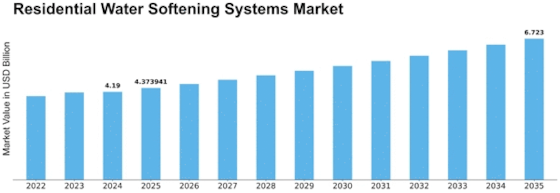

Residential Water Softening Systems Size

Residential Water Softening Systems Market Growth Projections and Opportunities

The residential water softening systems market is driven by a number of factors related to the overall markets that have an impact on its dynamics. A central aspect is increasing consumer awareness concerning the adverse effects of hard water on plumbing systems and home appliances. With growing awareness of the advantages that water softeners have to offer in terms of preventing scale formation and increasing longevity levels for appliances, home based use continues. More importantly, the high incidence of hard water in different places enhances market growth. Hard water problems affecting most households include soap scum, stained fittings, and lower efficiency of the domestic water supply systems. Therefore, the homeowners look for efficient solutions hence water softening systems gain a larger number of adoptions. Another factor that significantly contributes to market dynamics is government regulations and the water quality standards. In regions where the water hardness is higher than allowable, regulatory agencies commonly suggest or require the construction of a softening system to improve liquid quality. This sets a conducive platform for market development as consumers adhere to these stipulations in order to maintain the healthy living of their families. The market has been greatly affected by the development of technologies, as manufacturers are innovating regularly to make water softening systems more efficient and sustainable. Smart technologies including sensor-based monitoring and automation have enabled these systems to be user friendly as well energy efficient. The market grows towards innovation because of the increasing attraction to advanced features that bring comfort and environmental friendliness for consumers. Finally, the residential water softening systems market is also driven by economic factors such as disposable income and housing trends. Since the disposable income level rises, consumers are ready to spend more on home improvement solutions like water softeners. In addition, in places where construction of new residential real estate is growing rapidly as well the adoption of water softening systems becomes a standard practice leading to even greater growth in market. Market dynamics are also influenced by changing consumer preferences and lifestyle trends. People want to live in healthier and more comfortable environments, which leads them to purchase products that improve the quality of water. During the process of health awareness, consumers tend to prefer softeners that not only solve problems with hard water but also promote overall well-being. Consumer decision making is influenced by such competitive factors as the presence of key players, pricing strategies and product differentiation within the market.

Leave a Comment