Market Trends

Key Emerging Trends in the Rotogravure Printing Inks Market

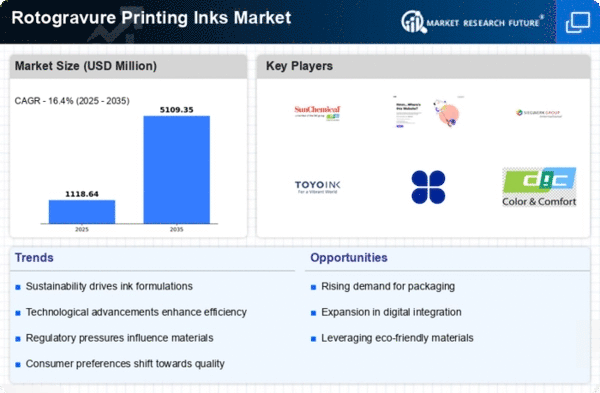

The Rotogravure Printing Inks Market is witnessing several notable trends that are shaping its dynamics:

Growing Demand in Packaging Industry: The market for rotogravure printing inks is experiencing a steady increase in demand, driven primarily by the growing packaging industry. Rotogravure printing is widely used for flexible packaging, labels, and shrink sleeves due to its high-quality printing capabilities and ability to achieve vibrant colors and intricate designs. As the demand for packaged goods continues to rise, particularly in food, beverage, and personal care sectors, the demand for rotogravure printing inks is expected to grow accordingly.

Shift towards Sustainable Inks: There is a noticeable trend towards sustainable and eco-friendly printing inks in the rotogravure printing industry. With increasing environmental awareness and regulatory pressures, printers and brand owners are seeking inks that minimize environmental impact and comply with sustainability standards. Manufacturers are responding by developing water-based, bio-based, and low-VOC (volatile organic compound) inks that offer comparable performance to traditional solvent-based inks while reducing environmental footprint.

Advancements in Ink Technology: Technological advancements in ink formulations are driving market trends in the rotogravure printing inks market. Manufacturers are investing in research and development to innovate new ink formulations with improved printability, adhesion, drying speed, and color consistency. These advancements enhance the efficiency and quality of rotogravure printing processes, meeting the evolving needs of printers and brand owners.

Focus on High-Performance Inks: There is a growing demand for high-performance rotogravure printing inks that offer excellent print quality, durability, and resistance to abrasion, fading, and chemicals. These inks are essential for applications requiring stringent performance requirements, such as food packaging, pharmaceutical labels, and outdoor signage. Manufacturers are developing specialized inks tailored to specific substrates and end-use applications to meet the demand for high-performance solutions.

Expansion in Flexible Packaging: The flexible packaging industry is experiencing robust growth, driven by factors such as changing consumer preferences, convenience, and lightweight packaging solutions. Rotogravure printing is widely used for printing on flexible packaging materials such as films, foils, and laminates. As the demand for flexible packaging continues to rise across various sectors, including food, healthcare, and pet care, the demand for rotogravure printing inks is expected to increase correspondingly.

Customization and Personalization: There is a growing demand for customization and personalization in printed packaging and labels, driven by consumer preferences for unique and eye-catching designs. Rotogravure printing offers the ability to achieve high-resolution prints with vibrant colors and intricate details, making it suitable for customized packaging and promotional materials. Printers are leveraging rotogravure printing inks to meet the demand for personalized packaging solutions in niche markets and product categories.

Market Expansion in Emerging Economies: Emerging economies in Asia-Pacific, Latin America, and Africa are witnessing significant growth in the rotogravure printing inks market. Rapid urbanization, increasing disposable incomes, and expanding consumer markets in these regions are driving demand for printed packaging and labels. Manufacturers are expanding their presence in emerging economies to capitalize on growing market opportunities and cater to the needs of local printers and brand owners.

Impact of COVID-19 Pandemic: The COVID-19 pandemic has had mixed effects on the rotogravure printing inks market. While the initial disruptions in supply chains and manufacturing activities affected market growth, the pandemic also accelerated certain trends such as e-commerce, home delivery, and online shopping. As the economy recovers and consumer behavior evolves, the demand for rotogravure printing inks is expected to rebound, driven by the continued growth of packaging and labeling applications.

Leave a Comment