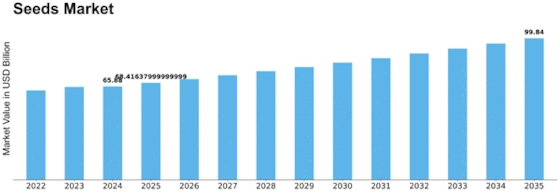

Seeds Size

Seeds Market Growth Projections and Opportunities

The global seeds market is anticipated to witness significant growth during the forecast period, driven by a confluence of factors. The surging global population and the escalating demand for food are primary drivers of the market's expansion. As the world's population continues to rise, the demand for agricultural commodities, particularly grains, fruits, and vegetables, is expected to increase concomitantly. This demand surge will necessitate the production of high-yielding crops, which can only be achieved through the utilization of high-quality seeds.

In addition to the rising population, the global seeds market is also being propelled by the increasing demand for high-quality yields. Consumers are increasingly demanding food that is not only nutritious but also aesthetically appealing and free from imperfections. This demand for high-quality produce is driving the development of new seed varieties that can withstand pests, diseases, and harsh environmental conditions while producing abundant yields of aesthetically pleasing crops. Technological advancements are playing a pivotal role in the growth of the global seeds market.

The development of new breeding techniques, such as marker-assisted breeding and gene editing, is enabling seed producers to develop crops with enhanced traits, such as disease resistance, improved nutritional value, and tolerance to adverse environmental conditions. These advancements are revolutionizing the seeds industry and contributing to the production of more sustainable and resilient crops. Another factor driving the growth of the global seeds market is the rising consumer inclination towards organic food.

Consumers are becoming increasingly aware of the potential health and environmental risks associated with the use of chemical fertilizers and pesticides in conventional agriculture. This awareness is fuelling a shift towards organic food, which is produced without the use of synthetic chemicals. As the demand for organic food grows, so does the demand for organic seeds. Extreme weather events, such as droughts, floods, and heat waves, can have a significant impact on crop yields and seed quality.

These events pose a threat to the global seeds market, as they can disrupt production cycles and lead to shortages of high-quality seeds. The emergence of new pests and diseases can also pose a challenge to the global seeds market. These pests and diseases can cause significant damage to crops, leading to reduced yields and increased seed demand.

Leave a Comment