Retail Fuel Market Summary

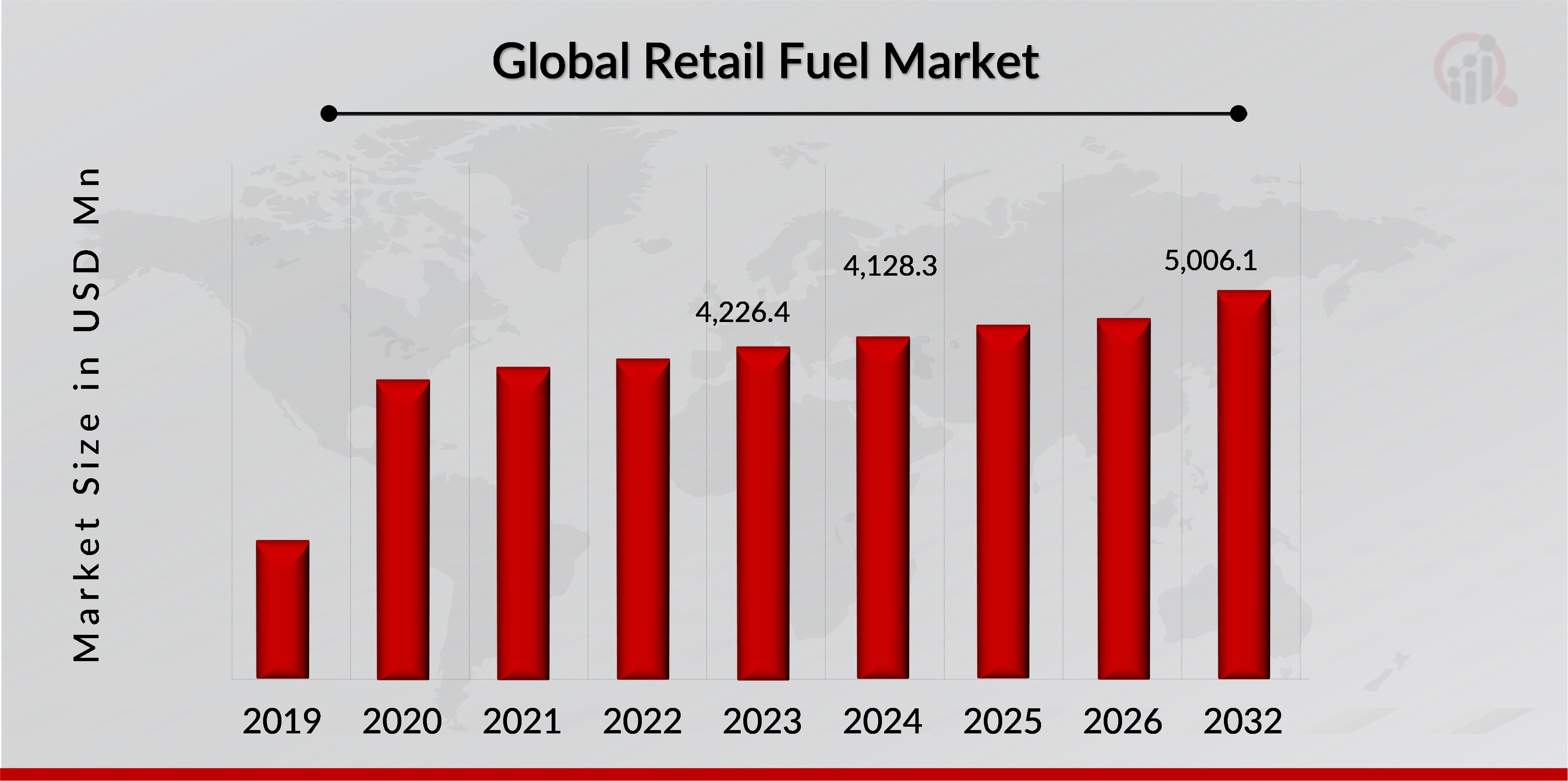

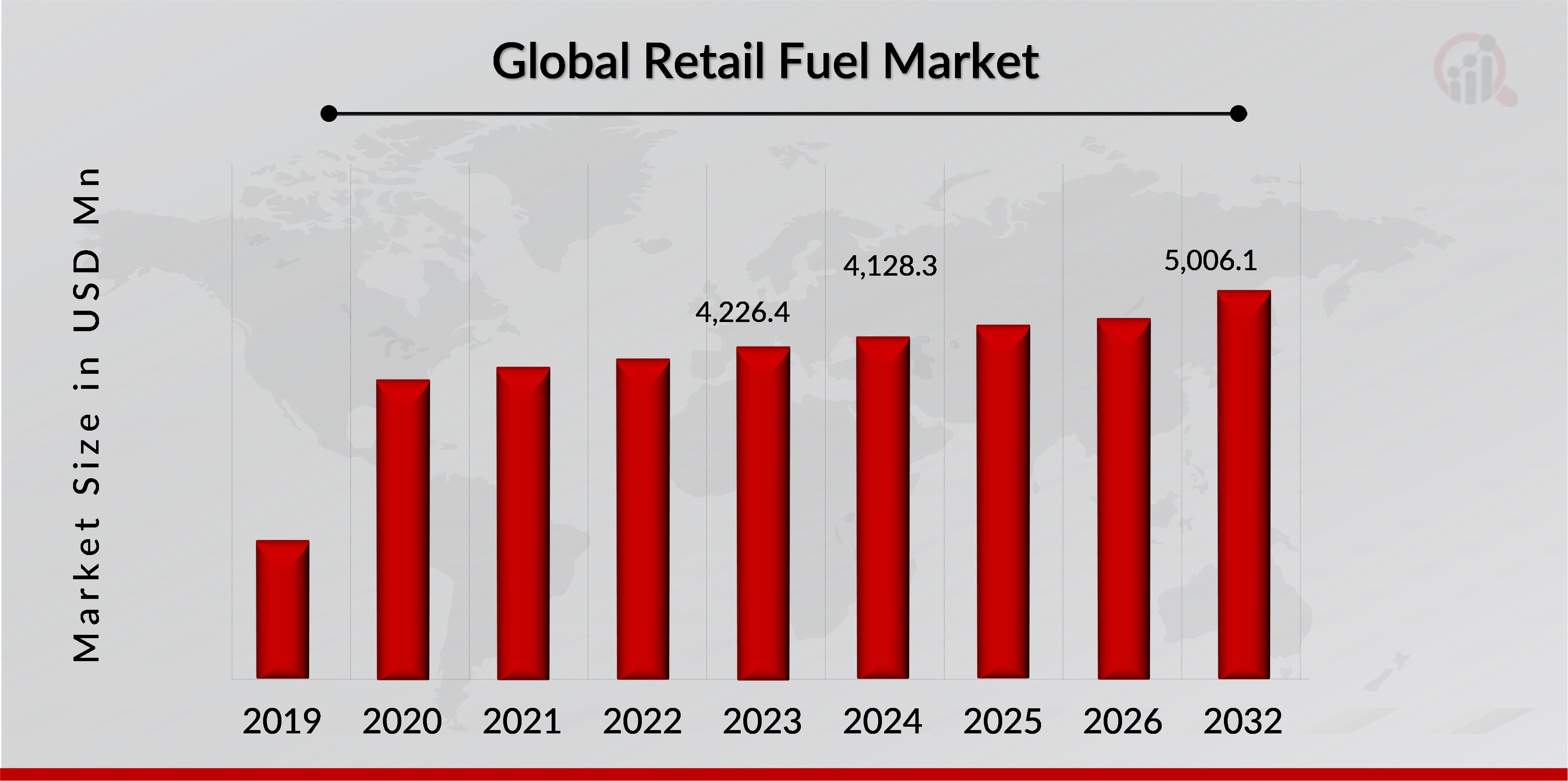

As per Market Research Future Analysis, the Global Retail Fuel Market was valued at USD 4,226.4 Million in 2023 and is projected to reach USD 5,006.1 Million by 2032, growing at a CAGR of 2.44% from 2023 to 2032. The market is primarily driven by the increasing demand from the automotive industry, stringent environmental regulations, and the need for fuel additives to enhance efficiency. Diesel remains the dominant fuel type, holding a 41.3% market share in 2023, while the power sector accounts for 33% of the end-use market. The retail fuel infrastructure is evolving with advancements in biofuels and modernization of fuel stations, particularly in the U.S. and Europe, to meet diverse energy needs.

Key Market Trends & Highlights

Key trends shaping the Retail Fuel Market include economic growth, infrastructure advancements, and the rise of bio-based fuels.

- Economic growth in emerging markets like India and China is driving increased vehicle ownership and fuel demand.

- The Diesel segment held a market value of USD 1,744.6 Million in 2023, indicating its continued reliance in commercial applications.

- The Power sector is projected to grow at a CAGR of 5.59%, highlighting strong demand for retail fuel in energy generation.

- Petrol Stations dominate the market with a 74.3% share, reflecting their importance as primary retail points.

Market Size & Forecast

2023 Market Size: USD 4,226.4 Million

2032 Market Size: USD 5,006.1 Million

CAGR: 2.44%

Largest Segment by Type: Diesel (41.3% share)

Largest End-Use Segment: Power (33% share).

Major Players

Key Companies include The Lubrizol Corporation, Fuel Performance Solutions, Evonik Industries, Innospec, Chevron Oronite, LANXESS, Infineum International, BASF, Afton Chemical, and Wynn's.

The prime drivers of the global fuel market include the extensive demand from the growing automotive industry. Stringent environmental regulations to reduce carbon footprint are also likely to drive the demand for fuel additives to enhance fuel efficiency. Another key driver of the fuel market is the degrading quality of crude oil.

Growing demand for ultra-low sulfur diesel and expanding industrialization in the developing countries is likely to create new growth avenues for the market players. Despite these challenges, the retail fuel market presents numerous opportunities. Innovations in refining processes and fuel additives can help reduce emissions and improve fuel economy.

Addressing environmental concerns while maintaining market relevance is crucial. The expansion of fuel distribution infrastructure in emerging markets offers significant growth potential, driven by increasing industrialization and transportation needs. Moreover, hybrid vehicles that combine traditional fuels with electric power present a transitional opportunity for the market, allowing for a gradual shift towards sustainability.

Retail Fuel Market Trends

Economic Growth and Increasing Vehicle Ownership

Rapid economic growth paired with a rise in vehicle ownership continues to play an essential role in nurturing the demand for retail fuel. The revenue potential of the retail fuel market is driven by an interplay between increasing income levels, population density in urban and industrialized environments, and changing consumer behaviors.

Economic growth is tied to rising production, employment, and disposable income. When countries move up economic ranks, the civilian populations' disposable incomes increase, and with that, folks tend to spend more on consumer goods, including automobiles. Even though India, China, and Brazil are amongst other emerging economies globally.

These economies have witnessed rapid industrialization & urbanization, demanding a market to transform their economic landscapes. This transformation impacts various sectors, including the retail fuel market, as increased economic activity directly correlates with higher transportation and industrial energy needs.

Better Retail Fuel Infrastructure and Demand for Bio-Based Fuels

Due to infrastructure and biofuel advancements, retail fuel is experiencing the most significant transformation phase. Environmental considerations and technological progress have prompted this shift, which is reflected on numerous fronts. Expanding retail fuel infrastructure is more essential than ever to fulfill the rising demand for bio-based fuels and other available inherited oil-based gasoline types.

To gear up with the times, fuel stations have seen significant modifications in terms of modernization and feature the latest dispensation technologies, increased safety security features, and customer service facilities. These upgrades are vital for accommodating the diverse energy needs of modern vehicles.

In the U.S., for example, Shell and Chevron have upgraded their stations with digital payment methods while monitoring fuel quality and inventory levels in real-time. The E.U. has also developed a Pan-European network of charging and fueling stations for alternative fuels.

The European Union's Alternative Fuels Infrastructure Directive (AFID) requires the use of a minimum number of publicly accessible refueling points for natural gas throughout member states. This plan has increased the number of fuel stations capable of handling bio-based fuels and charging electric vehicles (E.V.s) in countries such as Germany and France.

Retail Fuel Market Segment Insights

Retail Fuel Market By Type Insights

The Retail Fuel Market has been segmented into Petrol, Diesel, CNG, LPG, Jet Fuel, Others, and others. In 2023, the Diesel segment drove the Retail Fuel market by holding a substantial market share of 41.3% with a market value of USD 1,744.6 million.

It is projected to register a CAGR of 0.87% during the projected timeframe. This significant share highlights the continued reliance on diesel for various applications, especially in commercial transportation and industrial machinery.

Retail Fuel Market by End-Use Insights

Based on End-Use, the Retail Fuel market has been segmented into Transportation, Power, Aviation, Captive Power, Industrial, Others. In 2023, the Power drove the Retail Fuel Market by holding a substantial market share of 33% with a market value of USD 42,916.0 million.

It is projected to register a CAGR of 5.59% during the projected timeframe. This indicates a strong demand for retail fuel in power generation, especially in regions with limited alternative energy sources.

Retail Fuel Market by Retail Station Industry Insights

Based on Retail Station, the Retail Fuel market has been segmented into Gas Stations, Petrol Station. In 2023, the Petrol Station segment drove the Retail Fuel Market by holding a substantial market share of 74.3% with a market value of USD 3,138.3 million.

It is projected to register a CAGR of 1.67% during the projected timeframe. This dominance suggests that traditional petrol stations remain the primary point of sale for retail fuels, despite the emergence of alternative fuel options.

Retail Fuel Market Regional Insights

By region, the global market is segmented into North America, Europe, Rest of Latin America, Asia Pacific, Brazil & Argentina. Europe emerged as the leading segment with a share of 29.9%. The segment is projected to reach a value of USD 1,264.4 million by the end of the forecast period.

The Asia Pacific region witnessed the fastest segment with a healthy CAGR of 2.96%. This growth in Asia Pacific can be attributed to rapid industrialization, increasing vehicle ownership, and expanding transportation networks in the region.

Retail Fuel Key Market Players & Competitive Insights

The global fuel additives market is characterized by the presence of many global, regional, and local vendors. The market is highly competitive, with all the players competing to gain maximum market share. Rapid advancements in processes, frequent changes in government regulations, and growing applications of fuel additives in end-use industries are the key factors that confront the global market growth.

The vendors compete based on cost, product quality, availability, and reliability of the products. They must provide cost-effective and high-quality fuel additives to compete in the market. The competitive scenario is fragmented between the tier-1 and tier-2 companies.

Key Companies in the Retail Fuel Market include:

- The Lubrizol Corporation

- Fuel Performance Solutions

- Evonik Industries

- Innospec

- Chevron Oronite

- LANXESS

- Infineum International

- BASF

- Afton Chemical

- Wynn's

Retail Fuel Industry Developments

-

Q2 2024: TotalEnergies to acquire 100% of TotalEnergies Marketing Egypt TotalEnergies announced the acquisition of the remaining 35% stake in TotalEnergies Marketing Egypt, making it the sole owner of the retail fuel network in Egypt. The move is aimed at strengthening its downstream presence in the region.

-

Q2 2024: Shell Sells Downstream Assets in Malaysia to Sinopec Shell agreed to sell its retail fuel and lubricants business in Malaysia to Sinopec, marking a strategic exit from the Malaysian downstream market as part of its global portfolio optimization.

-

Q3 2024: BP and Reliance Industries launch new retail fuel outlets in India BP and Reliance Industries opened 100 new Jio-bp branded retail fuel stations across India, expanding their joint venture's footprint in the fast-growing Indian fuel retail market.

-

Q3 2024: ExxonMobil appoints new head of global retail fuels ExxonMobil named Jane Smith as the new global head of its retail fuels division, effective September 2024, as part of a broader leadership reshuffle.

-

Q4 2024: Chevron opens new retail fuel terminal in Texas Chevron inaugurated a new retail fuel terminal in Houston, Texas, increasing its supply capacity and distribution efficiency in the southern United States.

-

Q4 2024: Saudi Aramco launches first retail fuel station in China Saudi Aramco opened its first branded retail fuel station in China, marking its entry into the Chinese downstream market and expanding its global retail presence.

-

Q1 2025: Petrobras and Raízen announce partnership for biofuel retailing in Brazil Petrobras and Raízen entered a partnership to jointly develop and operate biofuel retailing infrastructure at select fuel stations across Brazil, targeting the growing demand for renewable fuels.

-

Q1 2025: Indian Oil Corporation to invest $500 million in new retail fuel outlets Indian Oil Corporation announced a $500 million investment plan to open 1,000 new retail fuel outlets across India by the end of 2025, aiming to strengthen its market leadership.

-

Q2 2025: Phillips 66 launches EV charging at select retail fuel stations Phillips 66 began offering electric vehicle charging services at 50 of its retail fuel stations in the United States, integrating alternative energy solutions into its traditional fuel retail network.

-

Q2 2025: Eni completes acquisition of 200 retail fuel stations in Spain Eni finalized the acquisition of 200 retail fuel stations from a local Spanish operator, expanding its downstream footprint in the Iberian Peninsula.

-

Q2 2025: Vivo Energy secures contract to supply fuel to Ghana’s public transport fleet Vivo Energy won a government contract to supply fuel to Ghana’s national public transport fleet, strengthening its position in the West African retail fuel market.

-

Q2 2025: Marathon Petroleum announces $300 million upgrade to retail fuel logistics network Marathon Petroleum unveiled a $300 million investment to upgrade its retail fuel logistics and distribution network across the Midwest, aiming to improve supply chain efficiency and customer service.

Retail Fuel Segmentation

Retail Fuel End-Use Outlook

- Petrol

- Diesel

- CNG

- LPG

- Jet Fuel

- Others

Retail Fuel Paints & Coatings End-Use Outlook

- Transportation

- Power

- Aviation

- Captive Power

- Industrial

- Other End-Use

Retail Fuel Retail Station Industry Outlook

- Gas Stations

- Petrol Station

Retail Fuel Regional Outlook

-

North America

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Austria

- Netherlands

- Belgium

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

-

Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

-

Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 4,226.4 Million |

| Market Size 2024 |

USD 4,128.3 Million |

| Market Size 2032 |

USD 5,006.1Million |

| Compound Annual Growth Rate (CAGR) |

2.44% (2023-2032) |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Data |

2018 & 2023 |

| Forecast Units |

Value (USD Million) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, End-Use, Retail Station, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered |

The U.S, Canada, Mexico, Germany, France, UK, Italy, Spain, Russia, China, Japan, India, South Korea, Malaysia, Thailand, Indonesia, Brazil, Argentina, GCC Countries, South Africa |

| Key Companies Profiled |

The Lubrizol Corporation, Fuel Performance Solutions, Evonik Industries, Innospec, Chevron Oronite, LANXESS, Infineum International, BASF, Afton Chemical, and Wynn's. |

| Key Market Opportunities |

Focus On Greener Fuels |

| Key Market Dynamics |

Economic Growth and Increasing Vehicle Ownership Better Retail Fuel Infrastructure and Demand for Bio-Based Fuels Power Outage Incidences |

Frequently Asked Questions (FAQ):

The Retail Fuel market is USD 4,226.4 Million in the year 2023.

The growth rate of Retail Fuel market is 2.44%

Europe held the largest market share in the Retail Fuel Market.

The Lubrizol Corporation, Fuel Performance Solutions, Evonik Industries, Innospec, Chevron Oronite, Others

CNG segment had the largest share in the Retail Fuel Market.

Transportation have the largest market share in the Retail Fuel Market.