Rising Air Travel Demand

The Commercial Aircraft Aviation Fuel Market is experiencing a notable surge in air travel demand, driven by increasing disposable incomes and a growing middle class in various regions. This trend is particularly evident in emerging economies, where the number of air passengers is projected to reach 8.2 billion by 2037, according to industry forecasts. As airlines expand their fleets to accommodate this influx of travelers, the demand for aviation fuel is expected to rise correspondingly. This growth in passenger numbers not only stimulates the need for more aircraft but also necessitates a reliable supply of aviation fuel, thereby bolstering the Commercial Aircraft Aviation Fuel Market. Airlines are likely to invest in more fuel-efficient aircraft, which could further influence fuel consumption patterns and market dynamics.

Emergence of Alternative Fuels

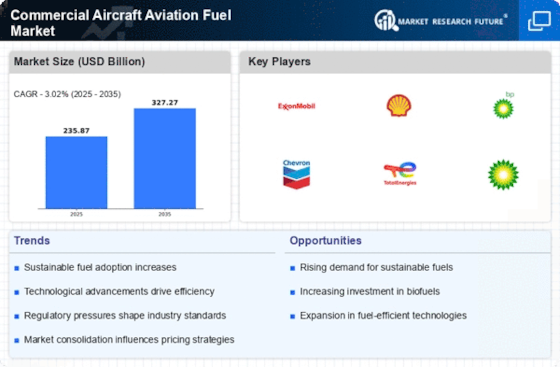

The emergence of alternative fuels is reshaping the landscape of the Commercial Aircraft Aviation Fuel Market. As concerns over climate change intensify, there is a growing emphasis on developing sustainable aviation fuels (SAF) derived from renewable sources. These alternative fuels have the potential to significantly reduce the carbon footprint of air travel. Industry stakeholders are increasingly investing in research and development to create viable SAF options that can be integrated into existing fuel supply chains. Reports suggest that the SAF market could reach a value of USD 15 billion by 2030, indicating a robust growth trajectory. This shift towards alternative fuels not only addresses environmental concerns but also presents new opportunities for innovation within the Commercial Aircraft Aviation Fuel Market.

Geopolitical Stability and Trade Relations

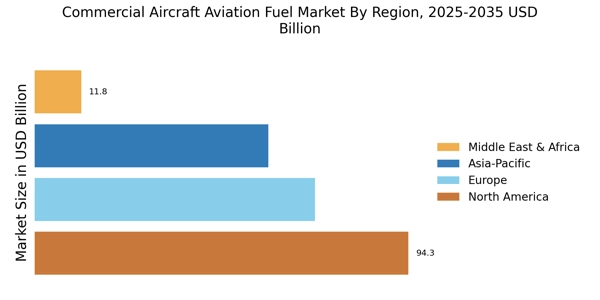

Geopolitical factors and trade relations have a profound impact on the Commercial Aircraft Aviation Fuel Market. Political stability in key regions can facilitate smoother operations for airlines, leading to increased fuel demand. Conversely, geopolitical tensions can disrupt supply chains and create volatility in fuel prices. For instance, fluctuations in oil prices due to geopolitical events can directly affect the cost of aviation fuel, influencing airline operational strategies. Additionally, trade agreements and partnerships between nations can enhance fuel supply security, thereby stabilizing the Commercial Aircraft Aviation Fuel Market. Airlines may need to adapt their fuel procurement strategies in response to these geopolitical dynamics, which could lead to shifts in market behavior and fuel sourcing practices.

Technological Innovations in Fuel Efficiency

Technological advancements play a pivotal role in shaping the Commercial Aircraft Aviation Fuel Market. Innovations in aircraft design, engine efficiency, and fuel management systems are contributing to reduced fuel consumption and operational costs for airlines. For example, the introduction of next-generation aircraft, such as the Boeing 787 and Airbus A350, has demonstrated significant improvements in fuel efficiency, with reductions of up to 20% compared to older models. These advancements not only enhance the profitability of airlines but also influence fuel demand patterns within the Commercial Aircraft Aviation Fuel Market. As airlines continue to prioritize fuel efficiency, the market may witness a shift towards more advanced fuel types and management practices, further driving the evolution of the industry.

Regulatory Frameworks and Environmental Policies

The Commercial Aircraft Aviation Fuel Market is significantly influenced by evolving regulatory frameworks and environmental policies aimed at reducing carbon emissions. Governments and international organizations are increasingly implementing stringent regulations that require airlines to adopt more sustainable practices. For instance, the International Civil Aviation Organization has set ambitious targets for reducing greenhouse gas emissions from aviation. These regulations may compel airlines to invest in alternative fuels and more efficient technologies, thereby impacting the demand for traditional aviation fuels. The shift towards sustainable aviation fuel (SAF) is gaining momentum, with projections indicating that SAF could account for up to 30% of total aviation fuel consumption by 2030. This transition presents both challenges and opportunities for the Commercial Aircraft Aviation Fuel Market.