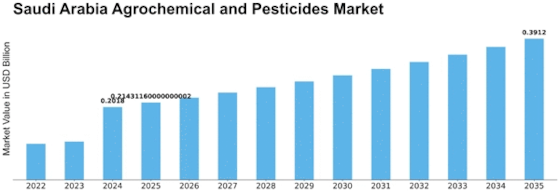

Saudi Arabia Agrochemical Pesticides Size

Saudi Arabia Agrochemical Pesticides Market Growth Projections and Opportunities

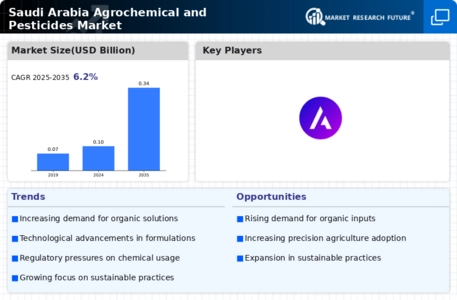

Market considerations shape the Saudi Arabian agrochemical and pesticides market. Country's strong farming sector drives this market. Saudi Arabia has invested in modernizing its agribusiness, adopting cutting-edge technologies, and developing manageable farming practices. This focus on rural improvement drives demand for agrochemicals and insecticides to boost crop output and protect crops from pests and diseases.

Environmental factors also shape Saudi Arabia's agrochemical and insecticides market. Horticulture is vulnerable to bugs and diseases in the country's bone-dry climate. Ranchers use agrochemicals and pesticides to overcome these issues and boost yields. Need for effective solutions to Saudi Arabia's unique agro-natural conditions drives market growth.

The Saudi agrochemical and pesticides market is also heavily influenced by government policies. The government has promoted practical farming and pesticide use. Administrative policies like agrochemical enlistment and endorsement affect the market by changing synthetics' accessibility and use. This administrative system seeks to balance agrarian efficiency and environmental and human welfare.

Financial conditions and global market trends affect Saudi Arabia's agrochemical and pesticides market. Global item prices, exchange rates, and financial conditions might affect natural substance prices and agrochemical product valuations. Saudi Arabia is an important part of the global horticulture production network, therefore these external financial factors affect agrochemical prices for local ranchers.

Mechanical and agrochemical advances boost Saudi Arabia's market. Accurate horticulture, bright growing breakthroughs, and biopesticides reflect a trend toward ecosystem-friendly practices. Saudi ranchers increasingly seek products that boost agricultural productivity and meet global maintainability goals. This demand is met by inventive and eco-friendly agrochemical and pesticide arrangements.

Saudi Arabia's agrochemical and pesticides market is also affected by competition and central players. The company features local and global producers battling for market share. Cutthroat estimating, product segregation, and vital organizations are common ways companies gain an edge. There are established firms and newcomers, creating a vibrant market.

Leave a Comment