- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

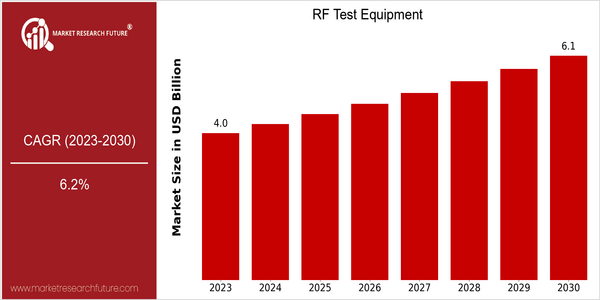

Market Size Snapshot

| Year | Value |

|---|---|

| 2023 | USD 4.03 Billion |

| 2030 | USD 6.14 Billion |

| CAGR (2023-2030) | 6.2 % |

Note – Market size depicts the revenue generated over the financial year

The RF Test Equipment market is valued at $ 4.03 billion in 2023, and is projected to reach $ 6.14 billion by 2030, at a CAGR of 6.2% during the forecast period. The growing demand for RF test equipment is mainly due to the complexity of wireless communication systems and the proliferation of IoT devices. Also, as industries continue to embrace advanced technology, the need for precise and reliable test equipment is becoming more important, which drives the market. The emergence of 5G technology requires advanced test equipment to ensure its performance and compliance with strict regulatory standards. In addition, the importance of R & D in the telecommunications and aerospace industries is also driving the demand for RF test equipment. RF test equipment market key players, such as Keysight, Anritsu, and Tektronix, are constantly launching new products and forming strategic alliances to enhance their offerings and capture a larger market share. In recent years, the industry has been committed to meeting the needs of 5G testing.

Regional Market Size

Regional Deep Dive

The RF test equipment market is expected to grow significantly across various regions, owing to the growing demand for wireless communication technology, the proliferation of IoT devices, and the development of 5G networks. Each region has its own characteristics influenced by technological advancements, government regulations, and economic conditions. North America is a major innovator and leader in terms of R&D, whereas Europe is a market with a focus on regulatory compliance and environment-friendly practices. Asia-Pacific is the fastest-growing market owing to the availability of raw materials and the growth of the population. The Middle East and Africa are witnessing a government push to develop the telecommunications sector, whereas Latin America is slowly adopting RF technology to support its growing telecommunications sector.

Europe

- The European Union's Green Deal is pushing for more sustainable technologies, prompting RF test equipment manufacturers to innovate in energy-efficient testing solutions, with companies like Rohde & Schwarz at the forefront.

- Regulatory changes in the telecommunications sector, particularly concerning spectrum allocation for 5G, are influencing the market dynamics, as companies must adapt their testing equipment to comply with new standards.

Asia Pacific

- China's aggressive investment in 5G infrastructure is significantly boosting the demand for RF test equipment, with local companies like Huawei and ZTE expanding their testing capabilities.

- The rise of IoT applications in countries like India is creating a need for versatile RF test solutions, leading to collaborations between local startups and established firms like National Instruments.

Latin America

- Brazil's National Telecommunications Agency (ANATEL) is implementing new regulations to enhance mobile network quality, which is increasing the demand for RF test equipment among local telecom operators.

- The growing adoption of smart city projects in Latin America is creating opportunities for RF test equipment manufacturers to provide solutions that support advanced communication technologies.

North America

- Moreover, the new regulations for the deployment of 5G by the FCC will further stimulate the demand for advanced RF test equipment from companies like Keysight and Anritsu.

- Recent innovations in RF test equipment, such as the development of software-defined radio (SDR) technology, are enabling more flexible and efficient testing solutions, with companies like Tektronix leading the charge.

Middle East And Africa

- Governments in the Middle East, particularly in the UAE and Saudi Arabia, are investing heavily in telecommunications infrastructure, which is driving demand for RF test equipment from companies like Anritsu and Keysight.

- The African Union's initiatives to improve digital connectivity are fostering partnerships between local governments and technology providers, enhancing the market for RF testing solutions.

Did You Know?

“Did you know that the RF Test Equipment Market is expected to see a surge in demand due to the anticipated rollout of 5G technology, which requires more sophisticated testing solutions than previous generations of wireless technology?” — Market Research Future

Segmental Market Size

The field of RF testing plays a vital role in the performance and reliability of wireless communication systems, and is currently experiencing strong growth. Demand is being driven by the increasing complexity of wireless systems such as 5G and the Internet of Things, which requires increasingly sophisticated testing solutions. Regulations also require that communication standards be met, further increasing the need for dependable RF test equipment. At present, RF test equipment is widely used, with companies such as Keysight and Anritsu leading the market. These companies provide solutions for various applications, including network optimisation, device testing and spectrum analysis. Typical examples of RF test applications include testing of automotive radar and wireless communication systems. These applications are being driven by the increasing demand for enhanced communication and the rise of smart devices. The growth of RF test is being shaped by developments in technology such as software-defined radio and the automation of testing.

Future Outlook

During the forecast period, the RF test equipment market is expected to grow at a compound annual growth rate (CAGR) of 6.2%. This growth is primarily driven by the increasing demand for advanced wireless communication technologies, including 5G and beyond, which requires sophisticated testing solutions to ensure optimum performance and compliance with regulatory standards. Moreover, as industries adopt IoT and smart technology, the need for reliable RF testing will become even more crucial. The market will be further driven by the integration of artificial intelligence and machine learning into RF testing processes, which will increase the efficiency and accuracy of the test results. Also, telecommunications and the aerospace industries will place greater emphasis on R&D, thereby driving the demand for RF test equipment. Also, miniaturization of devices and the growing complexity of RF systems will necessitate the development of advanced testing solutions. The result is a more diversified customer base and a broader range of applications.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 3.80 Billion |

| Market Size Value In 2023 | USD 4.03 Billion |

| Growth Rate | 6.20% (2023-2030) |

RF Test Equipment Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.