Renting Leasing Test Measurement Equipment Size

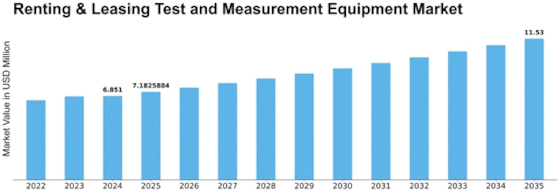

Renting Leasing Test Measurement Equipment Market Growth Projections and Opportunities

The Renting and Leasing Test and Measurement Equipment Market is shaped by various factors that influence its dynamics and growth. One key driver is the increasing cost-conscious approach adopted by businesses across industries. As companies strive to manage budgets effectively, the option to rent or lease test and measurement equipment becomes an attractive alternative to outright purchasing. This financial flexibility allows businesses to access cutting-edge equipment without the substantial upfront costs, making it a cost-effective solution, particularly for short-term projects or when specific equipment is only needed occasionally. In addition, the high market speed of innovative technologies in test and measure areas leads to fast growth. Technological changes in testing and measurement equipment are highly frequent, resulting in fast obsolescence of products based on the said technologies. It allows a company to have the latest and most up-to-date equipment without worrying about the long-term commitment neither of expenses because of depreciation costs as purchased for ownership.

The ability to adjust their operations in relation to changing technological trends positions the renting and leasing market as a strategic option for organizations looking for ways of staying relevant. However, there are also other factors that help to influence the demand for rented and leased test and measurement equipment, such as increasing outsourcing trend and project-based work. In the telecommunications industry as well as in aerospace and electronics, where project durations change from one project to another, firms opt for renting specialized equipment within the specified phases of projects. This helps them to increase the size of their operations relative to project requirements and maximize utilization of resources while minimizing standstill cost due to down times. In addition, the market grows in large part due to globalization of business activities.

If companies grow their reaches overseas, therefore testing equipment and measuring tools are not only needed in one place. The renting and leasing services ease away the hassles from companies which are not limited operations in a particular region. This makes it unnecessary to have the burden of logistic challenges and costs resulting from transports of owned equipment interstate, as a whole the selling argument for rental and leasing services is made globally. The new customer action of renting and leasing test and measurement equipment based on sustainability, increases demand for environmental responsibility as well. The awareness of the environmental issues that come with manufacturing, use, and eventually disposal is ever present among business as they demand high quality materials. Renting and leasing activities support a more sustainable approach through the promotion of reusing equipment, e-waste reduction, and lower CAPEX as well as OCIP.

The sustainability characteristic associated with renting and leasing a facility appeals to businesses that promote CSR standards and operate in line with principles of environmentally responsible business. Also, in the market there are regulatory compliance and industry standards, which influence its dynamics. When it comes to sectors such as health care, telecommunications, and manufacturing the need for adhering certain high standards and rules and regulations cannot be undermined. Renting and leasing services usually offer equipment which is up-to the mark of industry standards, with which businesses can fulfill regulatory laws without having to bother self-sufficiently maintaining their own equipment as per currently prevailing changes. The competitive landscape and the emergence of specialized rental and leasing service providers also impact the market. Companies that focus exclusively on providing test and measurement equipment rental services often offer a broader range of options, customized solutions, and expertise in the field. This specialization enhances the overall customer experience and fosters innovation in service delivery, further driving the market's growth.

Leave a Comment