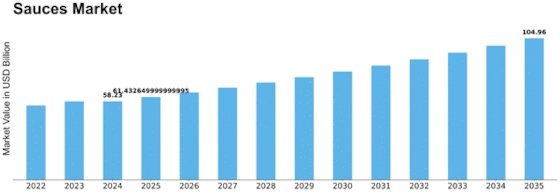

Sauces Size

Sauces Market Growth Projections and Opportunities

Market dynamics and consumer appeal of sauces are impacted by several factors. Food preferences are changing and global cuisines are expanding. Sauces provide flavor to various items, particularly when consumers want something new. Sauces with distinctive and ethnic flavors are in demand, as is foreign cuisine.

Economics heavily impact the sauces market. Economic expansions may boost demand for premium and gourmet sauces because buyers are more eager to try new items. During recessions, storing up on basic condiments and other cheap but versatile things may be wise. Consumer buying behaviors and economic conditions affect sauce market positioning and pricing.

Health and fitness are becoming important to sauce buyers. Due to rising health awareness, natural sauces are in demand. These consumers prefer organic, low-sugar, low-salt, and health-friendly sauces. Due to consumer demand, sauce makers are rethinking their formulas, eliminating artificial ingredients, and emphasizing nutritional value.

Packaging and product development impact the sauces market. Manufacturers produce new tastes to fulfill consumer and food industry needs. Sustainable packaging, portion-controlled sachets, and easy-to-squeeze bottles may attract consumers and distinguish goods. Cultural and regional preferences influence the sauces market. Regional sauces are made because individuals have varied preferences and cooking methods. Manufacturers adapt their sauces to regional tastes to satisfy a wide range of consumers.

Marketing and branding affect sauce purchasers. Innovative marketing, open product attribute communication, and successful branding build brand loyalty and trust. Due to celebrity endorsements, partnerships, and narrative about their origin and authenticity, the sauces may appeal to consumers seeking a unique and authentic dining experience. Geographically distinct sauces are especially influenced by global commerce, which impacts the sauces market. The tariffs, import/export rules, and trade agreements all have an effect on how much and where you may purchase imported sauces. Opportunities and obstacles for global sauces market players could result from changes in international relations and trade rules.

The sauces market is governed by customer convenience, which influences product kinds and usage conditions. Sauces that are pre-measured and quick to pour are a lifesaver for individuals who are constantly on the move. Sauces are more enticing to consumers as they may be used for dipping, marinating, or cooking, which is wonderful since people are constantly searching for convenient and multi-purpose kitchen items.

Finally, numerous variables shape the sauces industry. These include changing consumer preferences, the economy, new health and wellness trends, product and packaging developments, cultural influences, marketing strategies, retail dynamics, global trade concerns, and customer convenience preferences. Sauces industry players must comprehend and adapt to these complex influences to remain ahead of the competition, please consumers, and seize new opportunities in this dynamic market.

Leave a Comment