Rising Healthcare Expenditure

The Global sciatica treatment market is also benefiting from rising healthcare expenditure across various regions. Governments and private sectors are increasingly investing in healthcare infrastructure, which enhances access to sciatica treatment. This trend is particularly evident in developing countries, where improved healthcare facilities and services are becoming more accessible. As healthcare spending continues to rise, it is likely that more patients will receive timely and effective sciatica treatment, thereby contributing to the market's growth trajectory. The projected increase in market value to 26.1 USD Billion by 2035 reflects this positive trend

Rising Prevalence of Sciatica

The Global Sciatica Market Industry is experiencing growth driven by the increasing prevalence of sciatica disease among the population. Factors such as an aging demographic and sedentary lifestyles contribute to this trend. The sciatica treatment market is projected to reach USD 15.7 billion by 2024, indicating a growing demand for effective options. As more individuals seek relief from sciatica pain, healthcare providers are likely to expand their offerings, including physical therapy and surgical interventions. This growing patient population necessitates advancements in sciatica treatment modalities, thereby propelling the market forward.

Increased Awareness and Education

There is a growing emphasis on awareness and education regarding sciatica, which is positively impacting the Global Sciatica Market Industry. Healthcare campaigns aimed at informing the public about the causes, treatment for sciatica options are becoming more prevalent. This increased awareness encourages individuals to seek medical advice sooner, potentially leading to earlier interventions and better outcomes.As a result, healthcare providers may see an uptick in patient consultations, further driving market growth. The anticipated compound annual growth rate of 4.73% from 2025 to 2035 underscores the importance of education in shaping patient behavior and treatment pathways.

Growing Demand for Non-Invasive Treatments

The demand for non-invasive treatment options is shaping the Global sciatica treatment market Industry. Patients are increasingly favoring conservative sciatica management strategies, such as physical therapy, chiropractic care, and sciatica pain management techniques, over surgical interventions. This shift is driven by a desire to avoid the risks associated with surgery and to seek holistic approaches to sciatica pain relief. As healthcare providers adapt to this demand, they are likely to expand their offerings of non-invasive treatments, which may lead to a broader patient base. The market's growth, projected at a CAGR of 4.73% from 2025 to 2035, indicates a sustained interest in these alternatives.

Advancements in sciatica treatment technologies

Technological innovations in treatment for sciatica are significantly influencing the sciatica treatment market Industry. The introduction of minimally invasive surgical techniques and advanced imaging technologies enhances the accuracy of diagnoses and the effectiveness of sciatica treatment. For instance, procedures like endoscopic discectomy are gaining traction due to their reduced recovery times and improved patient outcomes. As these technologies continue to evolve, they are expected to attract more patients seeking relief from sciatica, thereby contributing to the market's projected growth to 26.1 USD Billion by 2035. This trend suggests a shift towards more patient-centered care in managing sciatica.

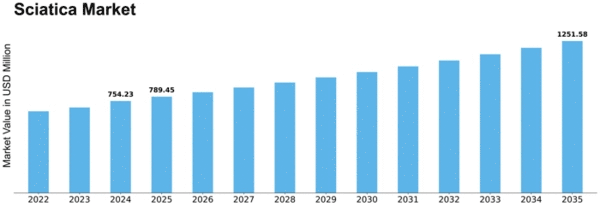

Sciatica Treatment Market: Outlook and Key Trends

The growth in the sciatica treatment market is expected to drive significant growth in the industry, estimated to grow from $15.7 billion in 2024 to $26.1 billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.73% from 2025 to 2035. Factors contributing to this expansion include the rising prevalence of sciatica, advancements in treatment technologies, and increased healthcare expenditure. As the market evolves, stakeholders are likely to focus on innovative solutions and patient-centered care to meet the growing demand for effective sciatica disease management.

Emerging Non-Opioid & Minimally Invasive Innovations

The sciatica treatment landscape is currently undergoing a pivot away from traditional open surgery and opioids toward ultra-minimally invasive technologies. Key among these is the rise of temporary Peripheral Nerve Stimulation (PNS) systems, such as the SPRINT system, which allow for 60-day implantable treatment without permanent hardware.

Simultaneously, the spinal cord stimulation (SCS) market is evolving with "closed-loop" technology, where devices automatically adjust electrical pulses in real-time based on the patient's spinal cord activity, significantly improving long-term sciatica pain management efficacy without manual adjustments.

Pipeline Breakthroughs in Injectables & Regenerative Care

On the pharmaceutical front, the market is anticipating the approval of the first targeted, non-opioid epidural treatments. Semdexa (SP-102), a novel viscous gel formulation of dexamethasone, is in late-stage development and aims to replace off-label liquid steroids by offering extended residence time at the nerve root.

Additionally, regenerative technologies like SoftWave therapy (unfocused acoustic waves) and investigational clonidine micropellets are gaining traction, offering patients non-surgical alternatives that recruit the body's own stem cells to repair tissue and modulate pain pathways without the risks associated with systemic medication.

Leave a Comment