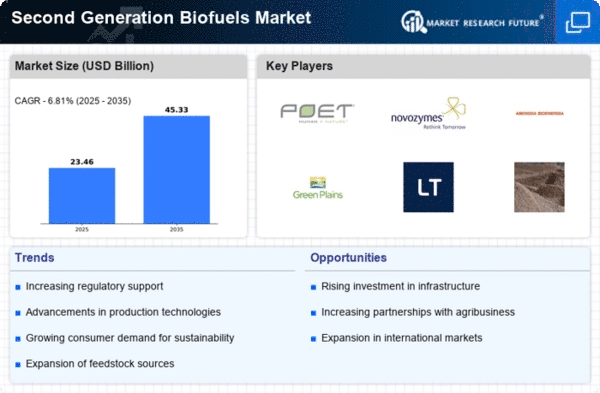

Market Trends

Key Emerging Trends in the Second Generation Bio fuels Market

The second-generation biofuels market is seeing dynamic patterns that reflect the emergence of feasible energy arrangements.This change addresses food security concerns and makes biofuel production easier.

The growing emphasis on cutting-edge biofuel production processes drives the second-generation biofuel business. Progress in biochemical and thermochemical transformation methods has made biofuel production from various feedstocks more efficient and cost-effective. Cellulosic ethanol production and pyrolysis generate higher yields and have less environmental impacts, making second-generation biofuels a viable alternative to non-renewable energy sources.

Second-generation biofuels have also gained popularity due to global decarbonization and ozone-damaging chemical reduction. To combat environmental change, legislatures and businesses worldwide are recognizing the importance of cleaner energy. Next, tactics and motives are being implemented to boost the use of cutting-edge biofuels, creating a market-friendly environment. Second-generation biofuels in the energy framework help the larger goal of a more sustainable and eco-friendly energy scenario.

A major market trend is the expansion of second-generation biofuel feedstock hotspots. Farming deposits are still a major source, but the company is exploring green growth and natural waste. This extension reduces food crop competition and increases biofuels production network adaptability. Green growth, which may be grown on non-arable terrain, may generate significant oil yields per section, providing sustainable biofuel production.

Social and private sector collaboration and investment in second-generation biofuels is growing. States, research foundations, and industry participants are working together to accelerate innovation, improve production limits, and create a stable biological system for biofuels market growth. This cooperative approach aims to solve specific issues, streamline administrative processes, and create a global market for second-generation biofuels.

Leave a Comment