Market Trends

Key Emerging Trends in the Self-adhesive Labels Market

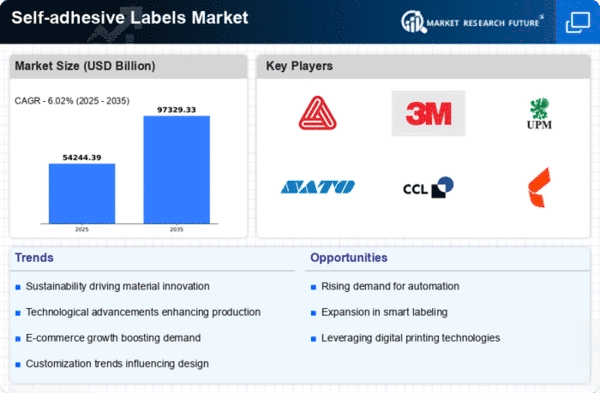

The self-adhesive labels market is witnessing notable trends driven by various factors influencing consumer preferences and industry dynamics. One significant trend is the growing demand for sustainable labeling solutions. With increasing awareness about environmental issues, consumers and businesses alike are seeking labeling options that minimize environmental impact. As a result, there's a surge in the adoption of eco-friendly materials such as paper labels, recyclable adhesives, and biodegradable substrates in the self-adhesive labels market. Brands are also investing in labeling solutions that promote recyclability and support circular economy initiatives, reflecting a broader trend towards sustainability across industries.

In July 2017, Henkel complete the acquisition of Darex Packaging Technologies and Sonderhoff Group. This helps strengthen the company’s portfolio through targeted acquisitions.

Another prominent trend in the self-adhesive labels market is the emphasis on customization and personalization. With consumers seeking unique and engaging brand experiences, there's a growing demand for labels that can be customized to reflect individual preferences and brand identities. This trend is particularly prevalent in industries such as food and beverage, cosmetics, and personal care, where brands are leveraging labeling technologies to create visually appealing and distinctive product packaging. Customizable labels allow brands to differentiate their products, communicate brand stories, and engage consumers on a more personal level, driving brand loyalty and customer retention.

Furthermore, technological advancements are driving innovation in the self-adhesive labels market, particularly in terms of printing and labeling technologies. Digital printing technologies such as inkjet and laser printing offer advantages such as high-quality printing, flexibility in design, and shorter lead times, enabling brands to create vibrant and eye-catching labels with intricate designs and variable data. Additionally, advancements in label materials and adhesives are expanding the application possibilities of self-adhesive labels, allowing for labels that can withstand extreme temperatures, moisture, and other challenging environments.

Moreover, the rise of e-commerce and online retail channels is reshaping the self-adhesive labels market. With the increasing popularity of online shopping, there's a growing demand for labels that can withstand the rigors of shipping and handling while maintaining product integrity and brand visibility. Self-adhesive labels with strong adhesion properties, durable materials, and smudge-resistant coatings are in high demand, particularly for products sold through e-commerce platforms where the first impression is made through product packaging.

In addition to these consumer-driven trends, regulatory requirements and industry standards play a significant role in shaping the self-adhesive labels market. Governments and regulatory bodies impose stringent regulations related to labeling requirements, including product information, safety warnings, and compliance with industry standards. Self-adhesive label manufacturers must ensure compliance with these regulations while also addressing consumer preferences for sustainability, customization, and durability.

Furthermore, the COVID-19 pandemic has accelerated certain trends in the self-adhesive labels market, particularly in terms of hygiene and safety labeling. With heightened awareness about hygiene practices and infection prevention, there's an increased demand for labels that communicate product safety information, usage instructions, and hygiene protocols. Self-adhesive labels with antimicrobial coatings, tamper-evident seals, and QR codes linking to online resources for product information and safety guidelines are witnessing greater adoption across various industries.

Leave a Comment