Security Testing Market Summary

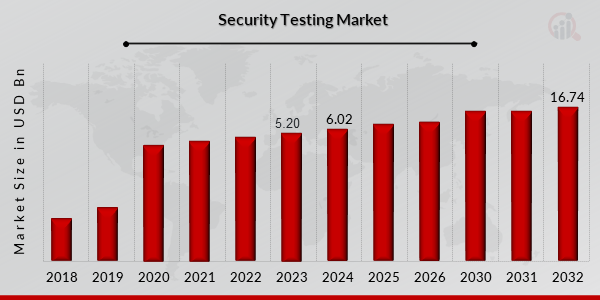

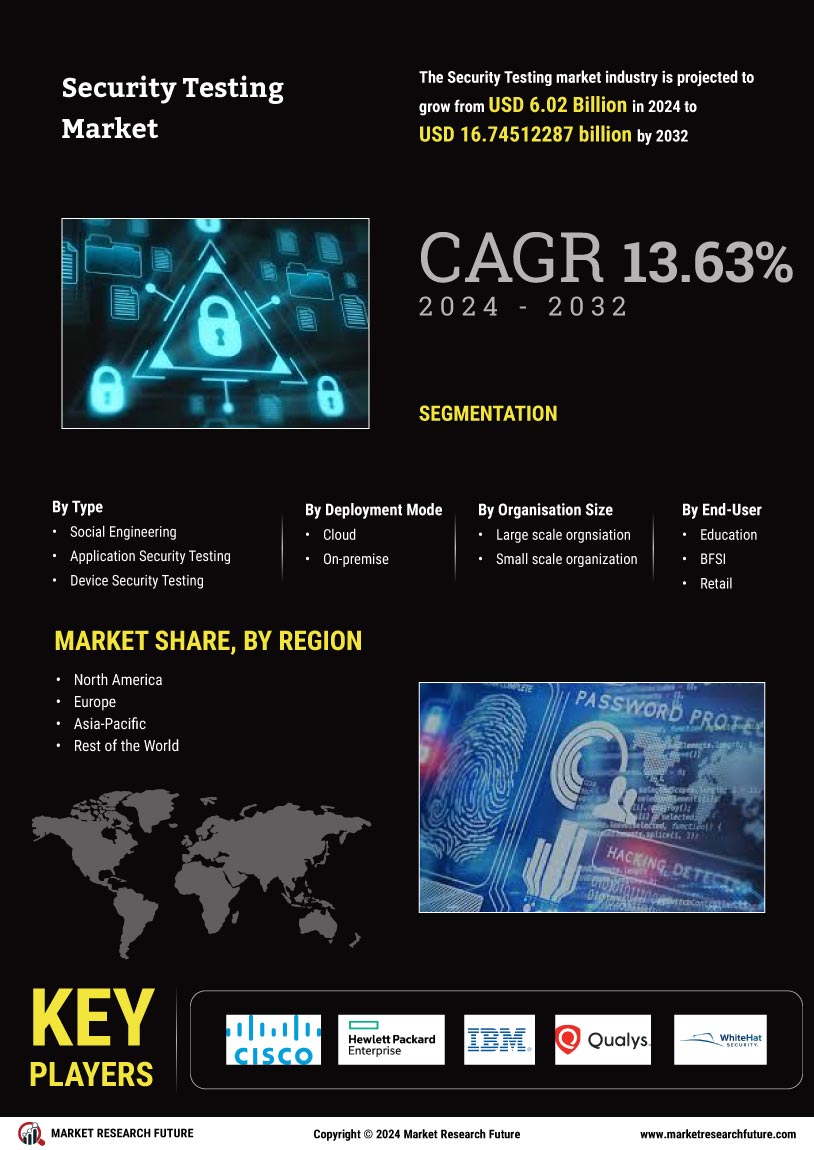

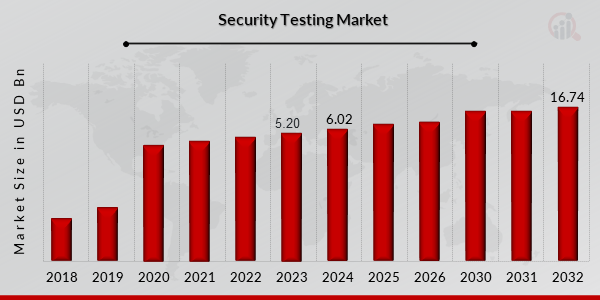

As per Market Research Future Analysis, the Global Security Testing Market was valued at USD 5.20 billion in 2023 and is projected to reach USD 16.75 billion by 2032, growing at a CAGR of 13.63% from 2024 to 2032. The market growth is driven by the increasing need for customer data protection, the rise in cyber-attacks, and the adoption of cloud-based security solutions. The surge in web and mobile-based business, along with the adoption of IoT and BYOD practices, has expanded the attack surface, necessitating timely security testing to mitigate potential threats. The BFSI sector remains the largest end-user segment due to its sensitivity to cyber threats, while North America leads the regional market share, followed by Europe and Asia-Pacific.

Key Market Trends & Highlights

Key trends driving the Security Testing Market include technological advancements and increasing digitalization.

- Market Size in 2023: USD 5.20 billion; projected to reach USD 16.75 billion by 2032.

- CAGR of 13.63% during the forecast period (2024-2032).

- BFSI sector is the largest end-user segment due to high sensitivity to cyber threats.

- North America holds the largest market share, driven by the presence of key players.

Market Size & Forecast

2023 Market Size: USD 5.20 billion

2024 Market Size: USD 6.02 billion

2032 Market Size: USD 16.75 billion

CAGR: 13.63% (2024-2032)

Largest Regional Market Share in 2024: North America.

Major Players

Cisco Systems Inc., Hewlett Packard Enterprise, IBM Corporation, Qualys Inc., WhiteHat Security, Applause App Quality Inc., Veracode, Checkmarx, UL LLC, Intertek Group PLC, Valency Networks Pvt Ltd, Capgemini SE, Wipro Limited, Cognizant Technology Solutions Corp, Infosys Limited, Tata Consultancy Services Limited.

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Security Testing Market Trends

- The surge in web and mobile-based business is driving the market growth

Enterprises are adopting technologies, such as the Internet of Things (IoT) and BYOD, which have increased the attack surface. Enterprises allow employees to bring their own devices, such as laptops and smartphones, to access company data and provide company-specific web and mobile-based applications. These devices function on the private network of the respective user, which is susceptible to various cyberattacks due to insufficient security. Business-sensitive data will be leaked and misused if any of these devices or applications are hacked. Timely security testing of such devices and applications for checking vulnerabilities can help prevent and mitigate potential cyber threats.

The cybersecurity statistics of Veronis revealed that the breached data from sources, such as loT and smartphones, are increasing drastically. The same study suggested that most companies have unprotected data and poor security testing practices, making them vulnerable to data loss. According to Symantec, in 2018, 1 in 36 mobile devices had high-risk apps installed, an average of 10,573 malicious mobile apps were blocked daily, and many devices experienced an average of 5,200 attacks per month.

According to CSO Online, 61% of organizations have experienced a lot of security incidents, and as per NETSCOUT, IoT devices are typically attacked within five minutes, mainly through malicious servers. These statistics highlight the need to secure endpoints to prevent data loss and, in turn, financial loss. These statistics are also making enterprises realize the importance of better security. This factor drives the Market CAGR.

Additionally, the initiatives by the government and digitalization will lead to plenty of growth opportunities. In the last few years, the transformation of enterprises to digitalization has been immense. According to mart insights, over 31% of companies are already adopting digitalization. The use of Al, machine learning, and much is bringing better organizational changestions. Through Al, businesses can track consumer preferences to make a great impact. Most of the consumers buy products that are according to their preferences.

Even the government encourages digitalization as there are plenty of benefits. The digital infrastructure of any organization uses Al and IoT. However, these technologies are prone to cyber threats. The increasing rate of digitalization is raising the need for security testing in the upcoming years. It is an exceptional opportunity for the security testing market to increase demand and profitability. Due to digitalization, awareness about security testing will increase. New end users will prefer security testing for secure processes and customers' user experience. All these growth prospects will ultimately enhance the security testing market size.

Thus, driving the Security Testing market revenue.

Security Testing Market Segment Insights:

Security Testing Type Insights

Based on type, the Security Testing Market segmentation includes Social Engineering, Application Security Testing, Device Security Testing, and Network Security Testing. The network security testingsegment dominated the market;the network security testing segment is the largest segment of the security testing market. This is because network security is essential for protecting organizations from cyberattacks. Network security testing helps identify and mitigate network infrastructure vulnerabilities, such as firewalls, routers, and switches.

Security Testing Deployment Mode Insights

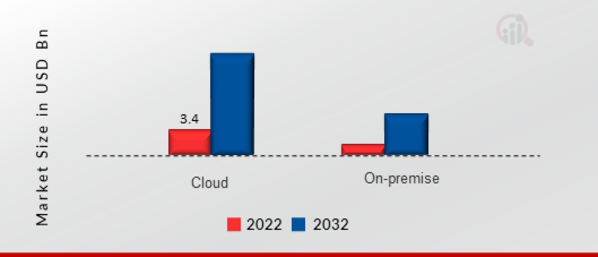

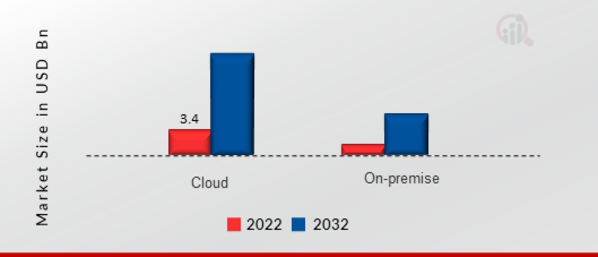

Based on deployment mode, the Security Testing Market segmentation includes Cloud, On-premise. The cloud segment dominated the market; the cloud segment is the largest segment of the security testing market. Cloud computing is becoming increasingly popular, and organizations seek ways to secure their cloud-based applications and infrastructure.

Figure1: Security Testing Market, by Deployment Mode, 2022&2032(USD billion)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Security Testing Organisation Size Insights

The Security Testing Market segmentation, based on Organisation Size, includes large-scale organizations and small-scale organizations. The cloud segment dominated the market because large-scale organizations have more complex IT infrastructures and are more likely to be targeted by cyberattacks. Large-scale organizations have more resources to invest in security testing.

Security Testing End-User Insights

The Security Testing Market segmentation, based on End-User, includes Education, BFSI, Retail, Telecomm, IT. The BFSI segment dominated the market;The BFSI segment is the largest segment of the security testing market. This is because the BFSI sector is a prime target for cyberattacks due to the sensitive data it holds.

Security Testing Regional Insights

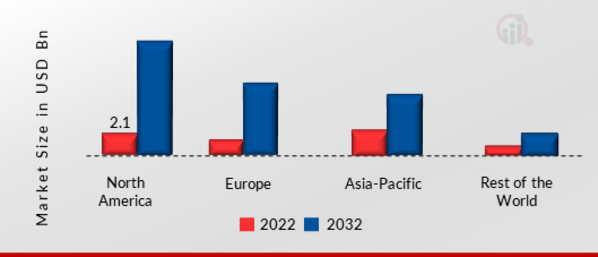

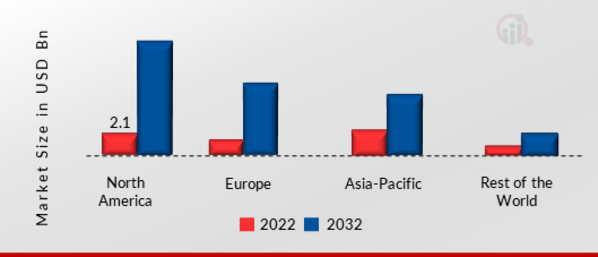

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Security Testing market area will dominate, owing to the need for security testing in organizations rising in this Region. Also, due to the presence of top players, the market will have many more developmentsto boost market growth in this Region.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure2: GLOBALSECURITY TESTING MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Europe's Security Testing market accounts for the second-largest market share due to theneed to detect potential loopholes are essential in this Region. It is a region with a high expansion rate in the forecast period. Further, the German Security Testing market held the largest market share, and the UK Security Testing market was the fastest-growing market in the European Region.

The Asia-Pacific Security Testing Market is expected to grow fastest from 2023 to 2032. This is due tothe merging of enterprises. These enterprises, both small and large, have high requirements for security testing. All these regional players will witness high demand and revenue rates. Moreover, China’s Security Testing market held the largest market share, and the IndianSecurity Testing market was the fastest-growing market in the Asia-Pacific region.

Security Testing Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Security Testing market grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. The Security Testing industry must offer cost-effective items to expand and survive in a more competitive and rising market climate.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the global Security Testing industry to benefit clients and increase the market sector. The Security Testing industry has offered some of the most significant advantages in recent years.

Major players in the Security Testing market, includingCisco Systems Inc. (US), Hewlett Packard Enterprise (US), IBM Corporation (US), Qualys Inc. (US), WhiteHat Security (US), Applause App Quality Inc. (US), Veracode (US), Checkmarx (Israel), UL LLC (Netherlands), and Intertek Group PLC (UK), Valency Networks Pvt Ltd (India), Capgemini SE (France), Wipro Limited (India), Cognizant Technology Solutions Corp (US), Infosys Limited (India), Tata Consultancy Services Limited (India)., and others, are attempting to increase market demand by investing in research and development operations.

StackHawk makes it simple for developers to find, triage, and fix application security bugs. Scan your application for AppSec bugs in the code your team wrote, triage and fix with provided documentation, and automate in your pipeline to prevent future bugs from hitting prod.StackHawk, an application security testing provider, announced the launch of its Deeper API Security Test Coverage. The company's Deeper API Security Test Coverage release allows teams to leverage existing automated testing tools, such as Postman or Cypress, to explore paths and endpoints, provide custom test data for scans, and cover proprietary use cases for security testing.

Datadog is an observability service for cloud-scale applications, providing monitoring of servers, databases, tools, and services through a SaaS-based data analytics platform.Datadog, Inc., a monitoring and security platform for cloud applications, announced the launch of Datadog Continuous Testing. This new product helps developers and quality engineers quickly create, manage, and run end-to-end tests for their web applications.

Key Companies in the Security Testing market include

Security Testing Market Developments

-

Q3 2025: Snyk acquires Invariant Labs to strengthen AI Trust Platform for defending against AI-generated code threats Snyk announced the acquisition of Invariant Labs, aiming to enhance its AI Trust Platform and bolster defenses against threats arising from AI-generated code.

-

Q3 2025: Harness merges with Traceable AI to provide end-to-end DevSecOps and API security Harness and Traceable AI completed a merger to deliver comprehensive DevSecOps and API security solutions, integrating their technologies for improved security testing capabilities.

-

Q3 2025: Palo Alto Networks' proposed $25 billion acquisition of Cyber Ark marks one of the largest cybersecurity deals Palo Alto Networks announced a proposed $25 billion acquisition of Cyber Ark, signaling a major move toward identity-focused threat defense in the security testing sector.

-

Q3 2025: Keysight's DOJ-approved acquisition of Spirent required divestment of key testing assets Keysight received U.S. Department of Justice approval for its acquisition of Spirent, contingent on the divestment of certain security testing assets to address regulatory concerns.

-

Q3 2025: Terra Security raises significant funding to develop next-gen automated penetration testing tools Startup Terra Security secured a funding round to accelerate the development of automated penetration testing solutions for enterprise security validation.

-

Q3 2025: Miggo Security raises funding for application runtime protection tools Miggo Security announced a new funding round to support the creation of advanced application runtime protection tools targeting modern security testing needs.

-

Q3 2025: IBM launches cloud-native vulnerability scanner integrated with Red Hat Open Shift IBM introduced a new cloud-native vulnerability scanner, fully integrated with Red Hat Open Shift, to enhance automated security testing in cloud environments.

Security Testing Market Segmentation:

Security Testing Type Outlook

Security Testing Deployment Mode Outlook

Security Testing Organisation Size Outlook

Security Testing End-User Outlook

Security Testing Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 5.20 billion |

| Market Size 2024 |

USD 6.02 billion |

| Market Size 2032 |

USD 16.74512287billion |

| Compound Annual Growth Rate (CAGR) |

13.63%(2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Deployment Mode,Organisation Size, and Region |

| Geographies Covered |

North America, Europe, AsiaPacific, and the Rest of the World |

| Countries Covered |

The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Cisco Systems Inc. (US), Hewlett Packard Enterprise (US), IBM Corporation (US), Qualys Inc. (US), WhiteHat Security (US), Applause App Quality Inc. (US), Veracode (US), Checkmarx (Israel), UL LLC (Netherlands), and Intertek Group PLC (UK), Valency Networks Pvt Ltd (India), Capgemini SE (France), Wipro Limited (India), Cognizant Technology Solutions Corp (US), Infosys Limited (India), Tata Consultancy Services Limited (India) |

| Key Market Opportunities |

Considering the increasing need for data protection. |

| Key Market Dynamics |

The increasing need for the protection of customer data and web and mobile applications |

Security Testing Market Highlights:

Frequently Asked Questions (FAQ):

The Security Testing Market size was valued at USD 5.20 Billion in 2023.

The global market is projected to grow at a CAGR of 13.63% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market areCisco Systems Inc. (US), Hewlett Packard Enterprise (US), IBM Corporation (US), Qualys Inc. (US), WhiteHat Security (US), Applause App Quality Inc. (US), Veracode (US), Checkmarx (Israel), UL LLC (Netherlands).

The Network Security Testing category dominated the market in 2022.

The BFSI had the largest share of the global market.