Market Share

Introduction: Navigating the Competitive Landscape of Retail Ready Packaging

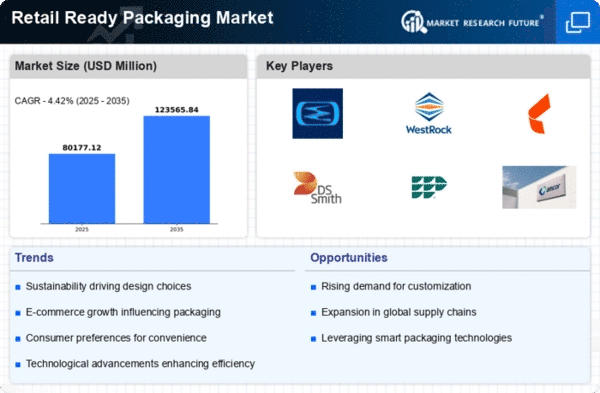

The RRPP market is in a state of evolution. Competition is growing in response to the emergence of new technology, changing regulations, and increasing consumer expectations for convenience and convenience. The market's leading players, including original equipment manufacturers, system integrators and new entrants, are trying to gain a lead by deploying advanced digital tools such as artificial intelligence, automation and IoT solutions to improve efficiency and customer engagement. While established manufacturers are focusing on greening their production processes to meet both regulatory requirements and consumer preferences, new players are introducing new packaging solutions that emphasize recyclability and ease of use. The most significant growth opportunities are in North America and Asia-Pacific, where strategic trends are in line with local market needs and green policies. The ability to take advantage of these technological advantages will be crucial for all stakeholders in the RRPP market in 2024–2025.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across the retail ready packaging spectrum, integrating design, production, and logistics.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| BillerudKorsnäs AB | Sustainable materials expertise | Sustainable packaging solutions | Europe, North America |

| Packaging Corporation of America | Strong focus on corrugated solutions | Corrugated packaging | United States |

| Georgia-Pacific LLC | Diverse product portfolio | Paper and packaging products | North America |

| International Paper Company | Global manufacturing footprint | Paper and packaging solutions | Global |

| Amcor | Innovative flexible packaging | Flexible and rigid packaging | Global |

| WestRock Company | Integrated packaging solutions | Containerboard and packaging | North America, South America |

Specialized Technology Vendors

These vendors focus on niche technologies and innovations that enhance packaging efficiency and sustainability.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| DS Smith | Circular economy focus | Sustainable packaging solutions | Europe, North America |

| Huhtamaki Group | Strong emphasis on food packaging | Food and drink packaging | Global |

| SIG Combibloc GmbH | Innovative carton solutions | Carton packaging technology | Global |

Infrastructure & Equipment Providers

These vendors supply the machinery and infrastructure necessary for the production and handling of retail ready packaging.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Weedon PSC Ltd | Custom machinery solutions | Packaging machinery | Europe |

| Smurfit Kappa Group | Innovative corrugated solutions | Corrugated packaging | Europe, Americas |

| Clearwater Paper Corporation | High-quality paper products | Paper and packaging products | North America |

| Linpac | Focus on food packaging | Rigid and flexible packaging | Europe |

| Refresco Group | Beverage packaging expertise | Beverage packaging solutions | Europe, North America |

Emerging Players & Regional Champions

- PackTech (USA) - This company, which specializes in sustainable and bespoke retail-ready packaging, has just signed a contract with a major food retailer to supply eco-friendly packaging. Challenges to traditional suppliers who rely on traditional materials.

- The Ecopack Solution (Europe) offers an innovative biodegradable packaging solution for the food and beverage industry. They have just completed a pilot project with a leading beverage company and are a strong competitor to conventional plastic packaging suppliers.

- SmartPack Innovations, a Singapore-based company, develops smart packaging that uses QR codes to engage consumers. They have teamed up with many retailers in the region to enhance the visibility of their products. As they do not use the technology themselves, they are a threat to the more traditional packaging companies.

- FlexiPack (Latin America): Focuses on flexible retail ready packaging that reduces waste and improves shelf life. They have recently expanded their operations in Brazil, competing directly with established players by offering lower-cost alternatives.

Regional Trends: In 2024, the trend for the development of sustainable and technologically integrated packaging in various regions is noticeable. North America has a tendency towards eco-friendly solutions, while Europe is interested in biodegradable materials. Asia is leading in the development of smart packaging, which enhances the interaction with consumers. Latin America has become the center of low-cost flexible packaging, a trend towards the development of regional champions serving local markets.

Collaborations & M&A Movements

- Smurfit Kappa and Mondi Group have entered into a partnership to develop sustainable packaging solutions for retail and to reduce plastic waste and increase recyclability, thus strengthening their position in the green packaging market.

- WestRock Company acquired the packaging division of International Paper in a strategic M&A move to expand its market share in the retail ready packaging sector and leverage synergies in production capabilities.

- DS Smith and Coca-Cola Europacific Partners announced a collaboration to innovate new retail ready packaging designs that improve shelf impact and reduce carbon footprint, reflecting the growing demand for sustainable packaging solutions.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Sustainability | Smurfit Kappa, WestRock | Both suppliers have implemented the use of new sustainable materials in their packaging solutions. Smurfit Kappa has developed a number of packaging solutions that are fully recyclable or biodegradable, while WestRock has focused on the use of recycled materials from post-consumer waste. |

| Customization | Mondi Group, DS Smith | Mondi provides bespoke solutions for the requirements of individual customers. It also offers brand visibility. D. Smith has invested in digital printing, which allows it to produce highly individualized and fast products, which is essential for retailers wanting to differentiate themselves. |

| Supply Chain Efficiency | International Paper, Packaging Corporation of America | International Paper has reduced lead times through the application of modern logistics and inventory management systems. Just-in-time delivery ensures that retailers receive packaging materials exactly when they need them, thus reducing the cost of storage. |

| Innovative Design | Graphic Packaging International, Sonoco Products Company | Graphic Package International is renowned for its revolutionary designs, which enhance the shelf-life and consumer appeal of products. Sonoco Products Company has developed unique formats that protect and display products in the most demanding retail settings. |

| Technology Integration | Avery Dennison, Sealed Air | Avery Dennison has incorporated in its labels a smart technology that enables traceability and consumer engagement. Sealed Air is developing IoT and automation solutions for the packaging industry that will optimize the supply chain and reduce waste. |

Conclusion: Navigating the Retail Ready Packaging Landscape

Approaching 2024, the retail-ready packaging market is characterized by intense competition and notable fragmentation, with the presence of both historical and new players. The trend toward sustainable and customer-oriented designs, which are causing the suppliers to constantly invent new products, is a common factor in the development of the retail-ready packaging market. Historical companies are relying on their long history, supply chains and brand names, while new players are concentrating on agility and new technology. The main determining factors in the market will be the ability to integrate artificial intelligence, automation and sustainable practices. Suppliers need to be able to adapt to changing customer preferences and regulations, and thus remain relevant in this constantly changing environment.

Leave a Comment