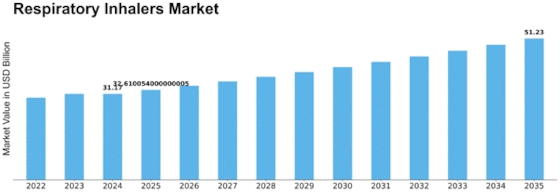

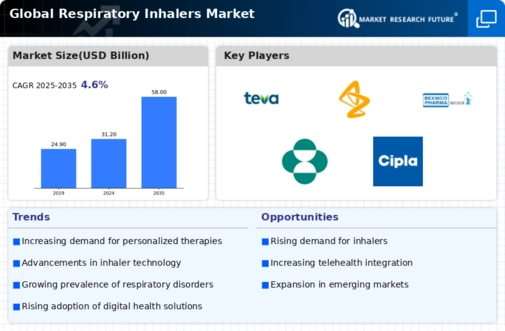

Respiratory Inhalers Size

Respiratory Inhalers Market Growth Projections and Opportunities

Dealing with respiratory disorders has always been a big challenge for medicine makers and doctors. In recent decades, the number of people facing respiratory issues has gone up a lot. This increase is mainly due to things like air pollution, smoking, and industrialization. To tackle these problems, scientists have created various drugs and devices. They've worked hard to control disorders like Asthma and Chronic Obstructive Pulmonary Disorder (COPD), which affect a lot of people. According to the World Health Organization (WHO), more than 300 million people worldwide have asthma, and over 200 million people have COPD as of 2016.

A specific area of focus is respiratory inhalers, and the market for these is steadily growing. Several factors contribute to this market growth, including an increase in chronic respiratory diseases, a rise in using combination therapy, a growing need for emergency medication, and advancements in inhaler device technology. However, there are also challenges like not having a single, effective inhaler for all disorders, side effects during drug inhalation, high inhaler prices, and non-standardized dosage.

This market is divided based on type, product, application, end user, and regions. The global respiratory inhaler market is categorized by type into manually operated inhalers and digitally operated inhalers. In 2016, manually operated inhalers made up the majority, with 89.9% of the market share. This is because traditional inhalers are widely available and used, while digital and smart inhalers are not as well-known and available everywhere.

In simpler terms, respiratory disorders are a significant health challenge, and the number of people facing these issues has gone up due to various reasons. To help, scientists have created drugs and devices, with a focus on inhalers. The market for these inhalers is growing steadily, driven by factors like an increase in respiratory diseases and advancements in inhaler technology. However, challenges include not having a one-size-fits-all inhaler, side effects, high prices, and varying dosages. The market is split based on different factors, and traditional manually operated inhalers currently dominate the scene, expected to continue growing in the coming years.

Leave a Comment