- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

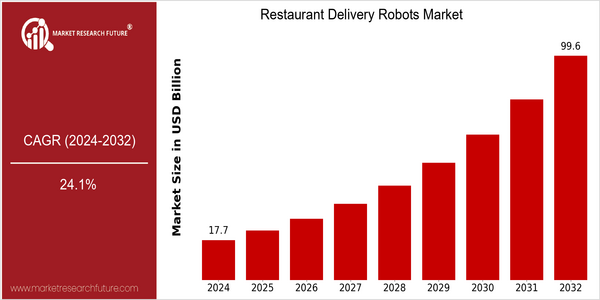

| Year | Value |

|---|---|

| 2024 | USD 17.71 Billion |

| 2032 | USD 99.64 Billion |

| CAGR (2024-2032) | 24.1 % |

Note – Market size depicts the revenue generated over the financial year

Restaurant delivery robots are set for a significant growth, with a current market size of $ 17.71 billion in 2024, expected to expand to $ 99.64 billion by 2032. The CAGR (compound annual growth rate) for this remarkable growth is 24.1%. The increasing demand for automation in the food delivery sector is mainly due to consumers’ increasing demand for convenience and speed in the delivery of services. The factors that are contributing to the growth of this market are the developments in automation, robotics, artificial intelligence, and machine learning, which have enhanced the capabilities of delivery robots. Contactless payment solutions, especially following the emergence of the COVID-09 virus, are also contributing to the integration of these systems into the restaurant industry. Starship Technologies, Nuro, and Kiwibot, the leading companies in this market, are investing heavily in R&D and forming strategic alliances to develop and launch new products and services to meet the growing demand for automated delivery solutions.

Regional Market Size

Regional Deep Dive

The restaurant delivery robot market is experiencing significant growth across various regions, driven by advancements in technology, changing consumer preferences, and increasing demand for contactless delivery solutions. North America is characterized by high automation and robotization investment, the presence of technology-savvy consumers, and a robust food delivery environment. Europe has a diverse regulatory and cultural environment, and Asia-Pacific is rapidly adopting delivery robots due to urbanization and a growing e-commerce sector. Middle East and Africa are also beginning to explore this technology, although at a slower pace, influenced by economic and developmental factors. Latin America is also emerging as a region, with the focus on enhancing delivery efficiency in urban areas.

Europe

- In the UK, the government has initiated trials for autonomous delivery vehicles, with companies like Ocado and Deliveroo actively participating to enhance their delivery capabilities.

- Countries like Germany and France are implementing strict regulations regarding the use of delivery robots on public roads, which is shaping the pace and scale of market adoption.

Asia Pacific

- China is witnessing rapid deployment of delivery robots, with companies like Meituan and JD.com investing heavily in autonomous delivery solutions to cater to the booming e-commerce market.

- Japan's unique cultural acceptance of robotics is leading to innovative applications of delivery robots, particularly in urban areas, supported by government initiatives promoting smart city technologies.

Latin America

- Brazil is emerging as a key player in the delivery robot market, with startups like Loggi experimenting with autonomous delivery solutions in major cities.

- Economic factors and urbanization are driving interest in delivery robots, as businesses seek to improve efficiency and reduce costs in the competitive food delivery landscape.

North America

- Companies like Starship Technologies and Nuro are leading the charge in deploying delivery robots in urban areas, with partnerships established with major food chains such as Domino's and Chipotle.

- Recent regulatory changes in cities like San Francisco and Los Angeles have paved the way for expanded testing and deployment of delivery robots, allowing for increased operational hours and broader service areas.

Middle East And Africa

- In the UAE, the government is actively promoting the use of delivery robots as part of its smart city initiatives, with companies like RoboCup and local startups testing their technologies in Dubai.

- Regulatory frameworks are still developing in many African countries, but pilot projects in cities like Cape Town are exploring the feasibility of delivery robots in urban logistics.

Did You Know?

“In 2022, the global market for restaurant delivery robots saw a surge in interest, with over 50% of consumers expressing a preference for automated delivery options due to convenience and safety concerns.” — Market Research Future

Segmental Market Size

The restaurant delivery robots play a key role in the evolving field of food delivery services, which are currently experiencing robust growth driven by consumers’ growing demand for speed and convenience. Besides the heightened demand for contactless delivery—which was further fueled by the COVID-19 pandemic—the field has also been driven by advances in robotics and artificial intelligence that have enhanced operational efficiency. And government support—such as California’s legislation permitting the use of driverless vehicles for delivery—has also stoked interest. Consequently, the use of restaurant delivery robots is now progressing from the testing stage to actual implementation. Notable examples include Starship Technologies and Nuro, which have been successfully operating their robots in urban areas and on college campus. These robots deliver food from restaurants to consumers’ doorsteps, navigating streets and sidewalks. The rapid growth of this field is being further accelerated by the growing emphasis on labor savings and the trend toward reducing CO2 emissions. And the field’s continued evolution is being shaped by the application of computer vision, machine learning, and GPS navigation.

Future Outlook

The Restaurant Ordering and Delivering Robots Market is projected to increase from $17.71 billion in 2024 to $99.64 billion by 2032, with a robust compound annual growth rate (CAGR) of 24.1%. The increase in demand for contactless delivery systems, which was accelerated by the Covid pandemic, as well as the continuing trend toward automation in the food service industry, will drive this market to greater heights. By 2032, it is expected that restaurant delivery robots will account for approximately 15 to 20% of the total food delivery market, which will be a major shift in consumer preference and restaurant operations. The development of a variety of new and improved technology, such as improved navigation, artificial intelligence, and increased battery life, will also help to further propel the market. The implementation of supportive government regulations and policies aimed at encouraging automation and alleviating labor shortages will also play a key role in the market’s development. Also, the integration of robots with mobile applications for more convenient customer service and the development of more eco-friendly delivery solutions will have a significant impact on the future of the restaurant delivery robots market. As the industry evolves, the key to capturing these opportunities will be the ability to respond quickly to the challenges, which include public safety concerns and public acceptance.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 11.5 Billion |

| Market Size Value In 2023 | USD 13.7 Billion |

| Growth Rate | 24.1% (2023-2032) |

Restaurant Delivery Robot Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.