies in APAC, the need for efficient blade repair and maintenance has grown in tandem, especially as many wind farms enter their operational middle age.

China, as the world’s largest wind energy producer, has seen substantial investments in wind turbine technology, creating a significant demand for specialized repair services to address blade wear and tear. In India, the market is driven by the growing number of onshore wind projects, while offshore wind developments in Japan and South Korea are increasing the complexity of maintenance tasks. The adoption of advanced repair technologies such as robotic blade inspection, resin infusion, and 3D printing is gaining traction in the region, allowing for more effective and sustainable solutions.

Figure 3: Renewables Blade Repair & Maintenance Market Value By Region 2024 And 2035 (Usd Million)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, the UK, France, Russia, Italy, Spain, China, India, Japan, South Korea, Australia, Thailand, Indonesia, Brazil, Argentina, GCC Countries, South Africa and others.

Global Renewables Blade Repair & Maintenance Key Market Players & Competitive Insights

Many global, regional, and local vendors characterize the Renewables Blade Repair & Maintenance Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major players in the market are OEG Renewables, Renewable Field Services, Swire Renewable Energy, MISTRAS Group, LM Wind Power, Renom Energy Services, Blade Power Renewable Energy Services, RTS Wind Limited, JFE Engineering Corporation, Suzlon are among others. The Renewables Blade Repair & Maintenance Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the Renewables Blade Repair & Maintenance Market include

- OEG Renewables

- Renewable Field Services

- Swire Renewable Energy

- MISTRAS Group

- LM Wind Power

- Renom Energy Services

- Blade Power Renewable Energy Services

- RTS Wind Limited

- JFE Engineering Corporation

- Suzlon

Renewables Blade Repair & Maintenance Market Industry Developments

4-November-2024: OEG Energy Group, a leading energy solutions business, announced that its renewables division, OEG Renewables, has signed a contract with Strategic Marine for the order of a new crew build transfer vessel (CTV). The vessel will support OEG Renewables’ offshore operations in the Asia Pacific region. The vessel, due to be named Wey Feng, is a BMT designed 27m aluminum catamaran and will be the fourth StratCat 27 vessel built by Strategic Marine to join the OEG Renewables fleet.

The CTV is powered by two Caterpillar C32 1450hp marine engines and has a fuel capacity of 35,000 liters, seating for up to 24 technicians and the capability to safely transfer in 1.75m Hs.

30-April-2024: RTS Wind, has secured two extensive framework agreements for the provision of expert blade services for leading renewable energy company Ørsted. The two 5-year framework agreements will see RTS Wind support Ørsted’s long-term blade care and maintenance campaigns across its entire regional portfolios in the UK, Denmark, Netherlands, and Germany.

29-March-2024: JFE Engineering Corporation entered a maritime transport contract with MOL Drybulk Ltd for the transportation of offshore wind power foundation structures, such as monopiles and transition pieces.

31-May-2024: Suzlon Group was awarded a contract to develop a 551.25 MW wind power project for the Aditya Birla Group. The project includes the installation of 175 wind turbines with hybrid tubular lattice towers of 3.15 MW each, spread across the districts of Barmer in Rajasthan and Bhuj in Gujarat. Suzlon supplies, supervises and commissions the wind turbines, and provides comprehensive operation and maintenance services after commissioning.

Renewables Blade Repair & Maintenance Market Segmentation

Renewables Blade Repair & Maintenance by Service Type Outlook

- Inspection

- Repair

- Preventive Maintenance

- Blade Replacement

- Consulting & Diagnostics

Renewables Blade Repair & Maintenance by Technology Outlook

- Drone-based Inspection

- Rope & Manual Access

- Robotics and Automated Solutions

- Thermal Imaging & Ultrasound

- Others

Renewables Blade Repair & Maintenance by Location of Service Outlook

- Onshore Wind Turbines

- Offshore Wind Turbines

Renewables Blade Repair & Maintenance by Blades Material Type Outlook

- Glass Fiber Reinforced Polymer (GFRP)

- Carbon Fiber Reinforced Polymer (CFRP)

- Hybrid Materials

Renewables Blade Repair & Maintenance by End-Users Outlook

- Wind Farm Owners/Operators

- Turbine OEMs

- Independent Service Providers (ISPs)

- Utility Companies

Renewables Blade Repair & Maintenance Regional Outlook

-

North America

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Thailand

- Indonesia

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

| Report Attribute/Metric |

Details |

| Market Size 2024 |

USD 3,080.52 Million |

| Market Size 2025 |

USD 3,357.28 Million |

| Market Size 2035 |

USD 7,214.78 Million |

| Compound Annual Growth Rate (CAGR) |

8.5% (2025-2035) |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Historical Data |

2019-2023 |

| Forecast Units |

Value (USD Million) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

By Service Type, By Technology, By Location of Service, By Blades Material Type, By End Users |

| Geographies Covered |

North America, Europe, Asia Pacific, South America, Middle East & Africa. |

| Countries Covered |

The US, Canada, Mexico, the UK, France, Russia, Italy, Spain, China, India, Japan, South Korea, Australia, Thailand, Indonesia, Brazil, Argentina, GCC Countries, South Africa. |

| Key Companies Profiled |

OEG Renewables, Renewable Field Services, Swire Renewable Energy, MISTRAS Group, LM Wind Power, Renom Energy Services, Blade Power Renewable Energy Services, RTS Wind Limited, JFE Engineering Corporation, Suzlon |

| Key Market Opportunities |

· Emerging economies boosting renewable energy investments |

| Key Market Dynamics |

· The growth of wind energy installations · Advancements in composite material types |

Frequently Asked Questions (FAQ):

USD 3.080.52 Million is the Renewables Blade Repair & Maintenance Market in 2024

The Rope & Manual Access segment by Component holds the largest market share and grows at a CAGR of 8.0% during the forecast period.

Asia-Pacific holds the largest market share in the Global Renewables Blade Repair & Maintenance Market.

OEG Renewables, Renewable Field Services, Swire Renewable Energy, MISTRAS Group, LM Wind Power, Renom Energy Services, Blade Power Renewable Energy Services, RTS Wind Limited, JFE Engineering Corporation, Suzlon are the prominent players in the Global Renewables Blade Repair & Maintenance Market.

The Glass Fiber Reinforced Polymer (GFRP) segment dominated the market in 2024.