Rf Power Amplifier Size

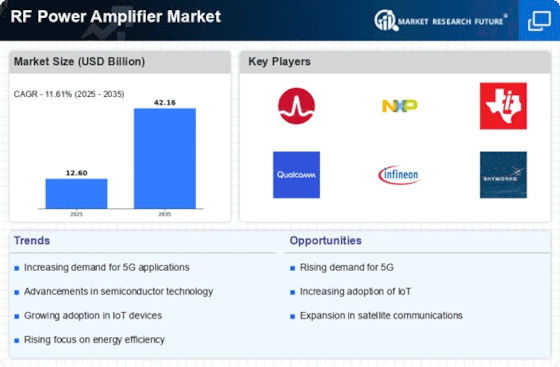

RF Power Amplifier Market Growth Projections and Opportunities

Exploring the Dynamics of the Global RF Power Amplifier Market

The global RF power amplifier market is a dynamic landscape, with several factors shaping its course, including frequency, raw materials, power output, noise figure, power gain, packaging type, application, and region.

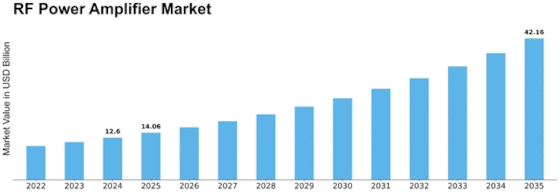

The market's growth trajectory is marked by a robust Compound Annual Growth Rate (CAGR) of approximately 13.37% from 2017 to 2023. The year 2016 saw Asia Pacific taking the lead with a substantial 41.13% market share, closely followed by North America at 30.88% and Europe at 22.15%. This growth surge in Asia Pacific is notably attributed to the escalating demand for cellular networks and the widespread adoption of IoT services across diverse industry sectors.

Delving into the specific segments, the global RF power amplifier market is intricately divided based on frequency, raw materials, packaging type, application, and region. Within the frequency spectrum, the range of 30-60 GHz emerged as the frontrunner, commanding the largest market share and boasting a value of USD 4.4 billion in 2016. The future looks promising for this segment, with a projected Compound Annual Growth Rate (CAGR) of 17.62% during the forecast period.

Shifting our focus to raw materials, silicon asserted its dominance, capturing a market value of USD 5 billion in 2016. The trajectory continues with a foreseen growth at a CAGR of 13.43%. Silicon's pivotal role in powering the RF power amplifier market underscores its significance in the technological landscape.

The segmentation strategy provides a nuanced understanding of the market, allowing stakeholders to navigate the intricacies of power output, noise figure, power gain, packaging type, application, and regional dynamics. These elements collectively contribute to the vibrancy and resilience of the global RF power amplifier market.

As the industry advances, guided by technological innovation and market demands, the RF power amplifier landscape is poised for further evolution. Stakeholders, from manufacturers to end-users, will play a crucial role in shaping the trajectory of this dynamic market in the years to come.

Leave a Comment